Welcome back to our blog, where we explore various topics in the IT and engineering fields, as well as business insights and the latest technologies, with a particular focus on the financial sector. We hope you have enjoyed our articles on the importance of the KYC procedure and compelling Accounts Payable management.

Today, we want to give you a behind-the-scenes look at the card issuing process, provide a clear understanding of the different types of cards available in the market, and shed light on the ecosystem of card issuing.

To begin, let’s define what card issuing is. Payment card issuing is the process that helps your business to stand out from the competitors and get payment cards under your brand without needing to acquire a licence or rights. Warning, it could cause a boost in Brand Awareness and customer loyalty, and if you are not afraid of the consequences, keep reading.

What cards are available on the market?

Each card type offers unique benefits and features to suit various financial needs.

Consumer Cards – enables the end customer to make a personal payment.

Credit Cards – allows its users to get money, usually owed from the bank, and return them later.

Debit Cards – allows users to get funds from their account and use them now without returning them later.

Prepaid Cards – granted to users with a specific amount of money so they could use it as needed.

Corporate Cards – the corporate card could be used to cover the costs of the company’s expenses. Usually, the specific person is responsible for purchasing on behalf of the company and then providing the reports to the accountants.

In the world of finance, it is essential to understand the different legislations, protocols, and limits that apply to various types of cards. To ensure that you select the right cards for your needs, it is crucial to consider the markets, countries, and currencies in which you plan to use them. If it is more or less understandable with the countries and the currencies, with the cards themselves, it is not that easy.

Cards come in various forms, including virtual, physical, or digital, and they all share common attributes such as a PIN, IBAN, 16 digits, and CVV.

Technology experts developed tokenisation to protect sensitive data in the digital space, such as card details and associated data. This technology involves replacing sensitive information with randomly generated data, also known as a token.

Tokenisation is widely used in e-commerce, banks, and digital wallets, making it an essential tool for anyone dealing with financial transactions. E-commerce, and banks are all using digital wallets to keep and transfer money as needed. Let’s take a deeper look at the term Digital Wallets.

Digital wallets offer the convenience of connecting physical and virtual cards and enable users to make payments via popular applications such as Apple Pay, Google Pay, Samsung Pay, and Garmin Pay.

To ensure that you make informed decisions regarding which cards or technologies to offer your customers, it is essential to understand the ecosystem of card issuing and payment processes.

By taking the time to learn about these processes, you can better serve your customers and ensure that all transactions are secure and compliant with relevant regulations. So, whether you’re a bank, an e-commerce platform, or a digital wallet provider, understanding the world of cards and payments is essential for success in the finance industry.

So, who are the leading participants in the card-issuing ecosystem?

KYC/KYB – providers.

“Know Your Customers” and “Know Your Business” are essential obligations that financial service providers must adhere to in order to prevent fraud and money laundering. Simply put, it is crucial to know who you are dealing with. This involves a comprehensive procedure where customers and businesses must verify their identities and activities by providing relevant documentation.

In most cases, external companies offer this service, requiring customers to provide real-time selfies and photos of their ID, passport, or driving licence. The verification process typically takes no longer than an hour. However, in the case of business verification, the process may take longer, as it requires processing documents such as business registration, licences, and authorised addresses.

By knowing your customers, you can establish trusted relationships and ensure the safety of all parties involved. Neglecting this procedure can result in significant fines for financial service providers, as some customers may be associated with fraudulent activities.

As a financial service provider, it is crucial to promptly adhere to laws and regulations and report any suspicious activities to the relevant authorities.

The processor of payment issuance.

An issuer payment processor is a technology company that handles the transaction process of approving or declining payments using various card types. It operates on the issuing side of the transaction process by relaying information between the card network, issuing bank, and settlement parties.

This type of processor differs from the acquiring processor, which handles the merchant and acquirer part of the transaction.

To gain a deeper understanding of the flow of information in a transaction, envision a scheme in which the issuer processor assumes responsibility for the customer and issuing aspects. Conversely, the acquiring processor takes charge of the merchant and acquirer components. This division of roles ensures efficient handling of the transaction process, providing a clear delineation of responsibilities between the parties involved.

Card schemes

The card scheme is a network that facilitates payments and card issuance. It is essential to understand the different players in the market, including Visa, Mastercard, American Express, and China Union Pay, which collectively hold a significant market share.

As a fellow business owner, we understand the importance of choosing the right provider for issuing your own branded virtual and physical cards. In addition to considering pricing and financial reports, we recommend to review key documents such as obtained licences, card schemes, supported currencies, and the technologies they employ.

We are thrilled at the opportunity to become your trusted business partner and eagerly look forward to exploring how we can assist you in achieving your goals.

Partner with Wallester – your skyrocket platform.

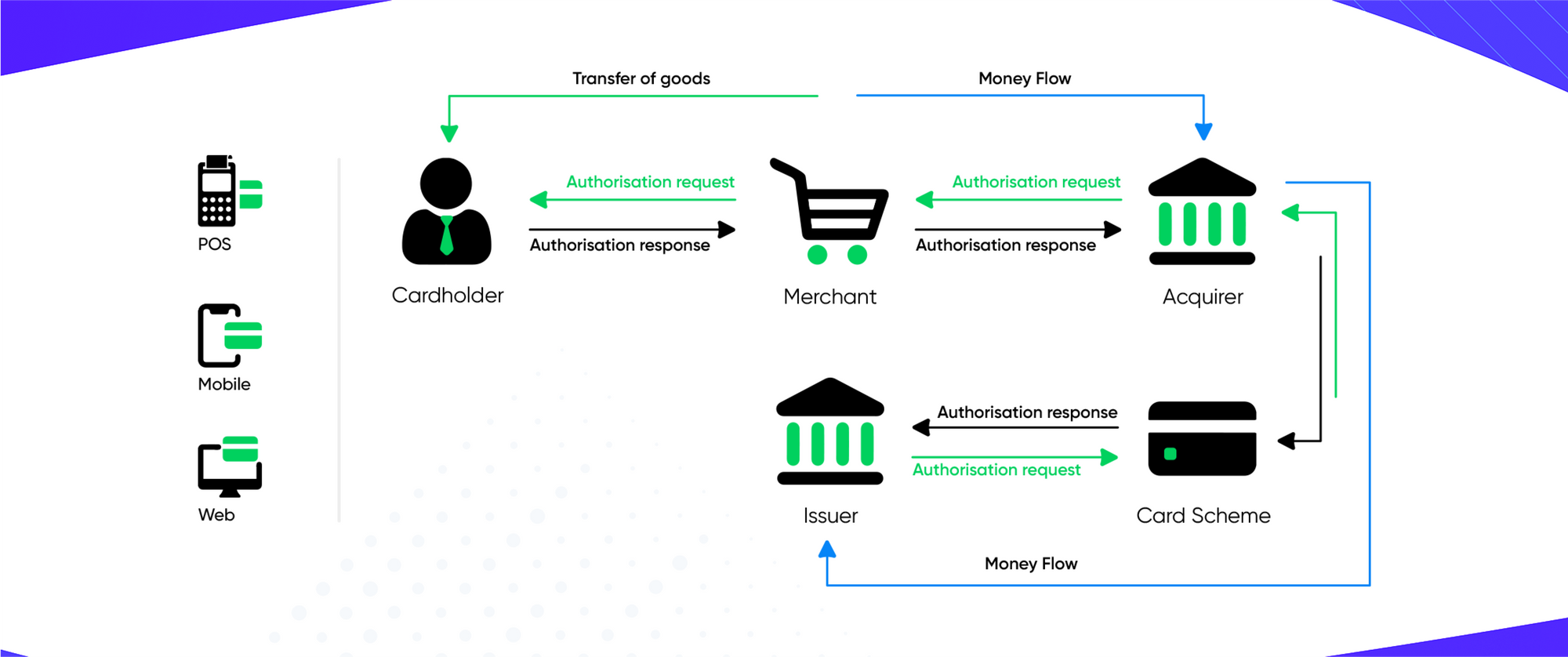

It is also important to understand the roles of each player in the payment process, such as the cardholder, merchant, acquirer, issuer, and the card scheme itself.

By understanding these roles, you can make informed decisions when partnering with a fintech or bank for card issuance.

- VISA – globally takes around 40% of the market and is one of the biggest payment processors by transaction volume.

- China Union Pay – a national payment system in China. They also have a subsidiary company – International Union Pay, that operates globally. The estimated number of cards in 2016, according to the Global Payment Cards Data and Forecasts to 2022 (RBR), is 43% out of 14 billion cards.

- MasterCard – the third biggest payment processor in the world, has 24% of the market based in the US.

- American Express – the US company with 63,5 million cards in international use. Has 19% of the global payment market share.

Let’s take a look at the Visa scheme. One of the most commonly used schemes and with the most extensive network in the world, which involves four key players:

The cardholder uses a Visa-branded card to make a payment to the merchant.

The merchant accepts the payment through their acquirer, who is connected to Visa.

Visa verifies the payment and communicates with the issuer to authorise the transaction.

The issuer approves the transaction, and Visa completes the payment to the merchant through the acquirer.

Understanding the roles of each player in the payment process is crucial when partnering with a fintech or bank for card issuance.

In this scheme, multiple steps take place before merchants receive funds from card issuers.

First, when a cardholder pays with their card (whether physical or virtual), an authorisation request is sent to check whether the cardholder has the necessary funds to make the purchase.

This request is sent from the merchant to the acquirer and then to the issuer, who provides an authorisation response indicating whether funds are available for payment.

Once the authorisation is received, the funds do not immediately transfer to the merchant but instead enter a pending status. The bank has up to 14 days to send the money to the merchant to avoid any potential double transactions.

It’s worth noting that merchants must pay a fee to both the acquirer and bank for the operation, which is typically a percentage of the transaction amount. This fee, called an interchange fee, has been regulated by the European Union since 2015. Therefore, if a client pays 100 euros for goods, the merchant will receive less than that amount after factoring in the commission policies.

Who else is involved in the ecosystem?

Another important player is FX Provider, a service provider that helps you to buy and sell currencies around the world. Some of the businesses do it by themself using trading platforms. Ensure that the FCA has authorised your service provider or the platform for trading.

Financial Conduct Authority (FCA) – a financial regulatory body in the UK that operates independently of the government and regulates financial firms providing services to consumers while maintaining the integrity of the financial markets. It works alongside other regulatory bodies to set requirements for the financial sector. It is responsible for the conduct of around 58,000 businesses, contributing around £65.6 billion in annual tax revenue to the economy in the UK.

Card producer or manufacturer.

A company that helps you to design and produce cards, to stand out from the crowd. Nowadays, it is possible to choose the card’s colour, thickness, materials, and edges and personalise it.

💡 The collection of 10 cards made out of unusual materials.

Issuer and BIN Sponsor

It is crucial to understand that the card producer and card issuer could be both or different organisations since to produce and issue cards, the companies have to have a specific set of rights and licences.

Wallester has the right to issue the card and help to personalise it, as well as develop tailored digital solutions to simplify the card-making process and management. Also, we provide a unique BIN and BIN range.

BIN stands for Banking Identification Number, which can be found on every card despite its country of origin or materials. Usually, it is 6 first digits on the card and helps merchants to accept multiple payments at once and differentiate one card from another.

BIN Range is up to 5 digits that come after the BIN and help to create as many cards as you need for faster processing of the payments and more straightforward navigation between the purposes of the card.

3DS Provider

Last but not least is to pick the 3DS provider that will ensure the safety of the transactions. A brief overview of what 3DS is.

3DS is a set of rules or protocols invented for the extra safety of the online payment process. It is not obliged for everybody to use it, but highly recommended to avoid fraud. Usually, it appears as a form of submitting your PIN code on your bank’s webpage when you are making online payments or via SMS code to verify that you have made the transaction.

Final Words

In the finance industry, businesses must comprehend the intricacies of card issuing and payment processes. When choosing a partner, it is essential to ensure that they are well-versed and implement the latest financial technology, particularly concerning data protection. A reliable service provider guarantees the security of all transactions, payments, and personal data in compliance with the latest safety regulations.

At Wallester, we prioritise user experience and strive to deliver exceptional service at every stage. Our solutions have facilitated the transformation of pension systems in Latvia by offering a turnkey solution to their clients. Additionally, we have assisted a Brazilian startup in penetrating the European market and securing new sources of revenue. Furthermore, we have designed a virtual card program for another startup to manage collective expenses.

We take immense pride in our clients’ accomplishments and the results they have achieved with our assistance.

Our sales team is available to assist you in elevating your business to new heights.