Trusted leader in FinTech services

Wallester is a next-generation FinTech company offering a unified platform for digital payments and card issuance.

As an official Visa Principal Member, we combine regulatory strength with cutting-edge technology, enabling businesses across Europe and beyond to launch their own card programs, streamline financial operations, and thrive in a dynamic market.

Our mission is

to revolutionize finance

by making advanced payment technology accessible to every forward-thinking business.

Built with purpose,

powered by passion

Our ecosystem

From card issuance to expense management, we provide technology, compliance, and expertise — so that you can focus on growth.

White-Label

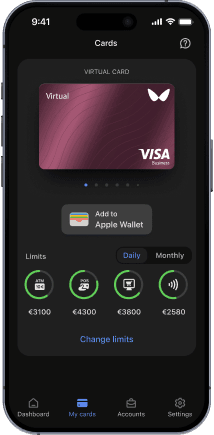

card program

Customizable physical and virtual Visa cards (debit, credit, prepaid) along with ready-to-use White-Label Mobile App and Client Portal, enabling partners to deliver a branded banking experience from day one.

Security & compliance

infrastructure

As a licensed financial institution, Wallester provides integrated KYC/AML solutions, fraud detection tools, and full regulatory compliance. Our platform is PCI DSS Level 1 certified, ensuring top-tier data security.

Core issuing & processing platform

A powerful backend with advanced APIs for issuing Visa cards, processing transactions in real time, and managing

every aspect of a card program. All developed in-house for maximum speed, scalability, and reliability.

transaction processing

card issuance

Global payment

network access

Thanks to our direct partnership with Visa, every Wallester-issued card is connected to the global Visa network. We also support digital wallet integrations and multi-currency capabilities for seamless global transactions.

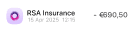

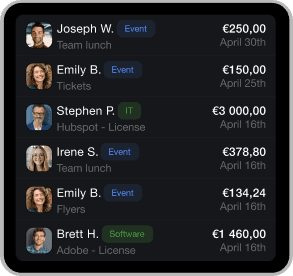

Expense management

& analytics

A built-in corporate expense management system that lets businesses track spending, set limits, automate expense reports, and gain real-time insights via analytics — all linked directly to the payment cards.

Get to know our leaders

Meet the visionary minds driving our success and shaping the future of fintech.Chief Operating Officer, Board Member

Board Member

Board Member

Impact that matters

Wallester promotes environmental, social, and governance practices to create a greener, more inclusive, and ethically responsible future.

- Environmental

With over 91% of active cards being virtual, cashless payments greatly reduce reliance on physical materials.

Physical cards are produced using eco-friendly methods and recyclable materials.

Digital office operations minimize paper use, supported by energy-efficient technologies and waste recycling initiatives.

- Social

Equal opportunity employment that fosters fair growth and development for all employees.

A diverse and inclusive workplace with a multinational team and gender parity in leadership roles.

A safe and supportive work environment offering sports reimbursements, medical insurance, regular health checks, and ergonomic workspaces.

Supporting communities through compassionate charity efforts.

- Governance

Strong corporate ethics and compliance practices that ensure transparency and alignment with international regulatory standards.

A values-driven culture supported by regular team-building events and internal alignment initiatives.

Rigorous client selection criteria designed to exclude high-risk industries.