Enterprises today depend on dozens of financial tools that rarely work in perfect sync. Card-issuing platforms, accounting systems, and reporting dashboards often operate in isolation, forcing finance teams to combine data manually. A unified financial architecture eliminates that divide by enabling every payment, transaction, and report to operate on a shared set of information. Through Wallester’s open API and its compatibility with primary ERP tools, companies can connect their financial systems into a single, continuous system where data flows seamlessly from payment to decision.

What a unified financial architecture means

A unified financial architecture is a framework that connects all financial systems into one consistent environment. In practice, this means that every time a transaction occurs, the information is automatically sent to the ERP system, updating budgets, ledgers, and dashboards in near real-time.

For global organisations, this approach brings structure to complexity. It aligns subsidiaries operating in different currencies, synchronises cost centres across regions, and provides finance leaders with a single version of the truth.

According to a 2025 Planful survey of more than 150 European finance leaders, fragmented systems and poor data quality remain key obstacles to accurate forecasting and timely decision-making. Integration through APIs directly addresses these issues by creating a single pipeline of verified financial information.

Further Reading: The Complete Guide to Integrating Wallester White-Label with ERP Systems

Why fragmented finance systems slow down decision-making

When payment and accounting systems operate independently, visibility suffers. Data often arrives late, records are duplicated, and reports rely on partial information. A transaction made on a corporate card might take days to appear in the accounting platform, leaving finance teams uncertain about available funds.

Disconnected systems create specific problems:

- Reconciliation depends on manual uploads and spreadsheet matching.

- Department budgets cannot reflect up-to-date spending.

- Forecasts are built on incomplete data.

- Audits require cross-checking between systems with different formats.

This fragmented structure slows down every financial process. Decision-makers have to wait for updated figures, while controllers spend valuable time validating numbers rather than analysing them. A unified architecture replaces this delay with continuous synchronisation between platforms.

How Wallester API connects payment infrastructure with ERP tools

Wallester White-Label provides an API-based infrastructure that allows enterprises to issue, manage, and track corporate Visa cards. Each transaction passes through Wallester’s authorisation system in real time and is recorded with complete details, including amount, merchant category, currency, and timestamp.

Through the Wallester API, this transaction data can be sent directly to ERP systems like SAP, Oracle NetSuite, or Microsoft Dynamics. The connection uses secure HTTPS communication with token-based authentication, ensuring that only verified systems exchange information.

A standard data flow includes:

- A payment is made through a Wallester card.

- Wallester processes and records the transaction in real time.

- Transaction details are transferred via API to the company’s ERP connector.

- The ERP maps each field to the corresponding account, department, or project code.

- The entry appears in the financial system for review, posting, or reporting.

This process replaces traditional file imports with direct, structured data exchange. Finance teams gain access to accurate information within minutes instead of days, keeping their reporting current at all times.

Further Reading: From Data to Decisions: Why Finance Teams Sync Wallester White-Label with Microsoft Dynamics

The benefits of a unified financial architecture

Connecting payment infrastructure and ERP systems delivers measurable improvements across finance and operations.

1. Real-time visibility

Transaction data is sent to the ERP as soon as payments are processed. Managers and controllers can monitor cash flow and expenses using up-to-date dashboards.

2. Faster reconciliation

Automatic data matching replaces manual imports and cross-checking. Each payment is linked directly to the correct account or cost centre.

3. Consistent reporting

All departments work from the same data, keeping regional and subsidiary reports remain consistent.

4. Improved forecasting

With live spending data available, financial forecasts reflect actual performance rather than outdated assumptions.

5. Transparent audit trails

Each transaction remains traceable from authorisation to posting, supporting compliance reviews and external audits.

Security and compliance foundations

Handling payment data requires full compliance with international security standards. Wallester operates under PCI DSS Level 1 certification, which defines the strictest controls for processing and storing cardholder information. All transaction data is transmitted over encrypted HTTPS connections, protected by token-based authentication.

Personal and financial information is handled according to GDPR (The EU General Data Protection Regulation) across all jurisdictions where Wallester operates. Sensitive details such as card numbers are tokenised before transfer, meaning they are replaced with random identifiers that cannot be linked back to individual accounts.

ERP platforms such as SAP, NetSuite, and Microsoft Dynamics extend this protection by enforcing role-based permissions and maintaining audit logs of all financial activity. This layered approach keeps company data secure at every point in the integration chain.

Further Reading: How Wallester White-Label Connects with SAP: From Transactions to Real-Time Reporting

Implementation path: from setup to live operation

Integrating Wallester’s API with ERP tools follows a clear, structured sequence. It mirrors standard ERP integration logic while allowing flexibility for each company’s infrastructure.

1. Connection setup

Developers register API credentials in the Wallester developer portal and establish secure communication with the ERP environment.

2. Data mapping

Finance and IT teams define how transaction data is mapped to accounts, cost centres, and departments in the ERP.

3. Testing and validation

Sample transactions are used to confirm that the integration posts entries correctly and that reports reflect accurate figures.

4. Deployment and monitoring

Once verified, the connection moves into live use. System logs and performance metrics are tracked to maintain reliability.

5. Ongoing optimisation

As reporting needs evolve, companies can adjust data mapping or automate additional processes using Wallester’s API endpoints.

From integration to intelligence

When payment and ERP systems operate together, finance data becomes accessible and actionable. Controllers can identify spending trends, compare real-time results with forecasts, and flag anomalies before they affect budgets.

Connected systems transform routine accounting into predictive analysis. A CFO can review actual expenses mid-quarter and adjust plans based on current figures. With unified data, business decisions move faster and rely on verified numbers instead of estimates. This transition from integration to intelligence is what defines modern finance operations. Data stops being a record of what happened and becomes a guide to what should happen next.

Long-term results for enterprise finance

Adopting a unified financial architecture built around Wallester’s API and ERP tools creates lasting organisational benefits.

- Shorter close cycles. Continuous reconciliation clears the month-end backlog of entries.

- Reduced administrative workload. Manual data handling declines as transactions post automatically.

- Improved accuracy. Automated mapping lowers the risk of errors in ledgers and reports.

- Better collaboration. Finance, procurement, and management teams operate from the same verified data.

- Enhanced scalability. The API structure adapts easily as companies grow or add new subsidiaries.

These outcomes support both daily operations and long-term financial planning, turning connected data into a foundation for sustainable growth.

Further Reading: Automating Expense Reconciliation: Wallester White-Label and Oracle NetSuite in Action

Wallester’s contribution to enterprise architecture

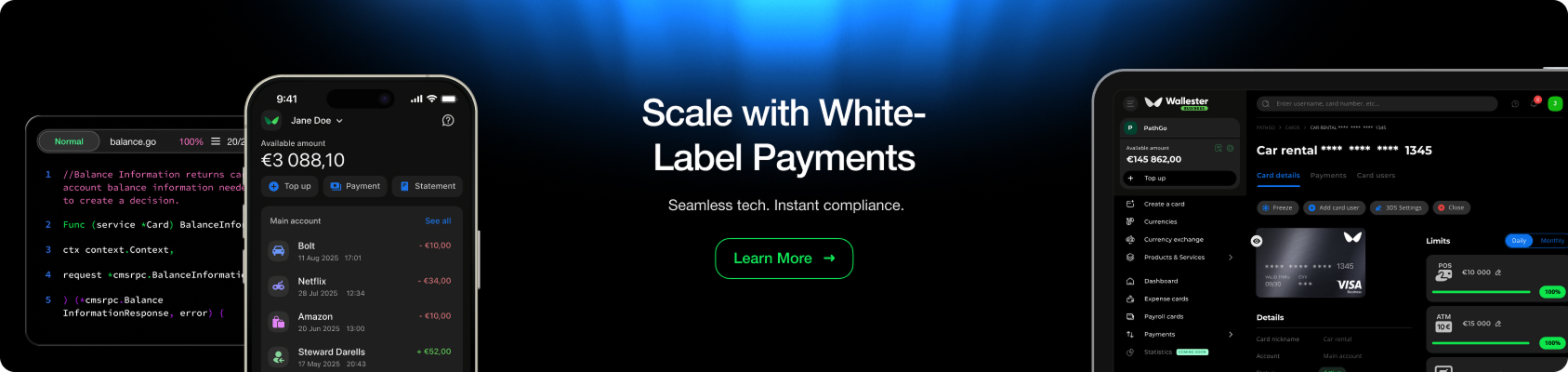

Wallester supports its partners through the whole integration process. The company provides a developer portal with comprehensive API documentation and a sandbox environment for teams to test card creation and transaction flows. These tools help enterprises design integrations that fit their existing systems without risk to live data.

Technical guidance is available to assist with authentication, data mapping, and connection stability. The API is designed to integrate with a variety of IT environments, including cloud and on-premise ERP deployments.

Through this structure, enterprises retain control of their configuration and compliance policies while benefiting from continuous, automated data exchange. The combination of Wallester’s API and ERP tools creates a connected financial framework ready for modern digital operations. By connecting Wallester’s API with ERP tools, companies can centralise their financial processes, automate reconciliation, and gain a real-time view of their spending.

If your organisation is ready to connect payments, accounting, and reporting into one integrated system, visit the Wallester White-Label page or contact the Wallester team to discuss API integration for your finance environment.