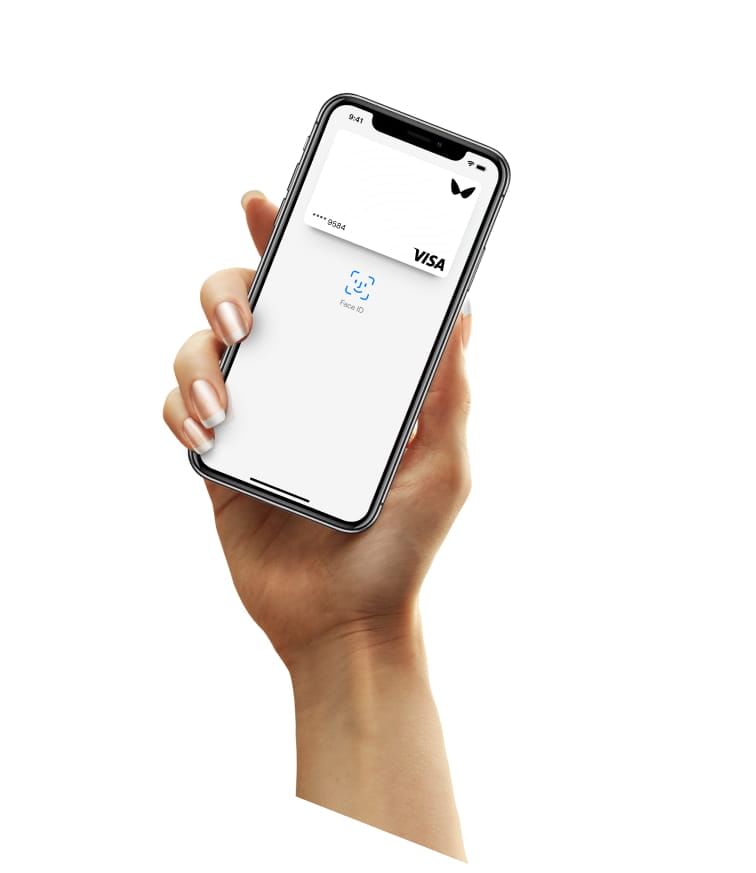

Virtual card

An optimal financial instrument to instantly pay for goods and services with the most convenient functionality for making cashless payments.

A virtual card is the most convenient alternative to classic payment cards. Make safe purchases everywhere where Visa cards are accepted.

Thanks to instant issuance, convenience, and multifunctionality, virtual cards have become a popular payment method worldwide.

What is a virtual card?

A virtual card is a digital payment card issued without a physical carrier and designed for cashless payments for goods and services at POS-terminals and online stores, as well as for ATM cash withdrawals.

There are virtual cards for multiple use and one-time purchases.

A virtual card has the same features as a traditional payment card: a number, an expiration date, and a three-digit security code (CVV).

Advantages of virtual cards

Functionality

A virtual card is issued digitally as soon as it is ordered, so it can be immediately used for making payments within the set money limit.

Besides, a virtual card can be connected to mobile payment systems or converted into a physical card by ordering a plastic copy. This way, you can withdraw money and make payments even if a contactless payment option is not available.

Security

A high level of transaction safety is ensured by 3D Secure double authentication technology created to guarantee a safe usage and full confidentiality of online payments.

The risk of fraud is excluded thanks to a limited card validity period and a payment limit for specific purchases set by the user.