There are plenty of reasons why small business needs another source of business financing other than their own costs. One of them is irregular cash flow caused by delays in client payments and emergency expenses. You may apply for a traditional bank loan in this case. However, there is another option – cash flow finance. It doesn’t require a proven credit history and applies to any business.

In this article, we will reveal the meaning of a cash flow loan, its drawbacks, and its benefits for small companies, solopreneurs, and other business forms. We will also depict some different options for cash flow funding for efficient cash flow management.

So, let’s start with the definition.

What is cash flow financing?

Entities are operating every day. However, not all of them work smoothly and receive money from their clients on time. A cash flow loan will be handy for maintaining a good business’s financial health. Cash flow loan products are short-term solutions for firms backed by their cash flow only. They provide your company with enough cash for business day-to-day operations. Cash flow finance suits businesses with unexpected expenses and unstable earnings, e.g. seasonal. When your firm has been waiting for customer payments for a long time, this type of credit will be helpful, too.

Business cash flow loans are quickly approved and don’t require collateral. A credit score is less significant for a lender. So, small companies and start-ups with low credit ratings may also apply.

The typical forms of cash flow finance are loans, overdrafts, and credit cards.

How do cash flow loans work?

Cash flow financing works the same way for every business. It is a four-step process. The procedure for gaining a loan is described below.

Step 1.Analysis of your company’s needs

Before applying to any financial organisation, determine what money you need for specific purposes. Assess all risks and economic costs you may have, such as interest, fees, and penalties for late payments.

Step 2. Sending a request to the financial service

Once you’ve defined the loan provider that suits you and the repayment terms, submit your application online.

Step 3. Approval process.

The financial organisation takes into consideration your future cash flows. You don’t need collateral. So, if your predicted annual sales and net income satisfy the lender, you will get money in your banking account within 1-2 working days.

Step 4. Financing yourbusiness expenses.

After receiving the necessary sum, you can spend it on your purposes.

Step 5.Monthlypayments.

You must repay the cash flow loan regularly each month. Once you’ve done so, you can apply for more credit.

How does a cash flow loan differ from a traditional loan?

The mechanics of both loans are the same. However, standard business loans are different from business cash flow loans. Here are the most meaningful distinctions:

- Speed of approval: Lenders approve cash flow loans much faster than asset-based loans.

- Terms: Cash flow finance is short-term, meaning you must repay them within a year. Specific repayment terms depend on the loan provider.

- Interest rates: Business cash flow loans are costlier than standard loans. You must pay higher fees and interest because this loan is unsecured and short-term.

- Collateral: A small business loan backed by cash flow only is unsecured. The borrower repays the loan using future cash flows. Traditional loans require a firm to have certain physical assets as collateral.

- Business performance: With a business cash flow loan, your credit score is less important than your firm’s effectiveness. An asset-based loan requires substantial credit ratings.

- Guarantees: A business owner provides personal repayment guarantees for cash flow funding with his own money if a company fails to repay the debt.

Cash flow loans vs personal loans: what is the difference?

Personal loans are for individual use. People use them to buy a car, mortgage, or shopping — all things that a person can purchase using a credit card.

Lenders provide cash flow finance or lend money to small businesses and other companies. With those loans, you don’t need a collateral. A bank or a financial service provider that disburses this loan supposes you to repay it based on your expected future cash flows.

Are small business cash flow loans different from start-up loans?

Small businesses look similar to start-ups. Each of them requires different procedures for receiving a loan.

Small business loans are more flexible. They are available for any small company that passes the eligibility criteria in the UK. A lender determines interest rates and repayment schedules. Depending on the agreement, loans can be unsecured or secured with business or personal assets.

A start-up loan is an unsecured loan backed by the government. Start-up firms need to meet a specific criteria:

- Doing business in the UK from 0 to 24 months.

- Age starting from 18 years.

- The loan amount is from £25,000 to £100,000.

Then, they will be eligible for loans with a 1 to 5-year repayment period. Interests’ level is 6%. Entrepreneurs can apply for practical and financial support with a free mentoring program lasting 12 months.

Why would I need a cash flow financing?

Cash flow loan is relevant for businesses that:

- need to finance working capital;

- urgently requiring emergency cash;

- a seasonal business that has unstable earnings but constant expenses each month.

What operations can be covered by cash flow finance? You would need a cash flow loan for everyday or monthly expenses that are regular for financing working capital or emergency operations, for instance:

- rent

- repair costs

- inventory expenses

- paying utility bills

- interests, fees

- hiring staff

- paying for services

- equipment purchase.

Upsides of cash flow loan

The main advantages of a small business loan backed by a firm’s future performance are the following:

- Credits are short-term: Your business can only repay credit for a short time.

- Loans are unsecured. Your company doesn’t have to back up guarantees with the assets mentioned in your financial statements, including your balance sheet.

- Financial cushion: This type of loan protects you from seasonal cash flow fluctuations, providing you with an additional source of financing.

- Quick approval: Cash flow loans are approved much faster than traditional loans, so your business can get financing much quicker than asset-based lending.

- A good credit rating is unnecessary: Lenders analyse your possibility of repaying a loan rather than looking for your credit score. They also may decrease the amount of credit and raise interest rates. Creditors are mostly worried if you can give this loan back. Loan providers pay attention to your current situation and your business’s capacity to generate cash flows. Each of them has its terms of business cash flow loans.

- Improving credit rating: The short-term characteristics of cash flow loans may help you increase your credit score by repaying your financial obligations within a shorter range than expected.

Downsides of cash flow loan

Each financial product has its limitations. So, let’s observe the common disadvantages of this business loan:

- Automatic payments: This requirement means you must pay the same monthly amount. This prerequisite may cause trouble wildly if your revenue fluctuates and you must pay your bill next to the automatic payment. Then, your working capital erodes, and you need to plan your cash flows diligently to avoid overdue payments.

- Requires personal guarantees: Your business doesn’t need collateral to apply for a cash flow loan. A lender usually asks for a general lien. This condition implies the creditor’s right to seize and hold the debtor’s property. In this case, the loan provider leverages your assets until you repay your debts. Moreover, creditors may ask you for a personal guarantee. That means you will pay the lender from your pocket if your entire business fails to repay debts.

- No long-term options: This loan is for short-term cash flow problems. It is unlikely that you will use it for expensive equipment purchases.

- High interest and fees: Cash flow loans are unsecured. So lenders ask you to pay higher interest and costs. Moreover, if you delay your repayment, they can impose significant penalties. So carefully analyse your financial abilities and the possible repercussions if you miss your payments.

How do I apply for a business cash flow loan?

Any creditor has specific requirements for a borrower. The number of possible steps to apply for a loan may vary. The sequence we present below is not exhaustive. So, if you apply for a cash flow loan, the algorithm of receiving it may look like the following:

Step 1. A borrower provides a lender with information such as business name, registered office address, the number of trading years or months, the monthly turnover, and the loan amount you would like to receive.

Step 2. If needed, the responsible employee provides the lender’s office with his full name, position, email address, phone number, and other contact details.

Step 3. The responsible person or a group of people from the borrower’s side peruses the terms of business cash flow credit and then asks for a quote.

Step 4. The creditor analyses the borrower’s application and decides whether to approve or reject the request.

Step 5. If the financial service provider makes a favourable decision about the application, you will sign a loan agreement with the lender. Then, the provider sends the necessary money to the borrower’s business account in 24-48 hours.

What are the requirements for a cash flow loan?

A company needs enough cash flow to get approval for a loan. The cash flow loans typically require:

- The borrower is 18 and over.

- A business is registered in the UK.

- A minimum monthly turnover, or credit card sales, is £5,000.

- Trading activity lasts for six months.

The types of businesses that apply for cash flow loans

Any business has permanent cash flow needs. That is why the list of entities that can apply for this type of business loan looks like the following:

- small businesses

- sole traders

- mid-size businesses

- limited corporations

- start-ups.

What are my alternatives to a cash flow loan?

Unsecured cash flow loans are one option among many for a small business. Below, we describe a few other methods of financing cash flow gaps.

Invoice financing

This financial product suits companies with many client invoices, resulting in many accounts receivables.

Invoice finance may take two forms: invoice factoring and invoice discounting. Factoring implies that the service company is responsible for collecting debts from clients. Discounting assumes that you have control over a payment collection from your clients.

Merchant cash advance

This option is for you if you operate many debit and credit cards. A lender provides you with the sum you need. Your company repays a predetermined percentage from each future debit or credit card payment you receive from clients. The credit line closes when you repay the total sum you received from the loan provider.

This financial product is typical for a small business, such as a pub, restaurant, retail shop, or e-commerce outlet that often uses card terminals.

This new form of financing aims to maintain a healthy cash flow and has a few benefits. In particular, a merchant cash advance has no fixed payments, paying a fraction of card sales. Another advantage is that financial service providers won’t charge you an annual percentage rate (APR), a yearly rate for borrowings or income earned through investments. With this type of funding, you must pay a single all-in-one fee.

Revolving credit line

A revolving credit facility is a flexible option for a small business. This method of financing is similar to overdrafts. You can receive funds and pay accrued interest on the outstanding amount of your debt. Creditors determine the minimal loan amount, considering your average monthly future revenue. The terms of revolving credit usually range from six months to one year.

Business credit card

This form of payment seems to be the last resort for financing. Credit cards have drawbacks, including high interest and fees (over 15%) and a strong dependency on your credit score. This type of lending is unsecured but also requires your guarantees.

You may opt for this funding if your business grows and you have a significant monthly cash flow.

How are cash flow lenders regulated?

The Prudential Regulation Authority (PRA) or the Financial Conduct Authority (FCA) control financial services related to lending, including mortgage and consumer credits. Small businesses and sole traders also fall into this category. However, the FCA does not regulate loans for limited and larger companies.

So, loans for small companies and entrepreneurs are managed by the FCA and PRA.

Note that the regulation is provided through the Financial Services and Markets Act.

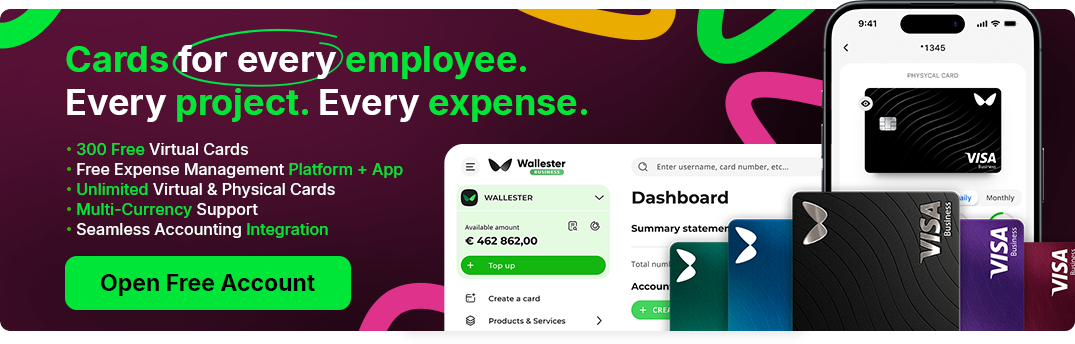

How can you get ahead of the competition with Wallester?

We possess an innovative White-Label solution that simplifies loan disbursement. Our branded credit card program enables fast and easy loan delivery on customised cards. Wallester’s user-friendly turnkey solution involves branded Visa card production, BIN sponsorship, seamless API integrations, tokenisation for robust security, white label mobile experience, and Apple Pay and Google Pay digital wallet support.

What do loan providers expect from it? Our solution revolutionises the lending industry, providing tangible benefits:

- Improved borrowing experience: Immediate loan access through personalisation and branded cards increases customer satisfaction and loyalty. The lending business manages operational processes through dashboards for enhanced analysis.

- Streamlining operational processes: Automation reduces mundane tasks and minimises errors and loan disbursement time. Optimisation leads to an increase in loan portfolio.

- Marketing growth: Extended scalability enables quick expansion, while branded features increase awareness and adaptation to market needs. Creditors become innovators, offering consumers cutting-edge solutions catering to their demands.

With Wallester, lenders enhance, essentially, the borrowing experience by overcoming standard loan disbursement challenges. Using innovative, user-friendly branded solutions, loan providers establish themselves as technology-driven experts who stand out from the competition. Ultimately, streamlined processes lead to higher customer satisfaction and brand loyalty.

Can I get a loan for cash flow?

Are cash flow loans secured?

What are the risks of cash flow lending?

High costs: You will pay high interest and fees, and you might pay costly penalties for late payments.

Automatic payment: You must reserve a specific amount each month, regardless of whether you have income.

Personal guarantees:If your company fails to repay the loan, you should return the outstanding sum from your individual earnings.