The number of business trips taken in Europe has grown significantly over the last few years, and this trend shows no signs of slowing down. According to the Global Business Travel Association, last year alone, corporate travel spending reached $391.1 billion (€360.4 billion), representing a 10.4% increase over 2023. With so many employees taking flights to conduct business, companies face constant obstacles. Effective payment solutions for business travellers are essential to address the lack of visibility into expenses, complex reimbursement processes, and errors in tracking spend.

Traditional expense management solutions are slow and error-prone, frustrating both employees and finance teams. Manual expense recording methods consume valuable time and increase the risk of accounting inaccuracies. However, Wallester’s virtual and physical cards offer an innovative and effective solution to these challenges, providing a comprehensive payment and expense management platform for business travel. Discover how Wallester cards are designed to simplify and optimise company financial processes.

Meet Wallester Business Cards

Travellers heading out into the world with Wallester Business cards can rest assured they are backed by a leading company in digital payment solutions. With a solid track record in the international market, Wallester specialises in issuing and managing virtual and physical cards, developing a deep understanding of the needs of its customers—from small businesses to large corporations.

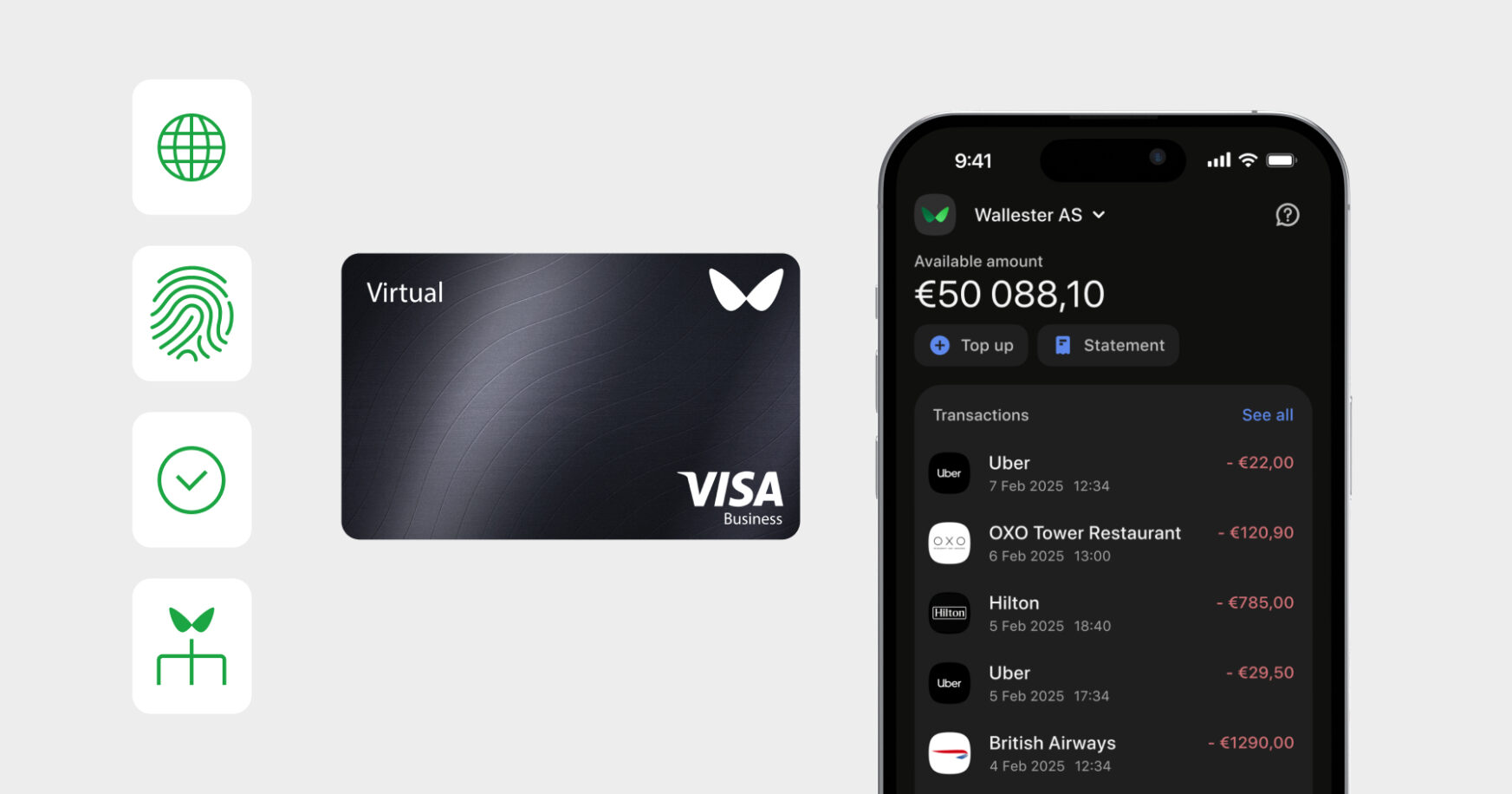

As a fully authorised Visa Principal Member, Wallester Business enables payments in more than 180 countries, processing transactions in over 150 currencies, including USD, EUR, GBP, and JPY. Its cards are accepted by millions of merchants, both online and offline, around the world. Thanks to competitive and transparent conversion rates, the platform offers real-time currency conversion, allowing users to make payments in local currencies without worrying about additional costs.

Wallester’s clear fee structure with no hidden costs facilitates business financial planning. Additionally, the company guarantees 24/7 technical support, with a dedicated customer service team ready to assist with specific queries or customised needs. This ensures that businesses and their employees receive fast and efficient assistance whenever needed.

What Are the Advantages for Corporate Travelers?

Every time an executive walks through the doors of an airport with a Wallester Business card in their wallet or virtually on their devices, they carry the peace of mind that they have reliable means of payment, no matter what life throws at them. Wallester Business has designed its corporate cards with the understanding that every trip is an opportunity for companies to strengthen business relationships and that every transaction should be conducted with the same confidence as the most important deals. Here are some key advantages:

- Instant Issuance: Virtual cards are activated in seconds, allowing immediate use for hotel bookings and urgent expenses.

- Global Compatibility: Wallester cards operate within the Visa network, ensuring acceptance worldwide.

- Digital Wallet Integration: Compatible with Apple Pay, Google Pay, Samsung Pay, and more, facilitating contactless payments.

- Customisable Spending Limits: Adjust spending limits according to the specific needs of each trip.

- Enhanced Security: Includes 3D Secure technology integrated into the Wallester app, eliminating the need for SMS or email verification steps and streamlining online transactions without compromising security.

- Instant Notifications: Employees receive immediate alerts about their transactions, making it easy to track payments in real time.

- Paperless Receipt Management: Thanks to OCR technology, the app allows receipts to be photographed and uploaded automatically, associating them with corresponding transactions.

- Real-Time Transaction Tracking: Facilitates the management and monitoring of budgets during trips.

Integrated Solutions for Companies

In a business environment where managing mobility costs can become an administrative headache and a significant financial risk, Wallester Business offers a comprehensive ecosystem of physical and virtual company cards. This system is specifically designed to transform the way companies manage expenses, offering travel agency payment solutions that streamline processes and enhance financial control while maintaining the flexibility corporate employees require.

- Unlimited Physical Card Issuance: Includes up to 300 free virtual cards to start using immediately at no cost.

- Demo Portal: A revolutionary “try before you buy” experience that allows users to explore key features such as card issuance and payment management without the need to register.

- BIN Exclusivity: Option to purchase exclusive BINs and BIN ranges for specific card groups.

- Real-Time Control: Administrators can monitor and control card usage instantly, blocking or unblocking as needed.

- Detailed Reporting: Provides real-time reports on spending, facilitating decision-making and financial planning.

- Accounting Integration: Offers integration with existing accounting systems through its RESTful API, simplifying expense reconciliation.

- Spending Policy Management: Allows independent spending policies for multiple cards, ensuring compliance with regulations.

- Automatic Expense Categorization: Integrated intelligence facilitates the classification and tracking of business charges.

- Data Export: Export bank statements and transactions in formats such as Excel or CSV.

- Tokenisation: Cards issued by Wallester are tokenised, replacing sensitive cardholder data with unique tokens.

- Real-Time Fraud Detection: Implements fraud detection systems and compliance controls based on AWS, adhering to PCI DSS Level 1 certification, the highest standard in payment security.

- Compliance: Ensures high compliance standards in KYC (Know Your Customer), AML (Anti-Money Laundering), and CTF (Counter-Terrorism Financing).

How Does All This Work in Practice for the Business Traveler?

You know what day-to-day business looks like in your company. You may not yet imagine how much it can be improved with Wallester’s physical and virtual cards. Based on real-life cases, here are just some of the benefits our customers experience:

Convenience Without Borders

When David, a marketing executive, lands in Singapore for an international conference, he doesn’t need to worry about finding a bureau de change or using his personal card. His Wallester card is accepted globally and integrated with his preferred digital wallet. During his week-long stay, he makes payments seamlessly: from last-minute reservations at a boutique hotel to dinners with potential clients—everything is processed as quickly as it would be in his home country.

Instant issuance of virtual cards for business travel ensures that even when an unexpected trip arises, the finance team can provide access to funds within minutes. Business delegates can start making bookings and payments immediately, with no waiting or bureaucratic hassle.

Accurate Cost Control

Expense control comes to life through the experience of Ana, CFO of a growing company. From her dashboard, she can set dynamic limits for different expense categories: €200 per day for meals, €300 for transportation, and a flexible budget for accommodation that varies by city. When an executive needs to adjust their limits, Ana can modify them instantly from the mobile application.

Real-time monitoring allows proactive intervention. If an employee is close to reaching their limit during an important trip, the system sends an early alert, enabling immediate adjustments that avoid uncomfortable situations without compromising budgetary control.

Enterprise-Level Security

Wallester’s security is evident in every transaction. For example, let’s say your team is heading to China and visiting various manufacturers with the intent of buying items on the spot, the purchasing team can generate single-use virtual cards. These cards, valid only for a specific transaction, eliminate the risk of unauthorised use or subsequent fraud.

3D Secure verification integrated into the app streamlines online shopping without compromising security. Every transaction is protected by real-time fraud detection systems, while PCI DSS Level 1 certification ensures compliance with the highest payment security standards.

Operational Efficiency

Efficiency is embodied in the daily experiences of team members and finance teams. Employees photograph receipts through the mobile app using OCR technology, and the system automatically associates them with corresponding transactions. Automatic reminders ensure no expense goes undocumented, eliminating traditional month-end reconciliations.

For the accounting department, this means the end of manual spreadsheets and endless emails requesting missing receipts. Expense reports are automatically generated, categorised, and ready for review, dramatically reducing time spent on administrative tasks.

Seamless Integration

The true power of Wallester is revealed in its integration capabilities. Through its RESTful API, the system connects seamlessly with existing accounting software, ERP systems, and business management tools. Every transaction automatically flows into the correct systems, eliminating manual data entry and reducing errors.

For international companies, this means maintaining a unified view of global spending with real-time currency conversions and consolidated reporting that facilitates strategic decision-making. Spending policies can be implemented and modified centrally, ensuring consistency across global operations.

Beyond Traditional Expense Management

Business trips are evolving, and Wallester is positioned as the ideal partner for this transformation. Its comprehensive platform not only simplifies corporate travel expense management with globally accepted physical and virtual cards but also offers the perfect balance between financial control and operational flexibility that modern businesses need. With features such as real-time monitoring, maximum certified security, and intelligent automation, Wallester is redefining how businesses manage their travel payments.

Sign up for Wallester Business and receive 300 virtual cards plus access to our full corporate expense management portal–for free.

Discover how we can help you simplify your business processes while putting you in complete control of your company’s finances.