Effective financial management is essential for business success, and more companies are adopting modern tools to improve how they handle finances. Software for managing expenses has become a game-changer, providing entities with efficient ways to track, report, and analyze their expenses in real-time.

As financial technology advances, cost management software has taken on a central role in helping companies simplify their operations and gain clearer insights into their finances. Companies today face increasingly intricate challenges in managing their budgets and resources. These challenges often go beyond the capabilities of traditional methods like spreadsheets and manual bookkeeping. To address this, special software delivers a wide range of tools aimed at streamlining processes, minimize errors, and improve financial transparency.

These platforms let companies keep up with growing demands by automating tasks, reducing manual input, and integrating with existing financial systems. By embracing these innovations, companies improve efficiency and set the stage for more informed decision-making and long-term financial stability.

What is expense management software?

These systems automate processes, providing businesses with precise insights into their spending and enhanced control over financial operations. By addressing challenges like manual data entry and delayed expense reporting, this software plays a key role in modernizing financial workflows.

Right expense management software solves persistent issues that many organizations face in managing expenses. The expense report automation it offers eliminates tedious manual tasks, significantly reducing the risk of human error. Real-time tracking capabilities allow monitoring expenses as they happen, ensuring better control and faster responses to budgetary concerns. Finance teams, armed with tools for generating detailed reports, can analyze spending trends and make decisions based on accurate, up-to-date data.

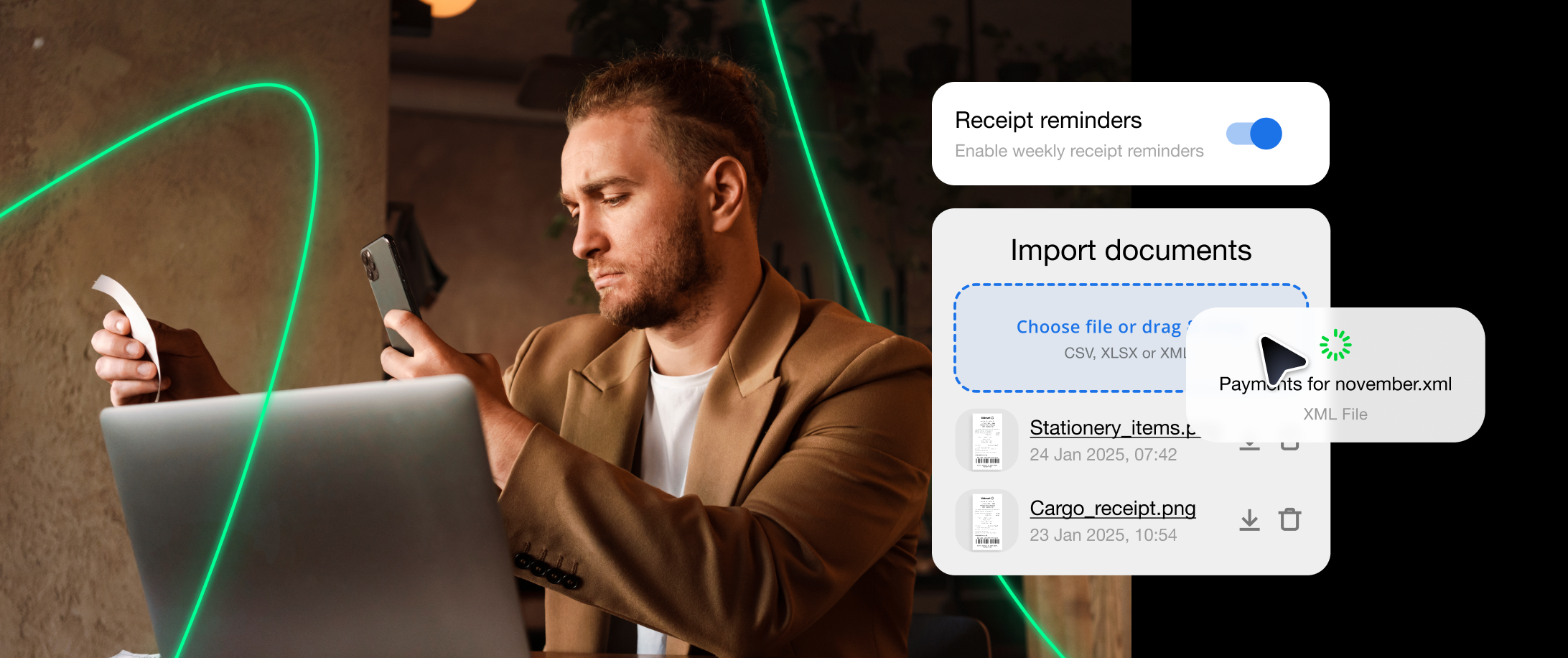

The most advanced solutions provide a comprehensive suite of features designed to optimize financial operations. With tools for automated receipt capture, companies no longer have to rely on outdated, time-consuming methods to document expenses. The ability to scan receipts directly into the platform reduces the risk of lost documentation and speeds up the expense submission process. Sophisticated expense reporting systems enable easy tracking and categorization of spending and provide detailed reports that break down all expenses incurred, giving businesses a picture of their financial activities. Additionally, these platforms support compliance by confirming company policies are consistently applied, reducing the likelihood of errors or violations.

For organizations aiming to scale, the benefits of cost management software extend beyond immediate operational improvements. It integrates seamlessly with existing systems, streamlines workflows, and frees up valuable time for teams to focus on strategic initiatives. By providing a centralized view of expenses, these platforms help manage resources efficiently, support sustainable growth, and maintain financial stability.

How does expense management software benefit my business?

Companies adopting special software gain a wide range of strategic benefits that transform their financial operations. These platforms simplify complex processes, reduce administrative workloads, and offer valuable insights to support better decision-making. By integrating these tools, any organization can improve efficiency, compliance, and financial oversight across all levels.

One of the most notable advantages is enhanced financial efficiency. Automating expense tracking and expense reporting saves significant time and resources compared to traditional manual methods. With automated systems, employee expenses are categorized accurately. Employees can submit them in just a few clicks, while managers can review and approve claims without delays. For finance teams, this means more time to focus on critical tasks like budget analysis and strategic financial planning rather than routine administrative work.

Compliance is another key benefit offered by modern software. These tools guarantee that company spending policies are enforced consistently and accurately. Automated systems can flag potential violations, such as exceeding spending limits or missing receipts, ensuring that issues are addressed promptly. With built-in features to maintain detailed documentation and audit trails, organizations are better equipped to meet regulatory requirements and avoid compliance risks.

In addition to efficiency and compliance, these platforms also provide actionable insights into company spending. By analyzing expense data in real time, it’s easy to identify cost-saving opportunities, streamline workflows, and allocate resources more effectively. The software’s mileage tracking capabilities, for example, make it easier to monitor travel-related expenses and maintain compliance with company policies. This combination of automation, oversight, and strategic insights makes expense software an essential tool for organizations looking to improve their financial operations and support long-term growth.

Benefits for managers

Managers benefit greatly from the features offered by advanced software, gaining tools that allow them to oversee financial operations with precision and efficiency. Approval workflows help them review and authorize expenses quickly, reducing delays and keeping financial processes on track. With the ability to set clear spending limits, track expenses in real-time, and generate in-depth financial reports, these platforms provide a complete view of company expenditures.

Tracking and analyzing spending patterns becomes an easy process. Employee expenses can be tracked in real-time, giving a clear overview of departmental spending. Managers can easily identify areas where project costs can be reduced, evaluate departmental spending trends, and make data-driven decisions about resource allocation. This level of visibility supports better budgeting and enables more strategic use of financial resources.

By using these tools, managers are equipped to act proactively. They can adjust policies, reallocate funds to high-priority projects, and confirm that every dollar spent aligns with organizational goals. With the support of right software, oversight and decision-making become more efficient and impactful, driving better financial outcomes.

Benefits for finance teams

Finance teams see a profound improvement in their workflows with the adoption of systems for managing expenses. These platforms significantly cut down the time spent on manual tasks like reconciliation, reduce errors commonly associated with traditional accounting methods, and integrate effortlessly with existing accounting systems to streamline operations. The software simplifies the approval process for employee expenses, improving efficiency across teams.

With automation handling repetitive processes, finance professionals can focus on higher-value activities such as strategic analysis and financial planning. The software facilitates more accurate forecasting and enables teams to build detailed financial models that reflect real-time data. This improves their ability to anticipate trends, allocate resources effectively, and provide valuable insights to support organizational goals.

By reducing administrative workloads and improving accuracy, expense software empowers finance teams to contribute to broader strategies. This shift in focus allows organizations to make more informed decisions and achieve long-term financial success.

Benefits for employees

Employees appreciate the simplicity and convenience that cost management software adds to their daily work. With easy-to-use mobile apps, submitting expenses, uploading receipts, and checking reimbursement status can all be done quickly, no matter where they are. Employees can quickly scan receipts using the mobile app, and this kind of flexibility is a game-changer, especially for employees who travel often or work remotely. For example, mileage tracking features allow them to log their travel expenses accurately.

The reimbursement process also feels much more transparent and straightforward. Employees no longer have to guess when or if their claims will be approved – they can track the entire process in real-time. Companies can use automated systems to reimburse expenses efficiently, cutting down processing times. High level of clarity saves time and builds trust, helping employees feel more supported and valued by their company.

What used to be a frustrating, paperwork-heavy task is now smooth and intuitive. Instead of dealing with piles of forms or waiting for manual approvals, employees can handle everything digitally in just a few steps. Best expense management software makes life easier, allowing employees to focus on their work rather than worrying about their expenses.

Expense management software trends in 2025

The future of cost management software holds exciting advancements that will reshape how finances are handled. Innovations driven by technologies like artificial intelligence and machine learning are aimed to transform financial management, making it smarter, faster, and more intuitive.

With predictive analytics, companies will be able to anticipate spending patterns with remarkable precision. This will help them allocate resources more effectively, identify potential cost-saving opportunities, and adjust budgets proactively. These insights will make financial planning less about guesswork and more about informed, strategic decisions.

Mobile app features will also take convenience and functionality to the next level. Real-time financial insights will empower decision-makers to act quickly, no matter where they are. Whether it’s approving expenses, analyzing trends, or setting spending limits, these tools will make managing finances more flexible and efficient than ever before. The combination of advanced technologies and user-friendly design promises a future where the best software becomes an even more indispensable part of success.

The best expense management software of 2025

1. Wallester

Wallester stands out as a premier cost management software solution, offering a comprehensive platform for financial control. The system provides real-time expense tracking, enabling companies to monitor spending instantaneously and address potential issues as they arise. Its integration with various accounting systems makes it a top choice for organizations looking for efficient and reliable financial management.

One of Wallester’s key strengths lies in simplifying the process of managing expenses. The platform boasts reliable corporate card reconciliation features, ensuring every transaction is accounted for with precision. Finance teams benefit from the platform’s detailed expense reporting capabilities, which provide actionable insights into company expenditures, helping optimize budgets and forecast more accurately. Additionally, Wallester supports the creation and management of virtual cards, enhancing security and control over spending.

2. Expensify

Expensify transforms the expense reporting experience through advanced automation. Its automated receipt capture feature uses cutting-edge scanning technology to eliminate manual data entry, saving significant time and effort. Employees can easily submit expenses through the user-friendly mobile app, which works seamlessly across platforms and locations.

Expensify simplifies the reimbursement process, assuring employees are reimbursed quickly and efficiently while reducing administrative workload for finance teams. The platform’s automated receipt scanning and categorization tools make managing corporate spending intuitive. For growing businesses, Expensify’s ability to integrate with major accounting systems ensures scalability and operational efficiency.

3. ExpenseIn

ExpenseIn focuses on delivering a useful solution for tracking and reporting expenses. Designed to minimize manual data entry, the software simplifies workflows for entities of all sizes. Employees can easily submit claims through the platform’s intuitive interface, while managers have access to tools for reviewing and approving expenses quickly.

ExpenseIn integrates effortlessly with existing accounting software, making it an excellent choice for those seeking a versatile and adaptable financial management tool. Its expense reporting features provide insights into spending trends, helping identify cost saving opportunities and maintaining compliance with company policies.

4. Zoho Expense

Zoho Expense offers a powerful and comprehensive software solution tailored to meet diverse needs. The platform includes sophisticated approval workflows that improve the expense approval process.

Zoho Expense’s advanced reporting capabilities provide companies with deep insights into their spending patterns. The ability to generate customizable, detailed reports makes this software a valuable tool for financial analysis and decision-making. With smooth integration into the larger Zoho ecosystem, it’s an ideal solution for those already using other Zoho products.

5. Airwallex

Airwallex delivers a strong system for managing financial operations, particularly for organizations with international reach. The platform allows companies to set spending limits and enforce company spending policies efficiently. Real-time tracking provides immediate insights into corporate spending patterns, enabling proactive financial management.

Airwallex also supports multi-currency transactions, making it a preferred choice for global businesses. With tools for integrating expenses into accounting workflows and guaranteeing compliance, Airwallex offers a reliable, scalable solution for dynamic financial environments.

6. Pleo

Pleo redefines expense software work with its innovative approach to managing expenses. By combining corporate card management with intelligent expense tracking, Pleo offers a comprehensive suite of tools that help gain control over their financial operations.

Employees can easily capture receipts and submit expenses via Pleo’s intuitive mobile app, while managers can approve transactions and analyze spending trends in real time. The platform also provides integration with popular accounting systems, securing smooth data flow and improved expense reporting.

7. QuickBooks Online

QuickBooks Online integrates expense tracking directly into its accounting ecosystem, making it a versatile solution for companies of all sizes. The platform offers connectivity between financial data and broader accounting workflows, reducing the need for duplicate entries and manual adjustments.

With its powerful reporting capabilities, QuickBooks Online allows tracking cash flow, monitoring budgets, and analyzing spending patterns in real time. The user-friendly interface makes it accessible even to those with limited financial expertise, making it a popular choice among small and medium-sized enterprises.

8. Xero

Xero provides a cloud-based system designed for flexibility and efficiency. Its integration with various systems assures that expense data flows seamlessly across departments, enabling more accurate expense reporting.

Xero’s intuitive and user-friendly interface simplifies tracking expenses, while its advanced reporting tools help monitor spending trends and guarantee compliance with company policies. The platform’s scalability makes it suitable for both small businesses and larger organizations looking to modernize their financial operations.

9. Rydoo

Rydoo focuses on creating a smooth and user-friendly experience for managing expenses. The platform simplifies the expense submission and approval process, making it quick and effortless for both employees and managers.

Rydoo’s tools include features for real-time expense tracking and policy enforcement. Its easy-to-navigate interface and advanced expense reporting capabilities make it a preferred choice for companies aiming to upgrade financial efficiency.

10. FreshBooks

FreshBooks is a practical solution for small entities seeking straightforward financial management tools. The platform offers accessible expense tracking capabilities with an emphasis on simplicity and usability.

With its clean, intuitive interface, FreshBooks allows users to log expenses, upload receipts, and generate basic financial reports without hassle. Its features cater specifically to freelancers and small businesses, so it is an ideal entry-level solution for those looking to manage expenses effectively.

11. SAP Concur

SAP Concur is a leading choice for enterprise-level expense software. The platform offers advanced expense reporting and integration features designed for enterprises with complex financial management needs.

SAP Concur provides tools for automating expense reporting, tracking travel expenses, and providing compliance with company policies. Its analytics capabilities allow them to gain a clear understanding of spending patterns, optimize budgets, and streamline approval workflows.

12. Spendesk

Spendesk delivers a holistic spend management solution that combines corporate card tracking with efficient features for managing expenses. The platform offers a centralized view of all expenditures, making it easier to track and control spending.

Spendesk’s tools include real-time tracking, detailed financial reporting, and integration with accounting systems. This comprehensive approach helps improve financial visibility and provide compliance with company policies.

13. Navan

Navan integrates processes of managing travel and expenses into a single, cohesive platform. Designed for organizations with frequent travel needs, the software streamlines the process of tracking and managing both travel-related and general corporate expenses.

Navan’s intuitive interface simplifies expense submission and reporting while providing real-time insights into spending. Its ability to combine travel bookings with tracking expenses makes it a unique solution for companies looking to manage expenses efficiently.

14. Wave

Wave offers free accounting software with effective expense tracking features. Ideal for small entities and freelancers, the platform provides basic tools for logging expenses, generating reports, and maintaining financial records.

Although Wave’s key features are less extensive than paid solutions, it offers a cost-effective option for those with simple financial management needs. The user-friendly interface makes it easy for beginners to track their spending and stay organized.

15. Ramp

Ramp combines intelligent corporate cards with integrated capabilities for managing expenses. The platform offers advanced tools for tracking expenses and controlling spending, making it an ideal choice for those looking to improve financial operations.

Ramp’s analytics tools provide deep insights into company expenditures, helping identify cost-saving opportunities and optimize budgets. Its automation features reduce administrative tasks, allowing finance teams to focus on strategic planning and decision-making.

Tips for implementing expense management software

This is how the benefits of their chosen solution can be maximized:

1. Assess current processes and identify needs

Before selecting a platform, the existing process of managing expenses should be thoroughly evaluated. Identify pain points, such as manual data entry, delayed reimbursements, or lack of visibility into spending. Understanding these challenges will help determine which features – such as real-time expense tracking, automated receipt capture, or policy enforcement – are most important for your organization.

2. Research and choose the right solution

Not all software is created equal, so researching available options is essential. Look for solutions that align with your company’s specific needs, focusing on features like automated receipt capture, expense reporting tools, and easy integration with existing accounting systems. Consider scalability to be sure the software can support your company’s growth.

3. Involve key stakeholders early

Include managers, finance teams, and frequent expense submitters in the decision-making process. Their input can provide valuable insights into daily pain points and confirm the chosen software meets practical needs.

4. Provide comprehensive training

Effective training is critical for successful adoption. Organize workshops or webinars to demonstrate the accounting software’s features and functionality. Both finance teams and employees should understand how to use tools like mobile app functionality for expense submission or real-time tracking. Clear guidelines on company spending policies will also help employees comply with organizational expense rules.

5. Set clear objectives and KPIs

Establish specific goals for implementing the software, such as reducing approval times, reducing manual data entry, or improving compliance. Define key performance indicators to measure the system’s effectiveness.

6. Pilot the system before full rollout

Start with a smaller group or department to test the software. Gather feedback on usability, integration, and any issues encountered. This pilot phase helps make necessary adjustments before rolling the system out company-wide.

7. Integrate with existing systems

Make sure the software integrates smoothly with your current accounting tools, major accounting systems, and other systems. Integration reduces redundancy, improves accuracy, and guarantees financial data flows efficiently across platforms.

8. Monitor usage and gather feedback

Post-implementation, regularly monitor how employees and teams are using the accounting software. Encourage feedback to address challenges early and refine processes. This ongoing engagement helps to be sure that the system continues to meet actual needs effectively.

9. Regularly review reports and adjust policies

Leverage the detailed reports generated by the software to gain insights into spending patterns, policy adherence, and areas for cost savings. Use this data to refine company policies, enforce spending limits, and identify opportunities for greater efficiency.

10. Stay updated with software upgrades

Expense software improves rapidly, with providers frequently releasing updates to add new features or improve functionality. Staying current with these updates ensures that your company benefits from the latest advancements, such as better mobile app functionality or predictive analytics.

By following these steps, businesses can guarantee a smooth transition to cost management software while maximizing its impact on their financial operations. With careful planning and continuous improvement, these tools can significantly boost efficiency, compliance, and financial oversight.

Streamline your expense management with Wallester

Wallester’s software for managing expenses upgrades financial operations of any company. By combining advanced tools with an intuitive platform, Wallester simplifies this complex process, ensuring that organizations can focus on strategic priorities rather than administrative burdens.

Wallester provides businesses with a powerful suite of features aimed to meet the demands of modern financial management:

- Instant card issuance.Issue both physical and virtual cards instantly, minimizing delays in providing employees with payment tools.

- Real-time tracking expenses. Monitor company spending as it happens, providing complete transparency and control over financial activities.

- Automated spending limits. Businesses can set and enforce spending limits on both virtual and physical cards to prevent overspending.

- Mobile-friendly features. Employees can manage expenses on the go, including submitting receipts and tracking reimbursement requests via a mobile app.

- Multi-department access. Expense controls and approval workflows are adaptable, supporting complex organizational structures.

- Seamless integration. The platform integrates effortlessly with major accounting systems, providing smooth data flow and eliminating redundant manual entries.

- Reliable expense reporting tools. Generate detailed reports to analyze spending patterns, identify cost-saving opportunities, and optimize resource allocation.

- Corporate card reconciliation. Manage expenses on corporate cards with accuracy, guaranteeing compliance with company spending policies and minimizing discrepancies.

- Scalable solutions. Wallester is designed to grow with your business, offering scalable features that adapt to your organization’s changing needs.

Wallester Business offers a unified platform aimed to simplify the management of various corporate expenses. The solution supports real-time oversight of all spending, making it easier for companies to maintain financial transparency and control. Key solutions include:

- Work rides. Pay for fuel or business-related transportation using a corporate card, eliminating the need for out-of-pocket expenses or paper receipts.

- Business trip expenses. Employees can make purchases anywhere in the world while managers monitor all spending remotely and in real time.

- Online media buying. Launch and manage ad campaigns with dedicated virtual cards, improving financial tracking and accounting accuracy.

- Cash payments. Easily withdraw funds from corporate cards for purchases and submit invoice photos via the mobile app for streamlined documentation.

For organizations requiring flexible payment options, Wallester Business introduces shared-access virtual cards. These cards can be assigned to multiple employees, with spending activity monitored and managed by a central administrator. Shared cards allow for easy collaboration across departments and remote teams without sacrificing control or compliance.