Global payment volumes are exploding, and more companies than ever are asking the same question: How do we embed finance into our business without building a bank from scratch? The answer: white-label card issuing.

Whether you’re a fintech startup, a global e-commerce brand, or a loyalty-driven travel app, launching your own card programme is no longer a multi-million euro fantasy. With white-label solutions, it’s fast, flexible, and financially sound.

This guide breaks down what white-label issuing is, why it’s reshaping embedded finance, and how it can drive serious return on investment (ROI) for your business.

What Is White-Label Card Issuing?

White-label card issuing lets companies create branded debit, credit, prepaid, or virtual cards without becoming a licensed financial institution. Instead of building the infrastructure in-house, you partner with a regulated provider who supplies the licensing, compliance, backend systems, and APIs.

You control the customer relationship, the card design, and the experience. Your provider handles everything under the hood.

It’s embedded finance without the overhead—and it’s changing how businesses think about payments.

Why White-Label Beats In-House Development

Building your own card infrastructure is expensive, time-consuming, and risky. You need to hire compliance experts, acquire licenses, partner with banks, and manage security at scale. For most companies, that’s a non-starter.

Compare that to a white-label model:

| In-House Development | White-Label Solution | |

| Time to Launch | 12–24 months or more | 4–8 weeks |

| Compliance Burden | Fully your responsibility | Fully outsourced |

| Tech Maintenance | Ongoing, internal | Provider-managed |

| Scalability | Resource-heavy | Built-in |

The takeaway? White-label is faster, cheaper, and less risky—and still gives you full control of your branded experience.

How White-Label Drives ROI

White-label card programmes aren’t just about saving time—they open up real, recurring revenue opportunities.

1. Interchange Fees: Earn Per Transaction

Every time a customer uses your branded card, you earn a small percentage of the transaction.

For example, 10,000 users each spending €300 per month with a 0.75% fee could generate around €270,000 per year in interchange revenue.

It’s important to remember that the percentage of interchange fee you receive will vary depending on your provider and the deal you sign with them. We use 0.75% in this article as an example, but it could be higher or lower depending on several factors.

2. Subscription & Premium Services

Charge monthly fees for card access or bundled benefits, such as insurance, travel perks, or cashback. These models add predictable, recurring income.

3. Increased Customer Lifetime Value

Branded cards build loyalty. You stay top of wallet and top of mind, driving repeat business and deeper relationships.

4. Data-Driven Monetisation

Gain insights into customer behaviour and spending patterns. Use it to improve products, personalise offers, and increase sales.

Example ROI Calculation

Let’s say your company has laid the groundwork and has its card program up and running. After the set-up, you spend €36,000* a year maintaining your white-label card solution. In the first year of full operations, you could generate:

- €37,500 in interchange fees (0.75% on €5 million in card transactions)

- €120,000 in subscription revenue (10,000 active cards at €1 per month)

- €30,000 in added value from improved customer retention (15% boost in lifetime value)

Total Benefit: €37,500 + €120,000 + €30,000 = €187,500

Net Benefit: €187,500 – €36,000 = €151,500

ROI: (€151,500 / €36,000) × 100 = 420.8%

While actual earnings may vary depending on the rate negotiated with your provider, we can say with confidence that this scenario is very conservative. Companies with high transaction volumes or premium card models can easily exceed this ROI. Even better is that providers like Wallester do not charge an up-front fee, but work on a monthly subscription model, which can boost the profitability beyond even this conservative estimate.

*Amount is purely illustrative and may vary depending on the provider you choose.

Factors That Enhance ROI

- More Transactions, More Profits: When your users regularly pay with your card, each purchase adds up.

- Loyal Customers, Predictable Income: Cards with rewards create habits.

- Grow Without Additional Investment: Unlike other businesses, you can double your users without doubling your costs.

- Protect Your Margins: While a traditional bank spends millions on regulatory compliance, you leverage your custom provider’s infrastructure, saving resources to invest in marketing.

- Profitable Innovation: Easily launch new functionalities—your provider absorbs the cost, so you scale without added expense.

How to Choose a White-Label Partner

Look for providers that offer:

- Speedy time to market (weeks, not months)

- End-to-end compliance coverage

- Card customisation (design, rewards, user flows)

- Integration ease (modern APIs, sandbox environments)

- Ongoing support & scalability

Leading platforms like Wallester handle everything from real-time KYC to multicurrency payment processing, helping brands get to market fast with zero friction.

How Wallester Facilitates White-Label Card Issuing

It’s a fact: Wallester White-Label provides the fastest and most cost-effective path to launching branded payment solutions, cutting development time from 12 to 16 months to just 2 to 4 months.

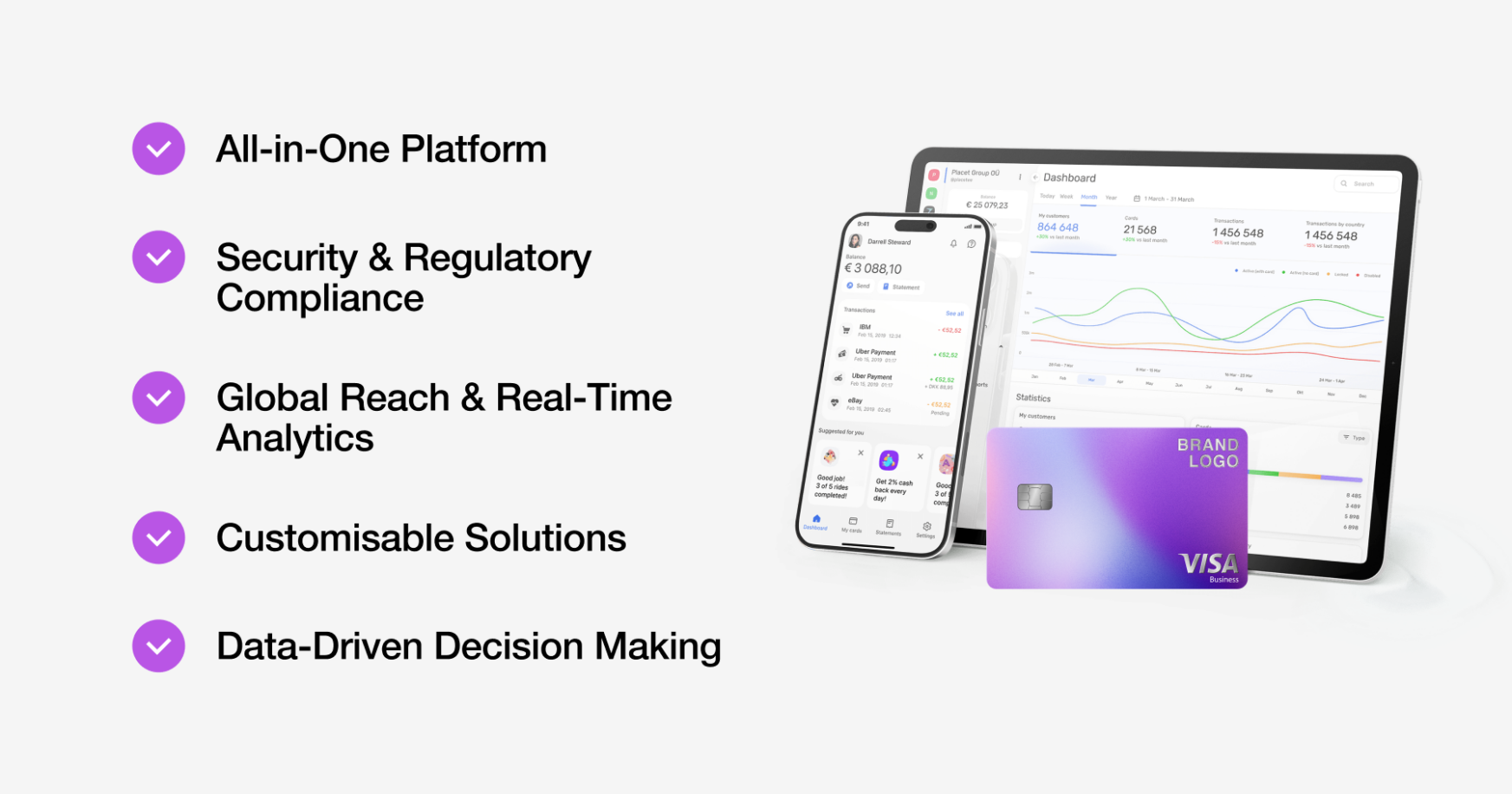

1. All-in-One Platform

Wallester’s cloud-based infrastructure integrates payment processing, financial management, and real-time analytics, eliminating the need for multiple systems. A flexible API ensures easy integration with ERP, CRM, and e-commerce platforms.

2. Security & Regulatory Compliance

As a regulated financial institution in Estonia, Wallester White-Label meets the highest PCI DSS, GDPR, and AML standards, ensuring security and mitigating legal risks. Its preconfigured infrastructure for KYC and PSD2 simplifies regulatory compliance.

3. Global Reach & Real-Time Analytics

Wallester enables payments in 180+ countries, processing transactions in 150+ currencies, including GBP, EUR and USD. Its suite provides data intelligence with real-time transaction monitoring, forecast data, and detailed financial reports.

4. Customisable Solutions

Cards can be fully tailored, from design to rewards logic, serving retail, fintech, travel, and more. With 24/7 technical support and automatic software updates, businesses can scale without operational roadblocks.

- Issue physical & virtual Visa cards with bespoke branding

- Seamless integration with Apple Pay & Google Pay via advanced tokenisation

5. Data-Driven Decision Making

Wallester’s real-time dashboards provide key financial insights and transaction tracking, empowering businesses with strategic data for growth.

The Bottom Line

White-label card issuing is more than a payments solution—it’s a business model upgrade.

You gain revenue, loyalty, brand visibility, and customer data—without the cost or complexity of building your own stack. And with the global embedded finance market expected to surpass €530B by 2025 according to EY, the time to act is now.

Don’t build a bank. Build a better business with embedded finance.