In a world where digitalisation is advancing rapidly, the European Union and the United Kingdom are taking a decisive step: making electronic invoicing mandatory for all businesses. This isn’t just another regulatory change. With estimated losses of €134 billion annually due to VAT fraud in the EU, we’re witnessing a transformation aimed at improving tax compliance, reducing fraud, and streamlining financial processes for businesses of all sizes.

Electronic Invoicing Legislation: The Critical Timeline Your Business Can’t Ignore

The implementation of electronic invoicing represents a fundamental change in the regulatory landscape, and it’s important to understand how it will directly affect you:

In the European Union:

- February 2025: The European Parliament officially approved the ViDA (VAT in the Digital Age) initiative.

- During 2025: Member States will be able to implement mandatory e-invoicing for domestic B2B and B2C transactions.

- 1 July 2030: It will be mandatory for all intra-EU B2B transactions.

- 1 January 2035: E-invoicing systems that existed before 2024 must be fully harmonised.

Meanwhile, countries such as Italy, France, and Poland have already made e-invoicing mandatory for B2B transactions, serving as models for other Member States.

In the United Kingdom:

- Spring 2025: HMRC will launch a public consultation on implementation.

- 2029: The official launch of mandatory e-invoicing is expected, beginning with larger companies.

Currently, use between companies is voluntary in the UK and only mandatory in the public health sector. However, companies must already declare their VAT records electronically through the Making Tax Digital (MTD) system.

Beyond Revenue: Real Benefits for Your Business

The implementation of e-invoicing isn’t just a government initiative to close the VAT gap (with reported losses of €61 billion according to an October 2023 report). For your business, it represents a transformation opportunity with tangible benefits:

E-invoicing enables real-time tracking of transactions, making data manipulation virtually impossible. For example, when a small furniture retailer updates its system, it will gain protection against fraudulent activities while creating an immutable record of each sale. This means fewer disputes and more time spent on growing the business rather than resolving paperwork issues.

The cost savings extend beyond the apparent elimination of paper, printing, and postage. A medium-sized distribution company can redirect thousands of euros previously spent on manual processing into expanding its market. More importantly, the accelerated billing and payment cycles will improve cash flow, often the lifeblood of growing enterprises.

For small and medium-sized enterprises, particularly those looking to expand internationally, e-invoicing removes significant barriers. A logistics company can navigate the complex regulatory requirements of multiple European markets without needing a dedicated compliance team in each country. The standardisation levels the playing field, allowing smaller businesses to compete more effectively across borders.

The Real Challenges That You Might Face

Despite the long-term benefits, the transition won’t be without obstacles. It’s better to know them now so you can prepare adequately. Most businesses operate accounting systems that have evolved organically over time. Adapting these legacy systems to generate compliant electronic invoices can be daunting.

Take, for example, a restaurant chain with outlets in several countries. It is easy to imagine how it might face difficulties integrating its point-of-sale systems with the new e-invoicing platforms. However, a company like this, if it dares to invest in automation, will typically reduce its invoice processing time by two-thirds.

The diversity of e-invoicing laws in different regions creates a complex compliance landscape. Consider for a moment a textile manufacturer exporting to five EU countries- for starters, it has to comply with five different sets of requirements, standards and regulations. For example, regulations in France differ significantly from those in Poland, creating a steep learning curve for companies operating in multiple jurisdictions.

The initial investment costs can appear substantial. Software upgrades, staff training, and maintenance fees add up quickly. A consultancy firm might need to budget an additional budget for the transition. However, the return on investment often materialises within a few months through reduced processing costs and fewer payment delays.

Security concerns become more pronounced as sensitive commercial data moves into digital formats. Technology companies have led the way by implementing robust security protocols, including end-to-end encryption and multi-factor authentication, setting standards that all businesses will need to follow to protect their financial data and customer information.

From Reactive to Proactive: Preparing Your Business in 3 Steps

The transition to paperless electronic alternatives requires strategic planning and concrete actions. Rather than viewing this as mere regulatory compliance, consider these steps as an opportunity to improve your operations:

1. Assess Your Current Systems

Your ERP systems must be capable of generating, sending, and receiving electronic invoices in standardised formats. This isn’t just about complying with the law—it’s a chance to modernise. When a London-based retail chain updated their systems, they discovered inefficiencies in their invoicing workflow that had gone unnoticed for years. Addressing these alongside the compliance requirements improved their overall financial management.

2. Adopt Compatible Software

Select platforms that comply with both EU and UK standards. The chosen software should allow automatic validations and support digital signatures to protect the integrity of invoices. Design agencies switching to compatible software often report a dramatic decrease in billing errors, with some seeing error rates drop below 5% of their previous levels. This saves countless hours previously spent on corrections and reconciliations.

3. Train Your Staff

Each role within your organisation has specific requirements that should be addressed in the training programme. When manufacturing companies invest in comprehensive training—including manuals, instructional videos, and hands-on sessions—they overcome the initial resistance to change much more effectively. The finance teams that receive proper training become advocates for the new system rather than obstacles to its implementation.

How Wallester Business Can Help Your Company

In the changing landscape of electronic invoicing, Wallester Business is capable of offering specialised solutions that help companies adapt seamlessly to the new regulatory requirements:

Integrated Payment and Invoicing Solutions

Our expense management system offers a unified platform where companies can:

- Upload invoices instantly via mobile app or web platform.

- Store all invoices securely in one place.

- Monitor all incoming invoices in real time.

Receipt digitisation allows employees to photograph invoices and immediately upload them to the system via the mobile app, eliminating the need to manage physical documents. The platform allows easy export of invoices to the company’s accounting system, facilitating the generation of accurate financial reports.

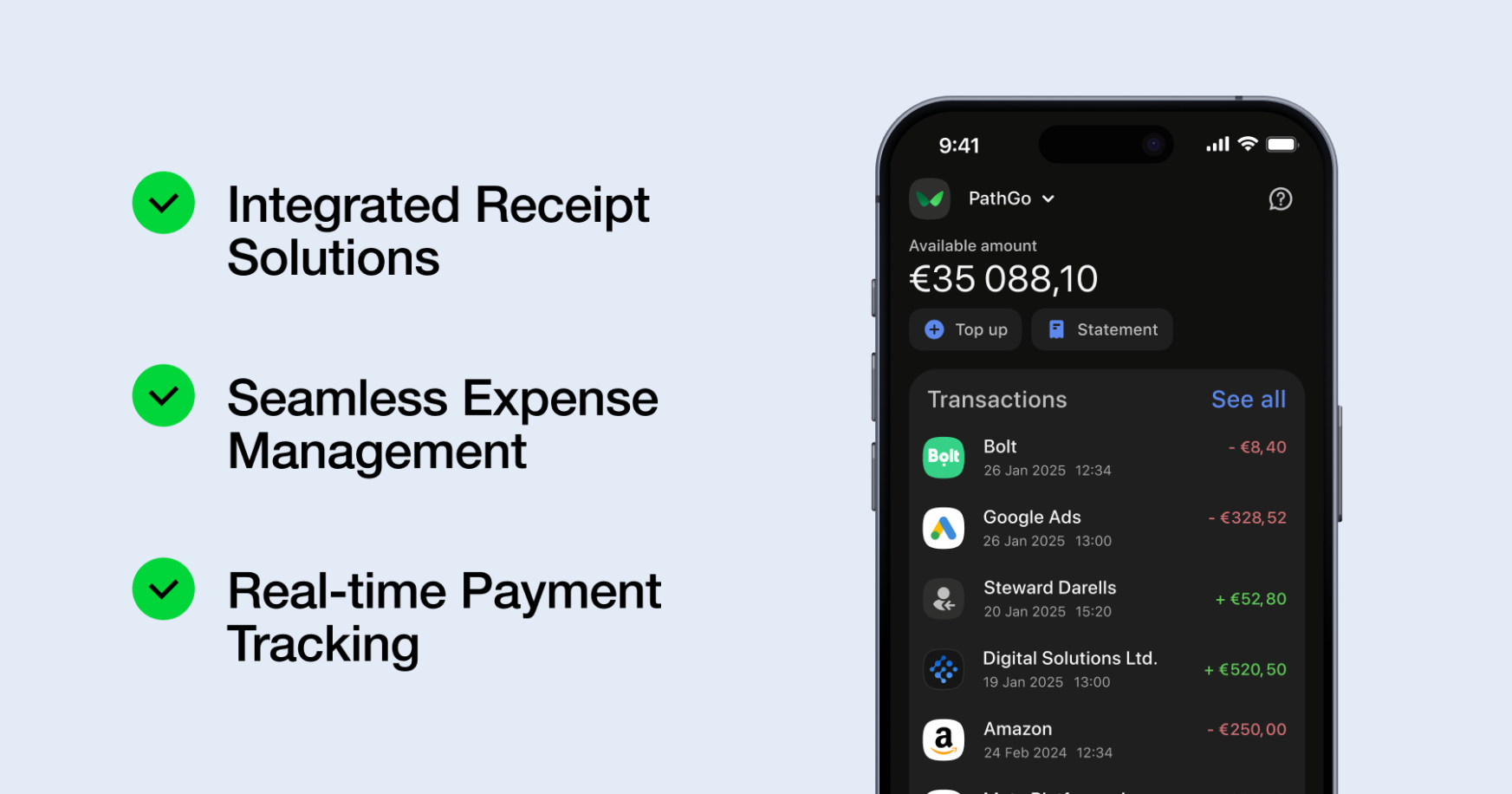

Real-time Payment Tracking

Our virtual and physical cards allow instant monitoring of invoice payments. The real-time dashboard enables administrators to check all expenses immediately from mobile devices or the web. The transaction filtering feature allows sorting movements to get a clear picture of individual expenses, while our instant notification system sends alerts to employees after each payment to upload the corresponding invoices.

Seamless Expense Management

The Wallester Business platform allows the consolidation of financial operations, significantly reducing administrative burdens. Corporate cards with individual limits enable precise control of expenses by employee or department, while virtual cards with shared access allow multiple employees to use funds simultaneously. Our paperless receipt management uses OCR technology to automatically upload and associate photographs of receipts with the corresponding transactions.

Allow Your Company to Stay Up to Date with Regulations

With electronic invoicing becoming mandatory across the EU and UK, businesses must act now to ensure compliance. While the transition may seem complex, the long-term benefits—including cost savings of up to 80%, increased operational efficiency, and significant reduction in tax fraud—far outweigh the initial challenges.

Wallester Business positions itself as a useful addition in companies’ efforts to navigate this regulatory change. Its comprehensive platform transforms a business’s financial management with invoice digitisation, real-time payment tracking, and robust security measures.