Business Expense Cards

Get 300 free virtual cards with no hidden fees and

easily manage your corporate spending with our platform.

Wallester clients' highlights

Wallester clients' highlights

Explore our clients' achievements to see how we’ve enhanced

their experiences with our Visa card solutions.

Wallester in  numbers

numbers

Our  latest news, updates,

latest news, updates,

and business insights

Explore the latest insights and trends on our blog page.

01 Kick-off

Start bold.

- Simply submit your Letter of Intent (LOI) to get started!

02 Onboarding

We do the prep,

you stay in control.

- Relax as we manage the due diligence process.

- Confirm the project scope to match your goals perfectly.

- Finalize the partnership by signing the Master Agreement.

03 Implementation

Your vision, brought to life.

- Get a dedicated Implementation Manager to guide you.

- Secure Visa approval for your card design and set up a unique BIN range.

- Configure security features and enable e-wallet integration.

- Run a pilot program for a flawless launch.

04 Go-live

Ready, set, success!

- Launch your branded card program commercially.

- Enjoy ongoing support from your CRM and Operations team.

- Track success with detailed reports via CRM or API.

- Get your branded cards into customers’ hands — fast, easy, and on-brand!

Get started with Wallester Business in just  24 hours

24 hours

You’re one click away from optimizing your finances. Take the next step!

Create free account01 Sign up

Your journey starts now.

- Create your account in minutes with just your phone number and email.

02 Verify your business

Fast, secure, and hassle-free.

- Submit your company details and complete our KYC process to unlock all features.

03 Accept the agreement

You’re all set!

- Review the terms, confirm your agreement, and dive into the platform with full access.

Have questions?  Check our FAQ

Check our FAQ

Find the answers to frequently asked questions and learn more about our embedded finance solutions.

Absolutely! Wallester operates under the rigorous financial regulations of Estonia. We are a Visa Principal Member and an audited company, ensuring we meet the highest financial security standards. Additionally, we comply with PCI DSS requirements, which are essential for any finance-licensed company. You can trust us to handle your financial needs with the utmost security and compliance.

Our Wallester Business solution is free because we focus on helping businesses operate more efficiently and safely. We earn from partnerships with Visa and others, which allows us to provide our services at no cost to our users. This approach ensures everyone benefits from easy and efficient card solutions.

Starting with Wallester Business is very easy and quick. Here’s how you can get set up in just 3 steps:

- Sign up and top up your account: Simply create your free account, complete the verification, and top up your Wallester Business account via bank transfer.

- Issue and set corporate cards: Generate both physical and virtual cards that provide instant access to funds and allow you to set individual spending limits.

- Control expenses in real time: Empower your employees to make purchases with Wallester Business cards and monitor all transactions in a unified system.

All set! You’re now ready to use the product and enjoy all the advantages of our Plug&Play finance platform.

The time required to launch your White-Label Visa card program can vary based on your business type, industry, and the complexity of integration. Generally, the launch timeframe ranges from 4 to 8 weeks.

Wallester Business operates within the European Economic Area (EEA) and extends services to clients in the United Kingdom, Ireland, Switzerland, Australia, and the USA. Our White-Label solutions are available in the EEA, the UK, Switzerland, and Ireland.

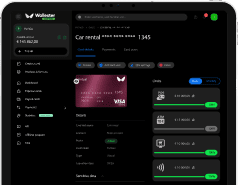

The Wallester White-Label solution is an innovative approach to launching your branded Visa card program. It ensures swift market entry and straightforward integration through our API or the Wallester Client Portal and White-Label Mobile Application.

Optional features of the program include:

- Client Portal, a web application for managing your card program

- White-Label Mobile Wallets for iOS and Android

- Compliance with KYC and AML regulations

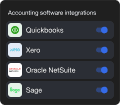

- Card tokenization for use with digital wallets such as Apple Pay, Google Pay, and others

- 3D Secure protection for online payments

- Issuance of both virtual and physical Visa-branded cards

- Continuous fraud monitoring to ensure security