Spend fast.

Stay in control.

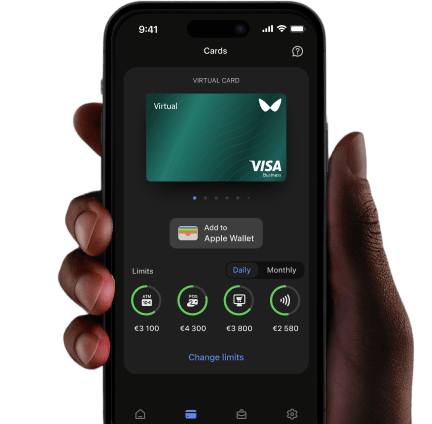

Go virtual

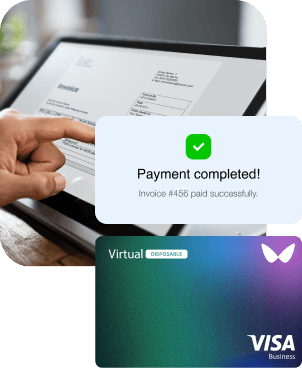

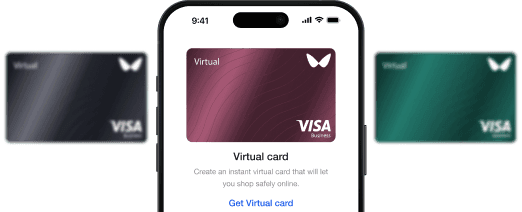

A virtual card is a fully digital payment card that works just like a physical one, except it’s faster, safer, and easier to manage. You can issue, use, and control it online without waiting for delivery or worrying about card loss or fraud.

Traditional cards

slow you down

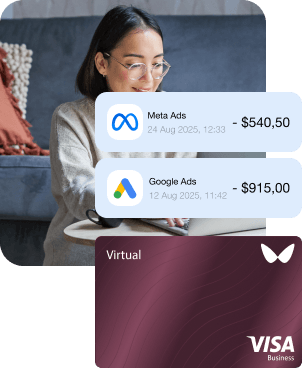

Whether you’re managing employee expenses, running multiple ad accounts, or covering international SaaS tools — you need flexibility, not friction.

Virtual cards move

at your speed

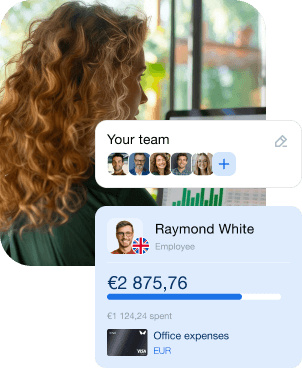

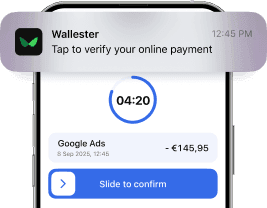

Wallester virtual cards are designed to simplify payments, prevent overspending, and scale with your business. For businesses, virtual cards mean instant access to funds, simplified accounting, and reduced risk. Every payment is traceable, every limit configurable, and every transaction under your control.

What makes Wallester

virtual cards different?

Regardless of whether you’re running a small agency or a global enterprise, Wallester’s virtual cards adapt to your workflow, making corporate payments transparent, auditable, and easy to scale across teams and markets.

- Instant issuance

Generate cards in seconds via platform or API — no delays or manual approvals.

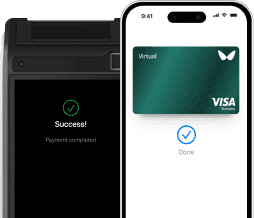

- Pay with your wallet

Enjoy the freedom of paying with any wallet you prefer in just a few seconds.

- Pay everywhere

Make purchases online, tap in stores,

or take out cash from any ATM.

- Fully customizable

Set spending limits, control merchant types, configure usage: per card, per user.

- Unlimited cards

Create as many as you need,

there’s no limit on your growth. - Protection you can trust

Added security means fewer risks

and safer payments online.

Need automation?

You’ve covered!

Automating card issuance through API helps businesses that handle thousands of transactions daily, from ad-tech platforms to a wide range of services. You can integrate Wallester directly into your own system and issue cards on demand.

Learn about our APIOne platform,

all the card types you need

Choose the right card for every scenario: from one-time vendor payments to

recurring team expenses. Each card type helps you manage budgets more

precisely and protect company funds.

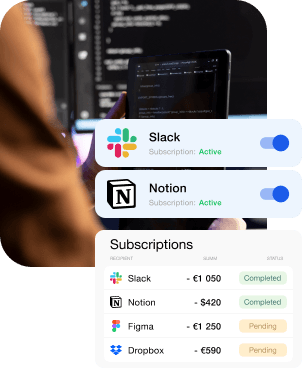

- Multi-use cards

Set once, use anytime

Ongoing subscriptions,

employee purchases - Disposable cards

Auto-deactive after use

One-time purchases,

suppliers, risky spend - Shared-access cards

Multiple users, full control

Team-based purchases, media

buying

Designed for the way

your business spends

Virtual cards transform how companies pay and track spending. They make it easy to separate budgets by team, project, or region, providing instant visibility across all expenses.

Start using virtual

cards that work like

your business does

Thousands of businesses already rely on Wallester virtual cards to streamline operations. Join them today and experience how effortless spending control can be.