The French payment card scene offers plenty of options, which can make choosing the right one a bit tricky. Are you a local wanting something better in your wallet? Perhaps a visitor planning a lengthy stay? Getting to know what’s available in France for 2025 truly matters. This helpful guide explains the top cards on offer, what makes each one special, and how to pick one that fits what you want to achieve with your money.

Best credit cards in France: an overview

The French payment system has undergone significant changes recently. Local banks now race against global financial players to win customers with better perks, from travel benefits to cash returns. The best options in 2025 blend low interest rates with rewarding loyalty programs, fewer charges, and easy-to-use banking apps.

1. Gold American Express (France)

Overview

The Gold American Express card is one of the most popular premium options in France, offering travel insurance, loyalty rewards, and lifestyle perks. Customers can activate a digital card immediately after approval in the Amex app, while the physical card arrives by post. The first year is free, and from the second year the card costs €16 per month (€192 annually). Transactions are billed through a deferred debit system, where all spending is collected into a single monthly statement. Combined with access to Amex Offers, the card appeals to frequent travellers and professionals who value flexibility and reliable protections.

Key features

- Fees: Free for the first 12 months, then €16/month (€192/year) from year two.

- Rewards: Earn 1 Membership Rewards point per €1 spent, redeemable for travel, shopping, or transferred to partner programmes (Amex Rewards France).

- Travel benefits: Medical assistance abroad up to €50,000 per event and per insured person, repatriation up to €50,000, and coverage for baggage delays and cancellations.

- Payment model: Deferred debit — all monthly charges are grouped into one payment, simplifying budgeting.

- Lifestyle perks: Exclusive discounts and cashback through Amex Offers.

Security and control

The Amex France app provides instant push notifications for every transaction. Cardholders can lock and unlock their card, reset their PIN, and adjust spending limits in real time. Online purchases are protected by SafeKey, Amex’s 3-D Secure system, which adds an extra layer of security for ecommerce transactions. If the card is lost or stolen, American Express provides rapid replacement and 24/7 customer support.

Active users and markets

American Express reported over 70 million cards worldwide in 2024, and in France the Gold remains a leading product for customers seeking premium perks without the higher Platinum fee. It continues to appear in 2025 French credit card rankings as one of the strongest mid-tier premium cards.

Best for

Travellers, shoppers, and professionals who want comprehensive travel insurance, purchase protection, and loyalty rewards. The deferred debit model also makes it practical for customers managing high monthly spending.

Quick stat

From the second year, the Gold Amex costs €16 per month (€192 annually), billed through deferred debit.

2. Air France KLM American Express Gold

Overview

The Air France KLM American Express Gold card is a co-branded product aimed at Flying Blue members in France. It allows cardholders to turn everyday spending into Flying Blue Miles, which can be redeemed for flights, upgrades, and partner services. Customers receive a digital card immediately after approval through the Amex mobile app, while the physical card is delivered later. The first year is free; from year two, the card costs €16 per month (€192 annually). It also comes with bundled travel insurance and assistance, making it attractive for frequent flyers.

Key features

- Fees: €0 in the first year, then €16/month (€192/year) from year two.

- Rewards: Earn up to 15 Flying Blue Miles for every €10 spent on eligible purchases, with higher accrual on Air France, KLM, and Transavia bookings.

- Welcome bonus: Up to 20,000 Miles offered in the first months when spending thresholds are met.

- Travel insurance: Includes medical cover, baggage protection, and trip cancellation (see insurance details).

- Status benefits: Extends Flying Blue Miles validity and supports faster XP accumulation.

Security and control

The Amex app allows real-time monitoring, instant card blocking, and PIN management. Transactions are protected with SafeKey, American Express’s 3-D Secure technology. Around-the-clock customer service helps with card replacement or travel-related queries.

Active users and markets

This card is especially popular among French Flying Blue members. It consistently features in airline loyalty programme recommendations and 2025 comparisons for those who want to boost Miles quickly while maintaining strong insurance coverage.

Best for

Regular Air France and KLM passengers who want to maximise Flying Blue Miles on everyday spending while benefiting from built-in travel insurance.

Quick stat

From the second year, the Air France KLM Amex Gold costs €16/month (€192/year), with a welcome bonus up to 20,000 Miles in the first months.

3. Platinum American Express (France)

Overview

The Platinum American Express is the French premium card offering, presented in metal and designed for frequent, discerning travellers. It provides immediate digital access via the Amex mobile app upon approval; the physical card is then delivered by post. As of 2025, the card operates on a deferred debit model: all your spending is consolidated into a single statement each month. It comes with exceptional benefits such as access to the Global Lounge Collection (including Priority Pass lounges), a robust travel insurance suite, concierge service, and exclusive lifestyle credits and offers.

Key features

- Lounge inclusion: Complimentary membership to the Priority Pass network, granting access to 1,700+ lounges globally – part of Amex’s Global Lounge Collection.

- Credits & perks: Regular statement credits for fine dining and travel purchases (details vary in 2025 promotions).

- Travel insurance: Extensive cover including delay, cancellation, medical, baggage, and trip interruption – fully spelled out in Amex’s official insurance documentation.

- Metal design & app features: Elegant metal card with full control via the Amex mobile app – lock/unlock, PIN resets, spending limits, and transaction alerts.

- Deferred billing: One monthly payment consolidates all spending, offering excellent budget clarity.

Security and control

The Amex France app offers real-time alerts, instant card freeze or unfreeze, and PIN management tools. SafeKey (Amex’s 3-D Secure system) secures all online purchases. Amex also provides 24/7 global customer support and emergency card replacement, which is invaluable when travelling.

Active users and markets

The Platinum card is part of Amex’s elite offerings worldwide – globally, Amex reported over 83 million proprietary cards-in-force by the end of 2024, as detailed in its annual report. In France, Platinum is marketed as the top-tier choice for frequent travellers who value comfort, lounge access, and premium service.

Best for

Frequent flyers and global travellers who prioritise airport comfort, hotel and lifestyle perks, comprehensive insurance, and a high-contact concierge service – all managed seamlessly via app with one monthly statement.

Quick stat

Includes complimentary Priority Pass access, granting entry to over 1,700 lounges worldwide.

4. Boursorama Banque – Ultim (Visa)

Overview

The Ultim Visa card by Boursorama Banque (now BoursoBank) stands out as a fully featured card with zero monthly fees, provided you use it at least once per month. You gain instant digital access upon approval, and the physical card is dispatched promptly. Both card payments and ATM withdrawals in euros are unlimited and free, while three free foreign-currency withdrawals per month are permitted before a 1.69 % fee applies. The card allows immediate or deferred debit (subject to income conditions), high spending limits, and broad contactless/mobile wallet compatibility.

Key features

- Fees: Card is free if used monthly; otherwise up to €9/month for inactivity. Physical card qualifies if a payment is made; digital version is free with no conditions.

- International use: Free card payments and cash withdrawals globally, with 3 free FX ATM withdrawals per month, then 1.69 % fee thereafter.

- Debit options: Immediate debit available by default; deferred debit unlocked after six months with ≥ €2,400 monthly income or ≥ €6,000 total account holdings.

- High limits: Payment capacity up to €20,000 over 30 rolling days; withdrawals up to €2,000 over 7 rolling days.

- Digital integration: Supports Apple Pay, Google Pay, Samsung Pay, Garmin Pay, and allows virtual cards. Full account and card controls come through the BoursoBank app.

Security and control

The BoursoBank app offers real-time transaction alerts, in-app card blocking, spending limit adjustments, and budgeting tools. Payments are secure via 3-D Secure authentication, and the bank offers prompt support and assistance if the card is lost or misused.

Active users and markets

BoursoBank transitioned in 2025 to a full digital model and serves millions of customers online. Ultim is frequently recommended in travel-friendly card reviews for its low fees and high flexibility among France’s online banking options.

Best for

Frequent travellers needing a free, flexible card with generous limits, easy app control, and minimal FX fees – ideal for cost-conscious users who still value strong digital functionality.

Quick stat

Allows 3 free foreign-currency ATM withdrawals per month, after which each withdrawal is charged 1.69 %.

5. BoursoBank – Metal (Visa)

Overview

The Metal Visa card by BoursoBank (formerly Boursorama) is a premium-tier offering priced at €9.90/month for the metal version or €5.90/month for the virtual-only option. It’s designed for frequent travellers and those who spend regularly in multiple currencies. The card includes a generous cashback scheme (0.20% in euros, 2.00% in foreign currencies, each capped at €20/month), comprehensive insurance, device protection, and seamless global payments with no hidden charges. The user-friendly app streamlines everything from shopping to managing card features and support.

Key features

- Fee: Metal physical card at €9.90/month, or €5.90/month for virtual-only.

- Cashback rates: 0.20% on euro purchases and 2.00% on foreign currency spend, each capped at €20/month (max €40/month).

- FX and fee structure: All card payments and ATM withdrawals abroad are free and unlimited.

- Device protection: Covers accidental damage or theft on mobile devices under Bourso Protect Plus up to €400 per incident, up to two incidents yearly.

- Additional perks: Access to ‘The Corner’ cashback programmes and enhanced support tiers.

Security and control

BoursoBank’s app gives instant alerts, the ability to freeze or unfreeze your card, adjust spend limits, and manage travel settings. It supports mobile payments (Apple Pay, Google Pay, etc.) and uses 3-D Secure for online transactions. BoursoBank’s support is accessible via the app as well.

Active users and markets

Following BoursoBank’s 2025 rebrand (with 7.6 million clients reported by SG), Metal remains its highest-tier subscription offering – frequently featured in French digital banking reviews for its value, particularly for travellers.

Best for

Frequent international spenders who want cashbacks, strong protections, and unlimited fee-free use in different currencies in one sleek, app-driven package.

Quick stat

Enjoy up to €40 total cashback per month (0.20% in euros and 2.00% in foreign currency, each capped at €20).

6. Fortuneo – Gold CB Mastercard

Overview

The Gold CB Mastercard from Fortuneo is a premium card that can be free — as long as you make at least one card payment per month. If not, a €9 inactivity fee applies, as noted on the Compte et Cartes page. Requires minimum income of €1,800 net/month to qualify. The card offers free global payments and ATM withdrawals, even outside the eurozone, and includes robust travel and purchase insurance—details are in Fortuneo’s assurances pages and blog articles.

Key features

- Fee: €0/month when you make ≥1 purchase; €9/month otherwise.

- Abroad: Free card use and ATM withdrawals worldwide.

- Eligibility: Requires ≥€1,800 net monthly income.

- Debit options: Immediate debit by default; deferred debit after 6 months and conditions met.

- Insurance: Covers medical, baggage, trip cancellation, with generous limits (see detail page).

Security and control

Fortuneo app offers instant alerts, controls to freeze/unfreeze cards, limit settings, and 3-D Secure protection. Digital assistance is available in-app.

Active users and markets

Fortuneo is regularly rated as France’s lowest-cost online bank. Their Gold card often ranks top in travel-friendly card reviews.

Best for

International travellers wanting insurance and zero fees abroad, without monthly charges, provided they use the card.

Quick stat

You avoid the €9/month inactivity fee by making at least one purchase each month.

7. Hello bank! – Hello Prime (Visa)

Overview

The Hello Prime package from Hello bank! offers a Visa card (physical + virtual), tailored for getting more from your spending. It costs €5/month as a solo account or €8/month for the duo option. The offer includes travel insurance and assistance, instant access to your virtual card, and fee-free payments and cash withdrawals worldwide. The package comes with Hello Extra cashback (doubled up to €50/year), full mobile control, and simplified banking under one digital roof.

Key features

- Monthly fee:€5 for Hello Prime solo; €8 for Duo.

- Global card use: No charges on card payments or withdrawals, in France or abroad.

- Insurance & assistance: Included with the card.

- Hello Extra: Cashback doubled up to €50/year.

- Bonus benefit: One-year fee waiver when subscribing to a Hello bank! mortgage.

Security and control

Hello bank!’s app provides real-time transaction alerts, allows you to freeze cards, change spending limits, and manage contactless or online payment settings. All online payments are protected by Visa’s 3-D Secure. The app also gives secured access to the Hello Team for priority support.

Best for

Digital-first users who want an all-in-one account with travel protections, global card use, and meaningful cashback for a modest monthly fee.

Quick stat

Includes up to €50/year cashback and is €5/month (or €8/month for Duo).

8. Société Générale – Visa Premier

Overview

The Visa Premier card from Société Générale is positioned as a mid-range premium card within the bank’s portfolio. It includes comprehensive travel and purchase insurance, flexible debit options, and competitive spending limits. As of 2025, the annual fee is approximately €135/year when taken outside of bundled account packages. While the card provides strong insurance coverage, Société Générale applies a 2.70 % foreign exchange margin on non-euro payments, plus a possible fixed commission depending on the ATM network – something to consider if you travel outside the eurozone frequently.

Key features

- Fee: Around €135/year when subscribed separately, according to Comparabanques.

- Debit type: Choice of immediate or deferred debit depending on income and client profile.

- Insurance cover: Wide protections including medical assistance, trip cancellation, baggage delay/loss, civil liability abroad, and rental car coverage.

- FX fees: ~2.70 % surcharge on non-euro transactions.

- Limits: Cardholders can personalise payment and withdrawal ceilings with their advisor or via the app.

Security and control

Through the Société Générale mobile app, clients can monitor transactions in real time, block or unblock the card, adjust limits, and manage online payments. Purchases are protected using Visa Secure (3-D Secure) authentication. In addition, Société Générale maintains a wide branch network across France, providing in-person support alongside digital tools.

Active users and markets

Visa Premier remains a stable product in Société Générale’s retail line-up, popular with long-standing customers who want a balance of traditional branch support and premium benefits. It is frequently cited in French comparison platforms as a reliable option for clients who prioritise insurance and service continuity over lowest-cost FX terms.

Best for

Existing Société Générale clients who want premium travel insurance and higher card ceilings, integrated into a traditional bank relationship. It’s particularly attractive to those who value in-branch advisory services.

Quick stat

Annual subscription is approximately €135/year, with a 2.70 % foreign exchange surcharge on non-euro transactions.

9. LCL – Visa Premier

Overview

The LCL Visa Premier is a premium card with strong travel cover and flexible billing. LCL lists customisable payment ceilings up to €15,000 and a €1,000 cash withdrawal limit per 3-day period, with acceptance in 200+ countries. You can choose immediate or deferred debit and manage most settings from the LCL Mes Comptes app. Standard pricing equals €144/year, with a reduced €6/month for “Jeunes Actifs” (18-29).

Key features

- Price: €144/year (Visa Premier) outside promos; €6/month for “Jeunes Actifs” (18-29). LCL also advertises occasional first-year offers in its welcome pages.

- Debit type: Immediate or deferred (selectable).

- Insurance & assistance: Medical assistance, trip disruption/cancellation, luggage, car-hire cover and more; see the Visa Premier insurance section from LCL.

- FX fees (without add-ons): Official 2025 tariff shows card payments in non-euro or outside EEE: €1.26 + 3.00% (Visa Premier falls under “autres cartes”).

- ATM withdrawal in non-euro:€3.17 + 3.00%.

- CityExplorer add-on: To avoid LCL’s FX fees, you can activate LCL CityExplorer in the app. The 2025 tariff table lists €2/month (18-29) and €15/month (30+) for Visa Premier.

Security and control

Manage the card in the LCL Mes Comptes app: real-time alerts, temporary lock/unlock, and ceiling changes. Online purchases use Visa’s strong customer authentication; LCL documents 3-D Secure via its payment resources and consumer guidance.

Active users and markets

Visa Premier is a core premium product for LCL’s retail customers, with wide acceptance and the option to neutralise FX fees on trips via CityExplorer rather than switching banks – useful for clients who want branch support plus full app control.

Best for

LCL customers who value deferred debit, broad travel insurance and high custom limits, and who want the choice to cap FX costs through CityExplorer during travel periods.

Quick stat

FX fee on non-euro card payments: €1.26 + 3.00% (standard), or €0 with CityExplorer (subscription: €2/month if 18–29; €15/month if 30+).

10. Carrefour Banque – Carte PASS Mastercard

Overview

The Carte PASS Mastercard is Carrefour Banque’s flagship card for everyday shopping and flexible financing. You can pay au comptant (immediate) or switch to revolving credit when needed, with the rate tied to the outstanding balance. As of 21 August 2025, Carrefour Banque lists the following TAEG révisables on its site: 23.37% (≤ €3,000), 15.77% (€3,000.01–€6,000), and 8.67% (> €6,000). Beyond finance, PASS gives access to exclusive retail deals and partner rewards, including Mastercard Travel Rewards for cashback-style offers when travelling.

Key features

- APR tiers (revolving credit):23.37% up to €3,000; 15.77% from €3,000.01 to €6,000; 8.67% above €6,000.

- Rewards & offers: Ongoing cardholder deals via Offres PASS and travel shopping perks through Mastercard Travel Rewards (participating merchants; up to double-digit cashback depending on partner).

- Payment flexibility: Choose immediate payment or revolving credit at checkout or in the app, with legal 14-day withdrawal rights on credit.

Security and control

Online payments use strong authentication with Clé Secure, integrated in the Carrefour Banque mobile app, for validating sensitive actions and purchases (generally from €30). You can consult balances, switch payment mode, adjust revolving repayments, and review statements directly in the app.

Active users and markets

With Carrefour’s retail network across France, the PASS ecosystem reaches a large base of in-store and online shoppers, making the card a common pick for households that value retail benefits plus financing flexibility. Current promotions and seasonal offers appear on the PASS hub.

Best for

Regular Carrefour customers who want one card for everyday purchases with the option to spread costs via regulated revolving credit, while tapping partner rewards (especially when travelling or shopping cross-border).

Quick stat

APR tiers (revolving): 23.37% (≤ €3,000) • 15.77% (€3,000.01–€6,000) • 8.67% (> €6,000).

What are credit cards?

Credit cards serve as payment tools that allow you to borrow money up to a predetermined limit. Unlike debit cards, which draw funds directly from your bank account, credit cards let you spend money that you’ll pay back later. They function as short-term loans, with the card issuer covering your purchases until you repay the borrowed amount.

In France, credit cards often work differently than in countries like the US or the UK. Many French “credit cards” operate as deferred debit cards, where the full balance gets automatically withdrawn from your current account at the end of the month. Traditional revolving credit options exist too, but they are less common in the French banking system.

The French market offers various card types, from basic no-frills options to premium cards packed with benefits. Each serves different needs and comes with distinct features, costs, and requirements.

How does a credit card work?

When you make a purchase with your credit card, the card provider pays the merchant on your behalf. This transaction adds to your balance, which you’ll need to repay according to your agreement with the card issuer. Most French banks offer a grace period before charging interest on new purchases, typically lasting 20-25 days.

If you don’t pay the full balance by the due date, you’ll likely face charged interest on the remaining amount. The interest rate, often expressed as a representative APR (Annual Percentage Rate), determines how much extra you’ll pay for carrying a balance. French credit cards generally have APRs ranging from 12% to 20%, depending on your credit history and the card type.

Many French credit cards also offer reward systems. Each time you use your plastic for eligible purchases, you earn points, cashback, or air miles. These rewards can later be redeemed for travel, merchandise, or statement credits, adding value beyond the basic payment function.

Further Reading: Virtual Cards vs. Physical Cards: What’s Better for Business?

Which factors do lenders consider when evaluating your credit card eligibility?

French banks assess several aspects when reviewing credit card applications. Your credit rating plays a central role, as it demonstrates your history of managing debt. Banks access this information through the Banque de France’s national credit database, which tracks payment defaults and current loans.

Income represents another important factor. Lenders want to confirm you earn enough to handle potential debt. Most premium credit cards require minimum monthly or annual income thresholds, sometimes starting at €30,000-€40,000 yearly for basic cards and reaching €100,000+ for elite options.

Your existing relationship with the bank matters too. If you already maintain a current account with positive standing, you likely receive more favorable terms. Many French banks reserve their best credit card offers for established customers with substantial deposits or investments.

Employment stability also influences decisions. Applicants with permanent contracts (CDI) generally receive easier approval than those with temporary employment or self-employed status. Lenders view stable employment as an indicator of reliable income, which translates to lower lending risk.

How safe is it to use my credit card in France?

France has embraced chip-and-PIN technology for years, making it one of the safer countries for card payments. All credit cards issued by French banks include EMV chips, which provide stronger security than magnetic stripes alone. When making purchases, you need to enter your PIN rather than sign, adding an extra layer of protection.

For online transactions, French banks implement 3D Secure authentication, requiring additional verification through your mobile phone. This two-factor authentication reduces the risk of unauthorised online charges. Most banks also offer instant transaction notifications through their mobile apps, letting you spot suspicious activity immediately.

Using your card abroad deserves extra attention. Before travelling, inform your bank about your travel plans to prevent them from flagging foreign transactions as potentially fraudulent. When withdrawing cash from ATMs in major cities, choose machines located inside bank branches whenever possible to minimise the risk of skimming devices.

If your card gets lost or stolen, French banks usually offer 24/7 emergency services. Most providers can freeze your account immediately and arrange emergency card replacements, even when you are travelling abroad.

Credit card fees

Knowing what you will pay helps dodge surprise costs. Here’s what to watch for:

The annual fee differs widely between card levels. Basic options usually cost €30-€50 yearly while fancy cards may run €200+. Some banks drop this fee if you keep enough money in your account or use the card often enough.

Foreign transaction fees need close attention if you travel or shop on websites based abroad. Regular cards often charge 2-3% extra on purchases in foreign currencies, while dedicated travel cards offer spending abroad without these extra costs.

Cash withdrawals come with extra charges. Even at your own bank’s ATMs, you’ll pay cash advance fees of 1-3% of what you take out, with minimum amounts. These transactions also start collecting interest right away, with no grace period.

Balance transfer fees hit when moving debt between cards. French banks usually take 1-4% of the amount moved, though some special offers skip this fee. Before transferring, compare what you save with a lower interest rate against what you pay in fees.

Late payment charges can really add up. Besides extra fees (often €8-€20 each time), late payments might trigger higher interest on what you already owe. Paying on time matters both for keeping costs down and maintaining good credit.

Choosing the right credit card

Finding the perfect credit card demands matching your lifestyle with the right card features. Start by analysing your spending habits – do you travel frequently, shop primarily online, or use your card mainly for everyday purchases? Your typical usage pattern should guide your selection.

For frequent travelers, prioritise cards offering no foreign transaction fees and travel perks like airport lounges access or travel insurance. If you drive regularly, consider cards with fuel station discounts or enhanced rewards for transportation expenses. Online shoppers might benefit from cards with extended warranty protection or purchase insurance.

Check whether your preferred bank offers a dedicated mobile banking app. The quality of digital tools varies widely among French banks, with some providing comprehensive expense tracking while others offer bare-bones functionality. A well-designed app simplifies managing your account, tracking expenses, and paying bills.

The representative APR matters most if you occasionally carry a balance. Even a few percentage points difference can save substantial money over time. However, if you typically pay your balance in full each month, focus instead on rewards programs and benefits rather than the interest rate.

Read the fine print regarding promotional offers. Many cards advertise attractive introductory rates or welcome bonuses, but these often come with spending requirements or time limitations. Understanding these conditions helps avoid disappointment when expected benefits fail to materialise.

The best balance transfer credit cards

Balance transfer options give you a smart way to combine debts at lower rates. The top French choices for 2025 present the best deals for moving money you owe.

- Société Générale’s Visa Premier now gives a 12-month 0% interest window on balance transfers, charging just 1.5% as a transfer fee. This works well if you have significant debt, since this small fee costs much less than keeping high-interest balances elsewhere.

- BNP Paribas has something different – their transfer deal offers 10 months at 0%, but with a key advantage: no transfer fee if you act within 30 days of opening your account. For quick movers, this means real savings on moving costs.

- LCL Bank takes another path with their transfer product, giving you a longer 14-month no-interest time but with a slightly higher rate afterward. They provide an online tool to help plan your payoff schedule before the regular rate kicks in.

When comparing these options, look at:

- The total cost (transfer fee plus any yearly charges)

- How long the promotional rate lasts

- What the standard rate will be afterward

- Any spending requirements to keep the offer valid

- Whether you can realistically pay off the balance during the promotional period

The best air miles credit cards

For people who fly often, cards connected to airline reward programs offer amazing value. The top air miles options in France team up with big airlines and travel companies to give you points when you spend.

- Air France-KLM’s Flying Blue Mastercard stands out from the crowd. You earn one mile for every €4 you spend, plus welcome bonuses up to 20,000 miles – enough for a round-trip flight within Europe. It comes with travel insurance and priority boarding, though you pay a €130 yearly fee.

- American Express’s Gold Card works with several airline programs, letting you move points to different carriers. The yearly fee runs higher at €170, but you get more ways to use your points and two free airport lounge visits each year.

- Boursorama Bank has a Visa that earns Avios points, which work with British Airways, Iberia, and other oneworld airlines. With just an €80 yearly fee, it costs less to start collecting miles, though you won’t earn them as fast as with fancier cards.

When picking an air miles card, consider:

- Which airlines you actually use most often

- How easily you can use the miles (blackout dates, seat availability)

- Whether the earning rate matches your spending habits

- If the yearly fee makes sense for your travel frequency

- Extra travel benefits beyond just the miles

Further Reading: Europe’s Skies Are Jammed with 37,000 Flights a Day, and Travel Agencies Are Taking the Hit

The best purchase credit cards

Purchase cards excel at providing benefits for everyday spending. The top options combine favorable purchase rates with consumer protections and rewards programs.

- Crédit Agricole’s purchase card stands out with its 45-day interest-free period, longer than the standard 30 days offered by most French banks. This extended grace period gives extra flexibility for managing cash flow between payments.

- Crédit Mutuel offers a card with an innovative approach to the purchase rate – the more you use your card, the lower your interest rate becomes. Regular spenders can see their effective APR decrease by up to 3 percentage points through this loyalty mechanism.

- Online bank N26’s standard card charges no annual fee while providing a competitive purchase rate. Their real-time transaction notifications and spending analytics help track expenses efficiently, making it an excellent choice for budget-conscious consumers.

The best purchase cards typically offer purchase protection insurance, covering items against damage or theft for a limited period. This added security becomes particularly valuable for expensive purchases like electronics or appliances.

The best shopping credit cards for rewards

Rewards cards transform everyday spending into meaningful benefits, with retail-focused options leading the pack in value for regular shoppers.

- Carrefour Banking’s pass card earns heightened points at their stores, with 1% back on grocery spending and additional bonuses during promotional periods. With no annual fee for regular Carrefour shoppers, it represents excellent value for families who shop there weekly.

- The Fnac Mastercard caters to tech and entertainment enthusiasts, offering 5% back on purchases at Fnac and Darty stores. While charging a €50 annual fee, frequent shoppers easily recoup this cost through accumulated rewards.

- The Auchan Visa combines grocery rewards with broader benefits, offering points on all purchases plus heightened earnings at Auchan locations. Its modest €24 annual fee makes it accessible for most shoppers seeking everyday rewards.

The best travel credit cards

Travel cards minimise expenses when venturing abroad through eliminated foreign transaction fees and travel-specific perks. For globetrotters, these cards prove invaluable companions.

- Revolut’s premium card offers fee-free spending abroad in over 150 currencies and competitive exchange rates. While technically a debit product rather than a traditional credit card, its travel benefits merit inclusion for anyone frequently crossing borders.

- HSBC’s Premier World Elite Mastercard delivers comprehensive travel benefits, including unlimited airport lounge access, travel insurance, and concierge service. Though its €590 annual fee seems steep, frequent international travelers receive substantial value through its premium benefits.

- Boursorama’s Ultim Card eliminates foreign transaction fees and cash withdrawal fees worldwide. As a no-annual-fee option, it presents an attractive choice for occasional travelers who prioritise low costs over premium benefits.

The best travel credit cards include emergency assistance services, helping navigate medical emergencies or lost documents while abroad. This support proves invaluable during stressful travel disruptions when you’re far from home.

Further Reading: The Ultimate Guide to Virtual Card Solutions for Travel Companies

Credit card types

French banks offer several categories, each designed for different customers:

- Standard cards – Basic features with few extras. They usually have lower yearly fees and spending limits. Perfect for occasional users or people new to building credit.

- Gold or Premier cards – Middle-range options with better perks like travel insurance, higher limits, and decent rewards. Yearly fees run €120-€180, aimed at professionals who travel sometimes.

- Platinum and Black cards – Top-tier options packed with benefits including personal assistants, extensive travel advantages, and higher rewards. These need excellent credit scores and good income, with yearly fees often above €500.

- Co-branded cards – Created through partnerships between banks and shops, airlines, or hotels. These give special benefits when you shop with the partner company, like faster points earning or exclusive discounts.

- Business cards – Made specifically for company spending, with accounting tools, cards for employees, and business-focused rewards. Approval looks at company finances rather than personal credit history.

Comparison of credit cards

When comparing cards, start with the fundamental costs: the representative APR and annual fee. These baseline expenses establish the minimum cost of card ownership before considering rewards or benefits.

Rewards structures vary significantly – some cards offer straightforward cashback percentages, while others use complex points systems with varying redemption values. Calculate the effective return rate based on your typical spending patterns to determine which delivers better value.

Credit limits affect both your purchasing power and credit utilisation ratio. French banks usually start with modest limits for new customers, increasing them after establishing a positive payment history. Some premium cards offer higher initial limits based on income verification.

Insurance benefits differ widely between cards. Basic options might include purchase protection, while premium cards add travel cancellation coverage, rental car insurance, and even medical evacuation services. These features provide value beyond the core payment function, particularly for travelers.

Digital integration capabilities vary among card providers. Leading banks offer virtual card numbers for online shopping, mobile wallet compatibility, and real-time spending notifications. These features enhance both convenience and security for daily card usage.

Further Reading: Is Cards-as-a-Service a Better Fit for You Than Banking-as-a-Service?

The top tips for using your credit card

Follow these golden rules to get the most from your card while dodging common traps:

- Pay in full each month. This one habit helps you avoid all interest charges, turning your card into a free short-term loan.

- Set up auto-payments. Program at least the minimum payment automatically. This stops late fees and bad marks on your credit even if you forget a due date. Schedule these payments several days early to allow for processing.

- Check your statements regularly. Look for charges you don’t recognise or billing mistakes. French laws protect you from fraud, but spotting problems early makes fixing them easier. Most banks let you dispute wrong charges right through their apps.

- Don’t use cards for cash. Avoid withdrawing cash with your card except in real emergencies. These transactions start charging interest immediately with no grace period, plus extra cash advance fees.

- Stay below 30% of your limit. Keeping your balance low compared to your available credit helps your credit profile and often leads to limit increases. If you regularly get close to maxing out, ask for a higher limit instead.

What credit card provider to choose?

Your options fall into several categories, each with distinct advantages:

Traditional French banks like BNP Paribas, Société Générale, and Crédit Agricole provide full card lineups that work smoothly with their other banking services. You’ll find branches everywhere for face-to-face help when needed, though you often pay more in fees compared to online choices.

Online-only banks including Boursorama, Fortuneo, and Hello Bank offer competitive products with smaller fees and smooth digital experiences. With lower operating costs, they pass savings to customers, though you won’t find physical locations for in-person help.

International banks in France, such as HSBC and ING, provide globally accepted products with consistent benefits across borders. These work particularly well for expats or frequent international travelers, offering the same experience regardless of where you go.

Payment startups like Revolut and N26 shake up the market with fresh features and clear fee structures. While they technically issue debit products rather than traditional credit cards, their travel perks and user-friendly apps attract younger, tech-loving customers.

When choosing a provider, think about:

- Your existing banking connections

- Whether you prefer digital or in-person service

- How often you travel internationally

- If you want all your finances in one place

- Special deals for bundling multiple products

Deciphering banking jargon

Credit card terms often create confusion through specialised terminology.

The representative APR (Annual Percentage Rate) combines the interest rate with standard fees to show the total yearly cost of credit as a percentage. This standardised figure allows straightforward comparison between different cards.

The purchase rate refers specifically to the interest charged on regular purchases when you carry a balance. This rate may differ from those applied to cash advances or balance transfers, which typically carry higher charges.

Grace period indicates the interest-free window between a purchase and its payment due date. French cards typically offer 20-45 days during which no interest accrues on new purchases, provided you paid your previous balance in full.

Minimum payment represents the smallest amount you must pay monthly to keep your account in good standing. While meeting this requirement avoids late fees, paying only the minimum results in extended debt periods and substantial interest costs.

Cash advance refers to obtaining cash using your credit card, either through ATMs or bank tellers. These transactions usually trigger both immediate interest charges and cash withdrawal fees, making them considerably more expensive than standard purchases.

Key takeaways

- Pick a card that matches what you actually need. If you travel often, look for one without foreign fees that lets you into airport lounges. If you shop regularly, find rewards that match where you spend money.

- Read everything before you sign up. Ads show all the good stuff while hiding the costs – you need to understand both sides to make smart choices. Watch especially for conditions on special offers, which often require spending certain amounts or have time limits.

- Consider having a few different cards for different jobs if your life has varied needs:

- A no-fee card for everyday purchases

- A rewards card for categories where you spend most

- A travel-focused card for trips abroad

- A low-interest card for times when you might carry a balance

- Check your cards once a year to make sure they still fit your life. As things change, so might the best cards for you. Most French banks let you switch products without hurting your credit score, making it easy to update as needed.

When used wisely, these payment tools provide real benefits from purchase protection to reward points. By knowing how they work and choosing the right ones, you turn regular spending into actual perks while steering clear of needless expenses.

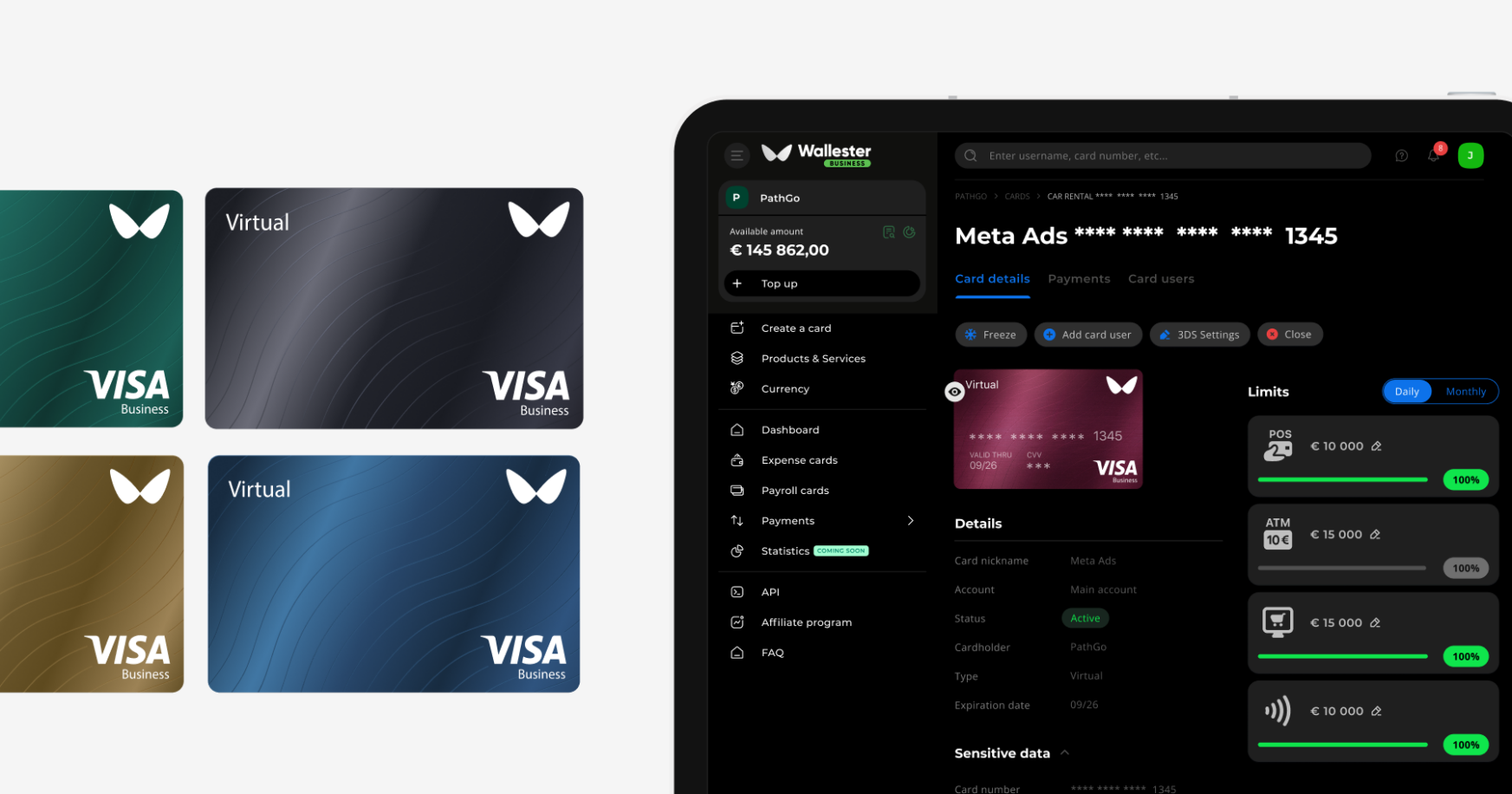

Wallester Business: flexible corporate card solutions

Wallester Business offers tailored corporate card solutions designed to meet the needs of companies operating in France and across Europe. As an official Visa partner, Wallester provides both physical and virtual cards, allowing businesses to issue and manage employee cards efficiently. These cards come with customisable spending limits and real-time tracking, making it easier to control expenses and allocate budgets across teams.

One of Wallester’s key advantages is the rapid deployment of new card programs, often set up within days rather than weeks. This is particularly beneficial for growing companies or temporary projects where quick access to funds is essential. The platform also supports multi-currency transactions, helping businesses save on conversion fees when operating internationally.

Wallester’s presence in France has grown significantly, especially through its involvement at the Sophia Antipolis technology park in Valbonne, where it actively collaborates with the local tech community. This connection reflects Wallester’s commitment to integrating innovative financial solutions into the French market. The platform’s API-driven approach allows seamless integration with existing financial systems, making it easier for companies to manage corporate spending and streamline accounting.

By offering transparent fee structures and versatile features, Wallester Business positions itself as a practical option for companies seeking modern, scalable payment solutions.