How often have you wished you had total control over every penny that leaves your travel agency? Have you considered how much you could grow if you reinvest the time you spend managing payments? You are not alone. The travel industry has been dealing with these challenges for years, and because we understand the issue perfectly, we’ve come up with a solution. We offer a product that goes further, making these problems a distant memory: Wallester virtual cards.

Optimise Payments With Virtual Cards

In an industry as competitive as travel, payment efficiency is not just an advantage; it’s a necessity. From boutique travel agencies to large-scale tour operators, businesses in the travel industry handle countless transactions daily. Any error or delay in these operations could cause financial losses, dissatisfied customers, and severe reputational damage. This is where our cards make the difference, providing you with an alternative that speeds up payments and incorporates extra levels of security and supervision.

Paying Hotels With Virtual Cards

Traditional payment methods for hotel bookings and stays require bank transfers or physical cards. Time-consuming and error-prone processes usually accompany this. Wallester allows travel offices to generate cards associated with a unique number per reservation and set spending caps. This minimises the risk of fraud and makes it easier to balance the books by linking each transaction to its reservation. And the best part is that hotels get their money instantly, strengthening commercial ties.

Real-Time Corporate Travel Expenses

Keeping an eye on expenses is vital for managing corporate business trips. Similar to the previous case, you can use our platform to create individual cards—either per traveller or per trip—with pre-set amounts. In this scenario, you can see the transactions recorded by the traveller instantly in a dashboard that provides accurate data and key metrics, streamlining accounting and reporting.

Refunds and Cancellations

As you know, exchanges and refunds are part of the travel business; virtual cards simplify this. If someone cancels their trip, you block or delete the card linked to it; this way, you avoid extra charges. Since every payment goes with your card, tracking refunds is instantaneous and reduces paperwork. By keeping everything documented, these cards prevent conflicts and provide clarity, which strengthens ties with both hotels and travellers.

Receipt Capture and Submission

Travel agents, tour guides and operators often need to pay various bills and invoices while out in the field. For example, customers pay in advance for an all-expenses trip, during which it is the responsibility of the guide to pay the resulting bills at restaurants, attractions, parks, nature reserves, toll booths etc. Wallester Business allows users to take photos of the invoice and then upload it via the app or portal, where it is is automatically associated with a payment. This means no more lost or misplaced receipts and easy, unified reporting and expense tracking.

We Offer Solutions to Every Challenge

One certainty remains: travel’s evolution shows no signs of slowing down. Finding an all-in-one platform like Wallester Business represents a leap into the future, offering innovative answers to persistent problems.

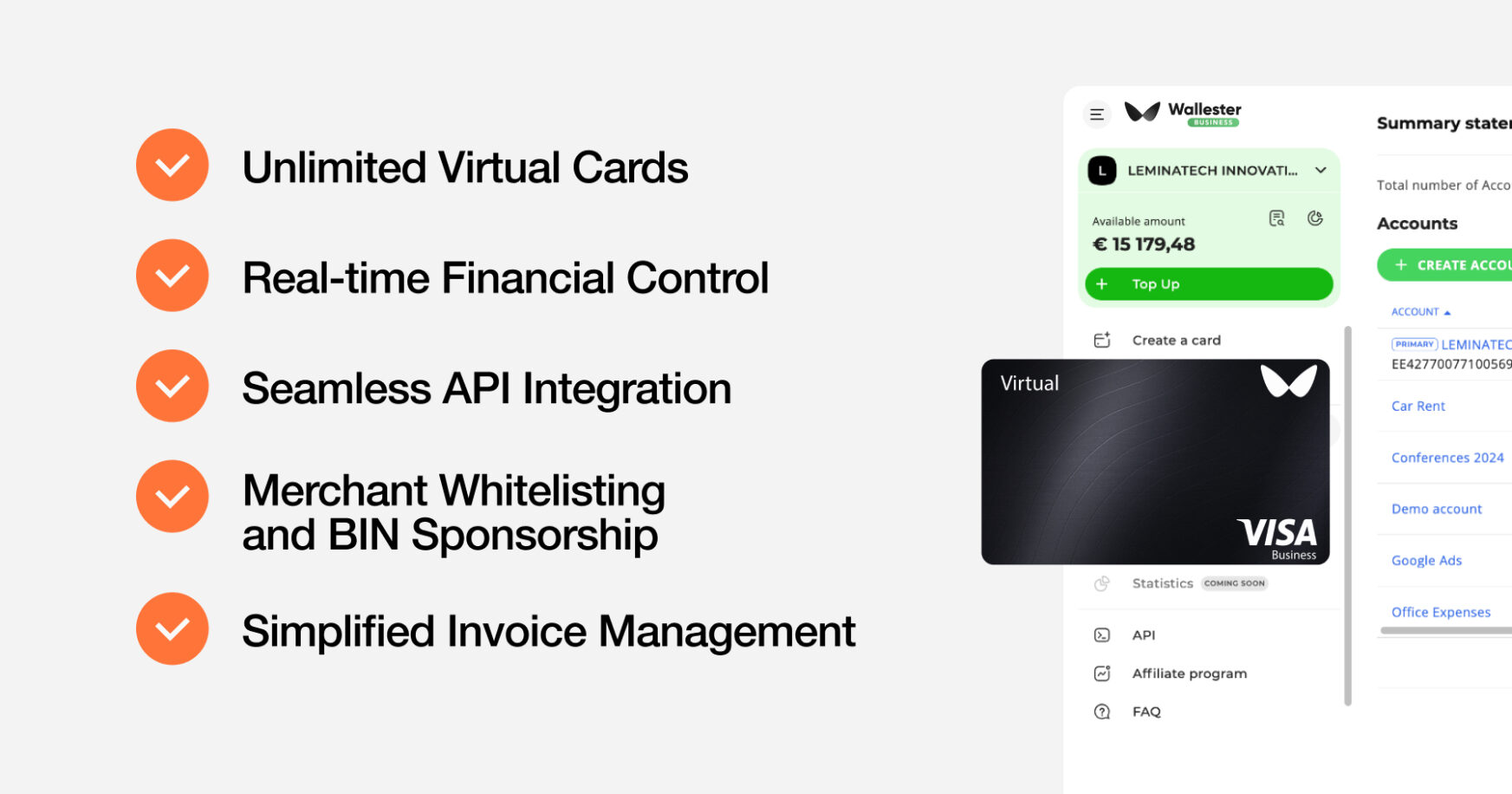

Hundreds of Free Virtual Cards

Did you know that you have 300 free virtual cards? Taking advantage of this benefit will allow you to quickly scale operations, handling multiple bookings and supplier payments without limitations. Cards are ready to use immediately after issuance, which is ideal for creating payment solutions just before a corporate or personal trip.

Total Financial Control

You can see expenses and cash flows in real-time with detailed reports and intuitive dashboards. The active use of single-use, time-limited cards reduces the risk of fraudulent actions or non-compliance with financial commitments by partners and suppliers.

Seamless API Integration

Whether your agency operates online or in a physical office, the flexible API makes it possible to incorporate payment services directly into existing systems, automating processes and improving efficiency. In addition, the virtual card is integrated with an e-wallet application on the smartphone, allowing it to be used with maximum convenience and without risk of damage or loss.

Frictionless Transactions

Our merchant whitelisting and BIN sponsorship solutions—offering up to four options—are ready to optimize payment processing, ensuring smooth transactions with hotels, airlines, and other suppliers. Also, you will discover that our cards are accepted for payments in all countries worldwide and can be used for multiple currencies.

Simplified Invoice Management

All invoices can be digitized, processed, and managed on a unified platform, saving time and reducing reconciliation errors. In addition, as a 100% green solution, it is environmentally friendly while ensuring maximum convenience for cashless payments and online shopping.

Improve Profits on Every Billed Trip

In addition to the solutions already mentioned, Wallester offers other key advantages that travel companies cannot overlook. In an industry where pressure on margins is constant, reducing operating costs with e-cards becomes a strategic advantage. And there’s more: you’ll soon discover how using our platform unlocks new revenue streams, letting you focus on growing while reducing financial complexity.

You’ll soon find yourself using tools that cover everything from automatic payments to operational improvements—and that are designed to boost your company in an ever-evolving marketplace.

Already using Wallester Business? Leave a review of your experience on G2 or Capterra!