The latest Weil European Distress Index shows that corporate distress across Europe surged from 3.0 in November 2024 to 3.8 by February 2025, its highest level in six months. This sharp rise, driven by weakening investment, tight liquidity, and market volatility, has prompted many business leaders to question the traditional ways of managing finances.

One of the key drivers of this situation? A set of unwritten rules that many companies follow without questioning:

- Marketing expenses are impossible to track in detail.

- Reimbursing travel expenses and incurring some financial loss is part of the process.

- You always need to have cash on hand for travel.

Fortunately, there are leaders and entrepreneurs determined to challenge the status quo. They are doing so with innovative tools, and the results are evident in those who are already breaking these paradigms.

Let’s look at some notable cases across different sectors.

Solutions for an E-commerce

A UK-based electronics seller operates its entire business through Amazon, focusing on products such as phones, computer mice, hard drives, and accessories. While the organisation doesn’t have its own standalone website, it consistently earns top ratings from customers, currently holding an impressive 4.8 out of 5.

The Challenge

The company required a fast and efficient way to purchase inventory for resale without delays in payment processing. Managing cash flow and ensuring smooth order fulfilment were critical for maintaining positive seller ratings.

The Solution

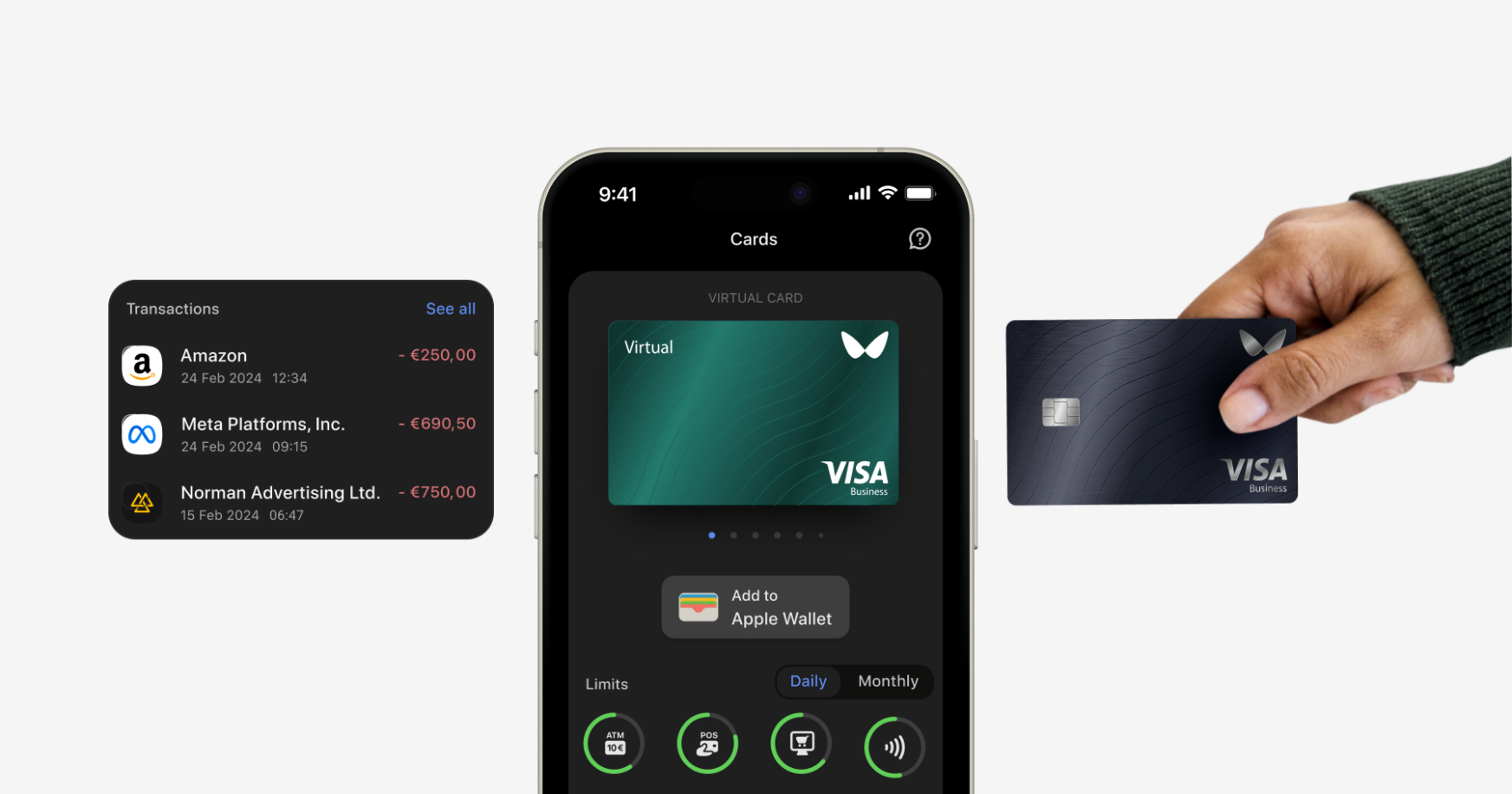

Wallester Business Cards provided:

- Instant payments – No waiting for wire transfers; inventory purchases are processed immediately.

- Seamless Amazon integration – Cards can be used directly on the platform for purchases.

- Better expense tracking – The company can monitor and categorise purchases with Wallester’s platform.

The Result

- Faster restocking – Ensuring availability of high-demand products.

- Optimised cash flow – No disruptions due to payment delays.

- Increased operational efficiency – Smooth supply chain management.

Real-Time Budget Control for Media Agencies

We found a European digital marketing agency with over 25 years in the market that has worked in collaboration with Fortune 1000 clients. They offer comprehensive advertising and lead generation services, primarily utilising Meta and Google for campaigns, with recent expansion into TikTok.

The Challenge

They needed to manage advertising expenses across multiple platforms efficiently and reliably, as it had become an operational obstacle. The company needed a system to precisely control ad spend, process payments efficiently, and comply with the specific billing requirements of each platform.

The Solution

This is how they transformed their management with Wallester Business:

- Platform-dedicated cards – Each advertising campaign has its own virtual card for precise tracking.

- Real-time expense control – Instant monitoring of all advertising payments from a centralised dashboard.

- Customised limit management – Prevention of overspending with predefined caps by client and platform.

The Result

- Total financial transparency – Complete visibility of advertising spend by channel and campaign.

- Improved operational efficiency – Elimination of approval cycles that previously took days.

- Strategic optimisation – Ability to quickly redistribute budgets to better-performing campaigns.

Car Rentals Deposit Management

A fintech company founded in 2022, it specialises in deposit-free rental solutions for the car rental and real estate industries. Their pioneering service, DepositFree, eliminates conventional security payments by placing the deposits themselves, assuming the risk for renters.

The Challenge

Traditional rental models require customers to provide large security deposits, creating a financial burden and limiting accessibility. The company required a flexible payment solution to handle deposits efficiently and cover potential damage costs.

The Solution

By integrating Wallester Business Cards, the company streamlined its deposit process:

- Instant Deposits – Cards are used to place deposits with rental providers, enabling seamless transactions.

- Damage Coverage – If a customer damages a rental car or property, Wallester cards facilitate quick payment for repairs, ensuring continued trust with rental partners.

- Scalability – Initially used in Cyprus and Malta, the company has expanded across the EEA, partnering with multiple rental providers.

The Result

- Efficient financial operations – No need for cumbersome bank transfers or traditional credit lines.

- Rapid Expansion – Enabled operations in multiple EEA countries.

- Improved Customer Experience – Renters enjoy a hassle-free, deposit-free rental experience.

Fuel Control For Fleet Management

A furniture transport firm based in Poland runs a fleet of 40 lorries across Germany and several neighbouring countries, handling everything from delivery to on-site assembly and removal of furniture for both homes and commercial spaces.

The Challenge

Managing fuel costs was a significant concern, given fluctuating prices and cross-border operations. The company needed a cost-effective solution for tracking and controlling fuel expenses.

The Solution

Wallester Business Cards enabled:

- Optimised Fuel Payments – Drivers can refuel without carrying cash or dealing with reimbursements.

- Real-Time Expense Monitoring – A centralised dashboard tracks all transactions.

- Automated Limits – Spending caps prevent unauthorised fuel purchases.

The Result

- Lower fuel costs – Better control over spending.

- Reduced administrative work – No need for manual expense reconciliation.

- Scalable across Europe – Accepted at multiple fuel stations across different countries.

Remote Payments in Travel Logistics

A specialist travel company with 27+ years’ experience focuses on tailor-made adventures and safaris throughout Southern Africa. They cover Malawi, Namibia, Botswana and various other locations across the region.

The Challenge

Operating expeditions in remote regions of Africa presented significant logistical challenges, particularly in acquiring essential provisions and paying for services in areas without modern banking infrastructure.

The Solution

The integration of Wallester cards allowed:

- Optimised provision management – Simplified purchase of food, water, fuel and campsite fees without relying on cash.

- Expense tracking during travel – Precise control of costs during extended expeditions in remote territories.

- Immediate financial support – Quick and effective assistance when any need arises during trips.

The Result

- Safer travels – Reduced risks associated with handling cash in distant areas.

- Transparency in expeditions – Detailed record of costs by safari type and operating season.

- Implementation of new routes – Access to previously inaccessible destinations due to financial restrictions.

Move Faster, Spend Smarter

These five stories demonstrate something extraordinary: the financial limitations that many companies accept as inevitable are, in reality, surmountable obstacles with the right technology.

Wallester Business allows you to experience this transformation without initial commitments. From real-time expense control to elimination of reimbursements, the benefits are immediate.

What if your organisation could be next?