Among ERP providers, the conversation around embedded finance has been shifting for some time. The question is less and less why they should add payments and card issuing to their platforms, because earnings boosts and customer retention benefits of it are now well understood. In fact, the real barrier has always been the how.

The widespread belief is that launching a financial product must be a slow, high-risk, expensive, and painfully complex process. Images of multi-month development cycles, huge legal budgets, and long negotiations with regulators are usually what come to mind. But this assumption is becoming outdated.

By partnering with a licensed, API-first infrastructure provider, an ERP can launch a fully branded card programme in weeks instead of months. The whole process shifts from a major legal and financial overhaul to a straightforward, three-stage integration project.

The Old Way vs. The Enabler Model

The traditional path to launching a card programme was something most software companies didn’t even consider, because, essentially, it meant trying to become a bank. That, in turn, meant acquiring a financial licence, building a secure backend, proving PCI-DSS and PSD2 compliance, and partnering with a card scheme like Visa.

The “enabler” model – or, in different wording, “embedded finance” – was designed to solve exactly those problems.

In short, you split the responsibilities. For example, Wallester, as the enabler, takes care of the financial, regulatory, and technical stack. We are a licensed Visa Principal Member and regulated by the Estonian FSA. We provide the payment processing, the compliance, the fraud monitoring, and the core infrastructure.

The ERP platform, on the other hand, simply does what it does best, and that’s owning the customer relationship and integrating these financial features into its user experience via API.

A Practical Go-Live: From API to Production

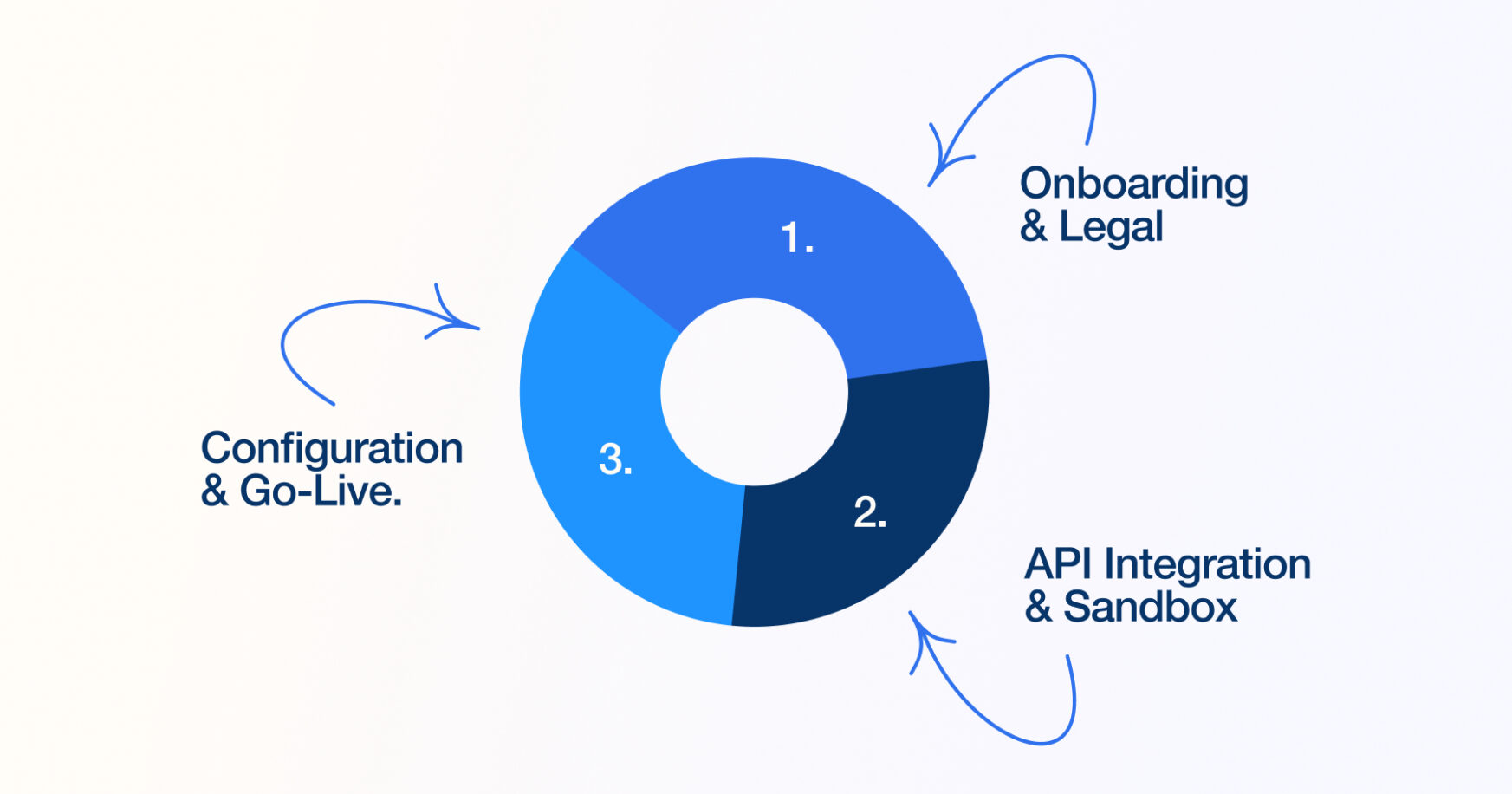

Think about the model as a way of condensing a multi-month licensing marathon into an elegant sprint. Obviously, every project varies, but the typical go-live process for a branded virtual card programme can be completed in 8 to 12 weeks.

Here’s what the timeline actually looks like:

Phase 1: Commercials & Onboarding

In this foundational stage we define the product. Your team provides the company information for our standard due diligence, we agree on the project scope, and sign the agreements. Then our implementation team is assigned, and your technical team is given access credentials to our platform.

Phase 2: Integration & Sandbox Testing

This is where the core technical work happens. Your IT team integrates with the Wallester REST API. This is a fast, modern process with clear documentation and active support. Your developers can test every function – issuing a card or setting a spend limit, for instance – in a secure sandbox environment to ensure the integration is flawless.

Phase 3: Configuration & Launch

Once the API integration is complete, we move to production. This final phase involves:

- Visa Co-Brand Approval: We manage the card design approval process with Visa.

- Product Configuration: Our team helps you set up your final product rules, limits, and 3D Secure settings.

- Pilot & Go-Live: After a final test run, you are ready to launch, offer financial features and begin issuing cards to your clients.

What Your Team Does and What We Do

The key to this speed is a clear division of labour. In other words, your team is not burdened with tasks outside its core expertise.

A typical project rollout looks like this.

What Your Team Handles:

- Product: Defines the product flows, card functionality, and limits.

- IT Team: Integrates with the Wallester API and runs acceptance testing.

- Legal: Handles the commercial agreements.

What Wallester Handles::

- All legal documentation and due diligence.

- The full technical stack: API, payment processing, fraud monitoring, and 3DS.

- All regulatory and compliance management (AML, PSD2, PCI-DSS).

- Direct partnership and all approvals with Visa.

- A dedicated project manager to guide your team from start to finish.

From Back-End Complexity to a Clear Path Forward

Adding payment features to your product or launching a branded card programme used to mean choosing between two bad options: build financial infrastructure in-house or partner with multiple entities and lose control.

A licensed API-first provider removes the obstacle. What took 18 months and millions in spending now takes weeks and what looked like operational risk now looks like a routine integration.

If you’re evaluating payments or card issuing for your product, get in touch and we’ll walk you through the setup.