Companies lose an average of 5% of annual revenue to fraud. That’s not a typo. Five percent—gone. And a significant chunk of that loss comes straight from within: nearly a quarter of employees admit to inflating or falsifying expenses on their claims for reimbursement. This presents a crisis-level threat for many companies, and the people tasked with preventing it are the accountants and financial managers. But without a strategic plan and the right tools, they’re fighting a losing battle. Read on and discover how to win the fight, the struggle, and the war against employee fraud.

Understanding the Magnitude of Financial Deception

Expense fraud isn’t just about the odd fake cab receipt. It spans false documentation, exaggerated claims, disguised personal purchases, and duplicate submissions.

According to the Association of Certified Fraud Examiners (ACFE), the typical loss per fraud case is €131,000, with 20% of cases exceeding €904,000. Of course, these numbers take in a wider range of misdeeds than expense fraud, but they’re still hugely concerning. And recent surveys paint an even grimmer picture:

- 24% of employees admit to having counted personal purchases as company costs.

- Men are twice as likely to engage in deceptive practices as women and often overstate claims by more than €1,000.

- Mid-level employees (58.1%) and those under 44 (82.9%)are the most frequent offenders.

So, the solution is simple: hire only women over 45 and eliminate middle management entirely. Obviously, we’re joking, and that’s not a feasible strategy (and quite possibly illegal), so this is where technology comes to the rescue.

The 5 Types of Fraud That Are Draining Your Business

Identifying who is engaging in mismanagement is essential to implementing adequate controls. Here are some of the most common.

- Inflated Expenses

The ACFE examined 2,000 cases of improper expense claims worldwide and found that 13% of these cases involve reimbursement fraud. To give a very simple example–an employee submits a claim for €50 on a meal while travelling, but the meal cost only €30. These small overstatements are often the most difficult to detect manually, as they seem reasonable and believable. Claiming €500 for lunch for one person would immediately raise the alarm.

- Fake Receipts

Fictitious receipts are a big part of the margin. Imagine if one of your employees charged up to $350,000 (€316,000) in costs for non-existent meals and fake happy hours, as happened to Amazon.

- Intentional Misclassification

According to Amex GBT’s survey of 1,200 finance managers, 69% anticipate an increase in mismanagement. Think family meals presented as ‘networking events’.

- Duplicate Reimbursements

This trick accounts for a large portion of illicit activity in companies with manual systems. The most recent ACFE Report to the Nations on Misappropriation states that T&E (Travel and Expenses) fraud accounts for 14.5% of all reported cases.

- Misuse of Corporate Cards

In relative terms, card direct debit fraud in terms of volume accounted for only 0.014% of the number of transactions reported in the EBA’s most recent report. But it is still something you want to nip in the bud early.

Spotting the Warning Signs: The Devil Is in the Details

Vigilance is key to preventing fraudulent activity. Here are some signs that should set off alarm bells for any financial officer or accountant:

- Frequent costs just below the approval limit:Some employees break larger expenses into smaller amounts to avoid review.

- Repetitive claims for the same items: Unusual patterns in different categories may indicate attempts at double billing.

- Vague or non-existent receipts: Lack of clear documentation or ambiguous descriptions may conceal suspicious activity.

- Excessive travel or meal charges: Unusual expenditures, such as first-class flights or luxury hotels, when company policy indicates otherwise.

- Suspicious patterns in specific departments or employees: If a particular team has disproportionate costs, there could be a systemic problem.

Turn Your Finance Team into Guardians

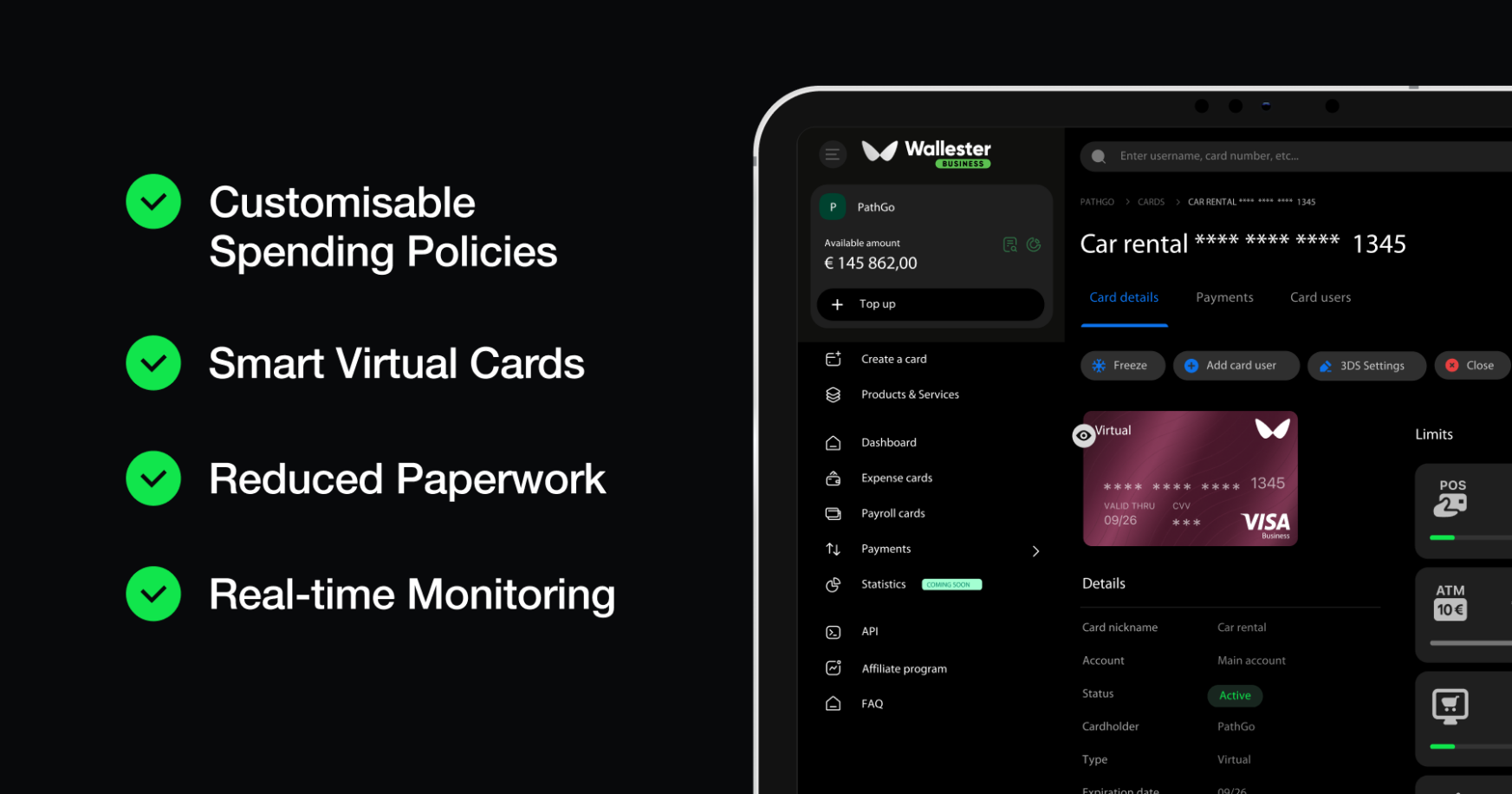

Your finance team doesn’t need capes and masks, but they do need tools to detect misconduct before it hits the accounts. With Wallester Business, they can anticipate every suspicious move and always have an excellent overview of what’s happening.

Smart Spending Policies

- Automated rules: Define spending limits per category (e.g. maximum €200 in meals/day) that are automatically applied on virtual cards.

- Real-time blocking: If an employee tries to spend €500 when their limit is €300, the transaction is instantly rejected.

Virtual Cards with Superpowers

- Dynamic limits: Create virtual cards for one-time use, specific projects or unique suppliers (e.g., card to pay only Hotel X with a €1,000 cap).

- Geolocation: Block transactions outside the authorised zone (e.g. if an employee is travelling to Berlin, only transactions in that city are approved).

Reduced Paperwork

- Downloadable reports: Generate monthly analyses by employee, department or project in PDF/Excel/CSV/XML.

- Intelligent OCR: Scan receipts which are matched with transactions, reducing manual errors by 90%.

Real-time Monitoring

- Employee and company portal: Each user sees only their own real-time costs, remaining limits, and applicable policies, while managers and admins can see information for the entire company.

- Accounting integration: Direct synchronisation with software such as QuickBooks or Xero through REST API.

The Bottom Line: Vigilance Pays Off

Expense fraud drains more than just money—it kills trust and erodes your margins. But with the right tools and policies, you can take back control.

Visit Wallester Business today and discover how easy it can be to protect your company’s finances.