Have you ever wondered why there aren’t more entrepreneurs revolutionising the financial sector? The answer lies in the barriers to entry. In a fintech market already worth $78.97 billion (€73.14 billion) globally and growing at an impressive 24.22% annually in Europe, the opportunities are enormous. However, the labyrinth of regulatory licences, the high cost of technological infrastructure, and the complexity of regulatory compliance have kept many innovators with great ideas at bay.

This is where white-label solutions completely change the game. In this article, we show you how these prefabricated systems are democratising access to the fintech sector and present a clear route to launching your own financial brand with Wallester.

The Challenges of Starting a Fintech Business

The fintech sector is radically transforming how we interact with money, but entering this market involves enormous challenges. With 75% of fintech startups failing, the entry barriers have turned this sector into an obstacle course. Let’s examine the three main challenges facing fintech entrepreneurs:

1. High Costs and Complex Infrastructure

Developing a fintech platform from scratch requires between €2-€5 million before you even start generating revenue. Payment systems need advanced technical development and robust security protocols, a luxury unattainable for most entrepreneurs in an increasingly restricted funding environment.

2. Regulatory Complexities and Licensing

Obtaining financial licenses (EMI/PSP) takes 12-18 months, with requirements that vary by jurisdiction. AML and KYC regulations constantly evolve, requiring continuous updates and specialised legal and customer onboarding teams. In a European market with 9,000+ competitors, compliance marks the difference between operating legally or facing sanctions.

3. Integration with Banking and Payment Networks

Even with funding and licences, establishing relationships with banks and processors like Visa requires institutional credibility, which startups lack. Simultaneously, processing transactions demands robust backend infrastructure that typically takes years to develop, creating a vicious circle difficult to break.

How White-Label Solutions Eliminate These Barriers

White-label systems represent a paradigm shift in the fintech sector. They allow entrepreneurs to launch financial products under their own brand without building everything from scratch, thus eliminating the main entry barriers by using preexisting infrastructure.

Accelerated Market Entry

Time is gold, especially in the competitive fintech sector. While custom development can keep your idea in the construction phase for over a year, rebranded financial systems drastically reduce this period:

The latest data shows that companies can enter the market in just 3 months using a white-label solution (provided they partner with the right company, of course), compared to the many months or even years typically required for custom development. This rapid implementation allows you to capitalise on market opportunities agilely and stay ahead of the competition.

Significant Cost Reduction

The economic impact of white-label solutions is perhaps their most attractive advantage for new entrants:

The average cost of developing a complex fintech application can exceed €300,000, not counting ongoing maintenance and update expenses. In contrast, some white-label platforms offer economically efficient alternatives with flexible pricing models that allow companies to pay only for the services they actually need.

Integrated Regulatory Compliance

White-label solutions solve one of the biggest headaches in the fintech sector: the complex regulatory tangle:

Regulatory costs average €181 billion annually across the financial sector, while the individual cost obviously varies for each company. White-label platforms include pre-integrated measures for AML, KYC, and PSD2 requirements, significantly reducing legal and financial risks. This allows businesses to focus on their core operations instead of assembling dedicated regulatory teams from scratch.

A Roadmap for Launching a Fintech Business with a White-Label Solution

If you’re determined to enter the fintech market without facing the traditional entry barriers, follow this step-by-step guide to launch your brand using a white-label solution. This structured approach will allow you to go from idea to implementation in weeks, not years.

Step 1: Define Your Unique Proposition

What financial problem will you solve? Whether simplifying payments, democratising investments, or reinventing expense management, your idea must resonate with a specific audience. Systems that address real pain points (like BNPL services in markets with debt aversion) quickly gain traction.

Step 2: Craft Your Brand Identity

A fintech business isn’t just about technology—it’s about trust. To stand out:

- Develop a strong brand mission and values

- Create a compelling name and logo

- Design an intuitive and visually appealing user experience (UX)

Step 3: Find Your Technology Ally

Don’t reinvent the wheel. White-label providers like Wallester can reduce your launch time by up to 70%. Look for partners that offer both technology and the regulatory backing and banking connections you’ll need to take off.

Step 4: Develop a Go-To-Market Strategy

A great product isn’t enough—you need an audience. Focus on:

- Social proof (customer testimonials, early adopters)

- Content marketing (blog posts, webinars, fintech thought leadership)

- Performance marketing (Google Ads, LinkedIn, and fintech communities)

- Public relations (find industry publications or news organisations that speak to your target market)

Step 5: Turn Regulation into an Advantage

Regulatory compliance doesn’t have to be your nightmare. By operating under the regulatory umbrella of an established provider, you transform what would be an obstacle into a strategic asset, allowing you to concentrate your energy and resources on growing your business, not dealing with regulators.

Step 6: Scale with Confidence

Start small, but think big. Validate your concept with initial users, adjust according to their feedback, and expand with confidence. With the right infrastructure, your solution can grow organically without the typical technological growing pains.

Monetisation Strategies: How Will Your Fintech Make Money?

Understanding how your fintech will generate revenue is crucial. Common monetisation models include:

- Interchange Fees (Earning a percentage from card transactions)

- Subscription Fees (Premium memberships or SaaS-based models)

- Transaction Fees (Charging per payment processed)

- Partnerships & Embedded Finance (Integrating with other platforms)

You need both a short-term strategy to bankroll your initial development phase and a long-term plan to ensure your ideas and the business’s viability.

How Wallester’s White-Label Solution Makes It Easy

One of the great advantages that makes Wallester’s White-Label proposal unique is its cost efficiency. Significant upfront costs are eliminated by not requiring development from scratch, allowing for a strategic allocation of resources. Our subscription model also means that there is no huge investment upfront.

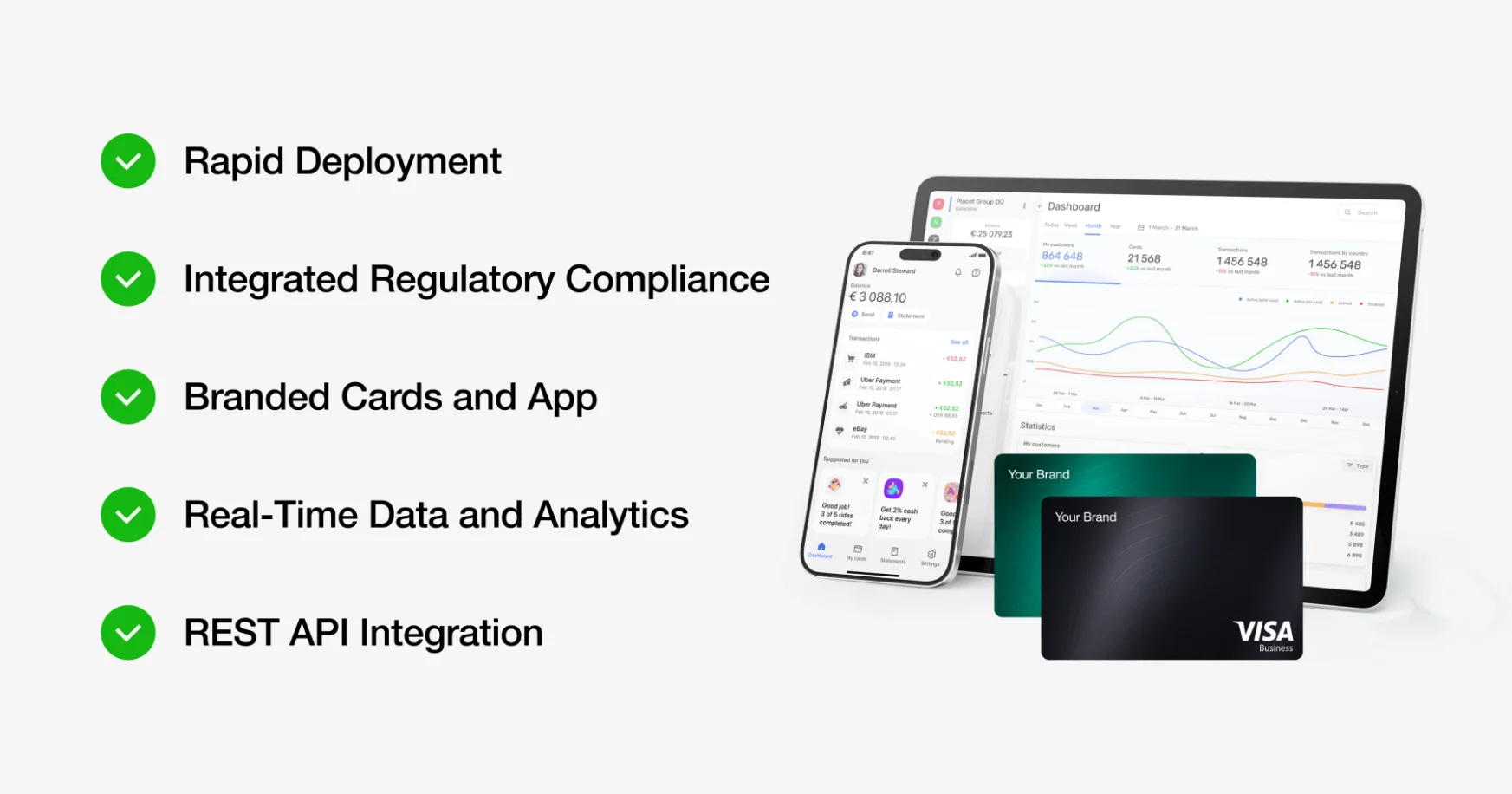

Rapid Deployment

Forget traditional long development cycles:

- Wallester White-Label has a track record of successfully onboarding new clients in 1-3 months, offering the market’s fastest and most cost-effective path to deploying customised payment solutions versus the typical 12-16 months of custom development.

- Support multi-currency transactions in EUR, GBP, USD, CZK, RON, SEK, NOK, HUF and more, making it ideal for companies operating throughout Europe and beyond.

- Leverage pre-configured infrastructure and software to accelerate your market entry significantly.

- Avoid technological bottlenecks that delay the launch of traditional financial products. Our expert in-house team and advanced infrastructure mean no challenge is too much, and we have dealt with it all before.

Integrated Regulatory Compliance

Regulatory conformity ceases to be an obstacle:

- Infrastructure ready for KYC, AML, and PSD2 that ensures legal framework with European and global standards.

- Automated identity verification and transaction monitoring systems that reduce legal risks.

Customisable Cards and App with Your Brand

Differentiate your financial offering with distinctive visual elements:

- Issue virtual and physical Visa cards with fully customised designs that reflect your brand identity.

- Integrate your cards with digital wallets like Apple Pay and Google Pay through advanced tokenisation.

- We’ll help you build a fully functional modern app with your branding.

Real-Time Data and Analytics

Make informed decisions based on updated data:

- Access real-time transaction monitoring and key metrics through intuitive management tools.

- Use business Intelligence functions for predictive analysis and discovery of behavioural patterns.

- Generate detailed financial reports that facilitate strategic and operational planning.

REST API for Perfect Integration

Connect seamlessly with your existing platforms:

- The modern REST API architecture allows efficient integration and customisation of card programmes.

- Automate card issuance, activation, and management processes through simple API calls.

- Connect Wallester’s infrastructure with your proprietary systems without months of additional development.

Fintech’s Future Within Your Reach

The fintech landscape has shifted from being the exclusive territory of giants with unlimited resources to an open horizon for visionaries with innovative ideas. How many brilliant ideas never saw the light of day due to regulatory barriers or prohibitive investments?

By partnering with Wallester, you obtain a clear path to financial innovation:

- Creative freedom—Design unique financial experiences while Wallester handles the infrastructure.

- Improved compliance—Operate under a solid regulatory framework without costly legal departments.

- Immediate scalability—Your infrastructure will grow with you without technical limitations.

The question is no longer whether you can afford to launch a fintech product but whether you can afford not to. Wallester has the infrastructure, compliance, and technology. All that’s missing is your idea. What are you waiting for?