Managing company spending takes coordination. Physical cards are slow to issue, and tracking everything by hand often leads to delays or missing information. When reports arrive late or incomplete, finance teams can’t see clearly where the money is going. Virtual cards give direct access to each transaction as it happens and allow control over who spends and how much. With timely data and clear rules, businesses can keep their expenses organised and avoid surprises.

Key takeaways

- Virtual cards for expenses let companies control spending in real time with set limits for each card.

- Every transaction is tracked as it happens, making it easier to spot unusual activity and keep spending in check.

- Transactions sync with your accounting tools, so expenses are tracked and sorted automatically.

- Cards are ready to use right away, with no need to wait for physical delivery.

What is a virtual card?

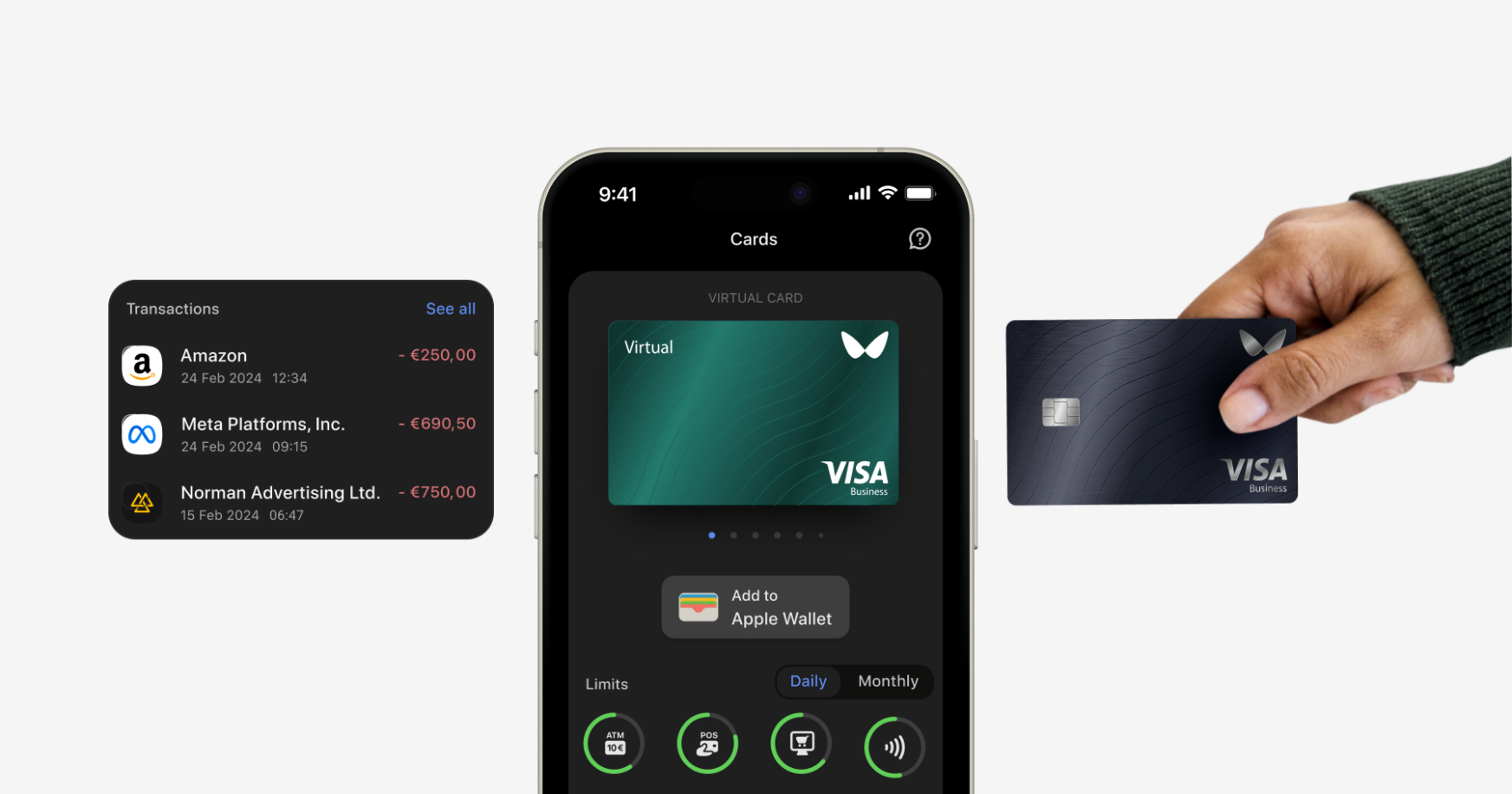

A virtual card is a digital version of a payment card. It has its own number, expiration date, and security code, but it only exists online. Businesses use it for purchases through their company app or digital wallets such as Google Pay and Apple Pay. Many virtual cards operate under the Visa card scheme pursuant to rules set by Visa Europe Limited, though other networks like Mastercard are also used, depending on the provider.

Virtual corporate cards are issued by electronic money institutions and connected directly to a company account. This allows finance teams to see each transaction as it happens and manage spending in real time.

They are flexible tools for managing expenses. You can set limits for each card, restrict where they can be used, or create shared cards for a whole department. When someone makes a payment, the transaction appears right away in your expense system, ready for accounting.

Further Reading: The Complete Guide to Virtual Cards for Business

How does a virtual card work?

Each virtual card has its own number and spending rules and is linked to your company’s main account. When a card is created, the system assigns limits and usage settings based on your company’s policies. A manager might approve the request first, or cards can be pre-issued for specific teams or purposes.

Once a card is ready, a team member can add it to a digital wallet like Google Pay or Apple Pay, or use it directly for online purchases. Every payment is recorded in real time, with full details like the amount, time, and merchant. Notifications can also be sent when a card is used.

Behind the scenes, the payment goes through the usual channels used for business transactions. One example is the Visa card scheme pursuant to rules set by Visa Europe Limited, which handles authorisation and settlement. This makes virtual cards usable anywhere that supports standard online card payments, from software subscriptions to car rentals.

Further Reading: How Virtual Cards Work: The Technology Behind the Solution

Why you should consider virtual cards for your business

Virtual cards solve many problems that plague traditional expense management. Physical cards take days to arrive, can be lost or stolen, and offer limited control over spending. Virtual cards address these issues and provide additional benefits that transform how companies handle their expenses.

Cost control and budgeting:

- Set specific spending limits that automatically prevent overspending.

- Create category restrictions to control what purchases team members can make.

- Monitor spending patterns in real time to identify areas for cost reduction.

- Automatically pause or cancel cards when projects end or budgets are exhausted.

Operational efficiency:

- Issue cards instantly without waiting for physical delivery.

- Integrate seamlessly with existing accounting software for automatic reconciliation.

- Upload receipts directly through mobile apps to maintain complete records.

- Generate detailed reports that show exactly where company money goes.

Team management:

- Give each team member access to funds without sharing sensitive card details.

- Create department-specific cards with appropriate spending limits.

- Track individual spending patterns to identify training needs or policy violations.

- Manage remote workers’ expenses without mailing physical cards.

The smart way to think about virtual cards is as a bridge between cash flow management and operational flexibility. Companies can maintain tight control over their finances and give teams the freedom to make necessary purchases quickly. This balance becomes very important for growing businesses that need to scale their operations without losing oversight of their expenses.

Further Reading: Top Use Cases for Virtual Cards in Business

What are the limitations of virtual cards?

Virtual cards for expenses work well in most cases, but they don’t cover every payment need.

One of the main limitations is in-store use. While many shops now support digital wallets, some still ask for a physical card at the point of sale. This can be a problem for companies that rely on cash purchases or deal with suppliers who don’t accept mobile payments. In those situations, it helps to have a physical card as a backup.

Spending limits and merchant restrictions can also get in the way. These controls are useful for preventing misuse, but they can block real transactions if a team member hits their daily limit or tries to pay a vendor that isn’t approved. Finance teams may need to step in to make adjustments.

Some companies run into problems with accounting software. Most new platforms sync easily with virtual cards, but older systems may need extra steps or manual data entry. It’s worth testing your setup before relying on full integration.

Finally, technical issues do happen. If the card platform goes offline or someone loses access to their digital wallet, payments might be delayed. Keeping a second payment method available can help avoid hold-ups when something goes wrong.

Secure online payments using virtual cards

Security represents one of the strongest advantages of virtual cards over traditional payment methods. Each card comes with unique details that expire automatically, limiting the window for potential fraud. When hackers compromise online retailers or payment processors, your virtual card details become useless after their expiration date.

Virtual cards generate unique transaction codes for each purchase, making it nearly impossible for criminals to replay stolen payment data. The Visa card scheme, pursuant to European regulations, includes additional fraud monitoring that flags suspicious activity instantly.

Real-time notifications provide immediate alerts about every transaction. If someone tries to use your virtual card details fraudulently, you’ll know within seconds and can take action immediately. This speed of detection reduces potential losses compared to traditional cards, where fraud might go unnoticed for days or weeks.

Companies can also implement additional security measures through their virtual card platforms. Geographic restrictions prevent cards from working in certain countries, merchant category controls block purchases from high-risk vendors, and spending limits cap potential losses. These controls work automatically, without requiring constant manual oversight from finance teams.

Using virtual cards to prevent fraud and increase security

Fraud prevention starts with the fundamental design of virtual cards. Unlike physical cards that contain static information, virtual cards can be programmed with specific restrictions that make them useless to criminals. When you create an expense card for a particular purpose, you can limit it to specific merchants, spending amounts, and time periods.

The firm reference number system used by electronic money institutions provides additional tracking capabilities. Every transaction includes detailed metadata that helps identify suspicious patterns or unauthorized usage. Finance teams can review this information to spot potential security breaches before they become serious problems.

Advanced security features:

- Single-use cards that automatically deactivate after one transaction.

- Time-limited cards that expire after specific periods.

- Merchant-specific cards that only work with approved vendors.

- Geographic restrictions that prevent usage outside designated areas.

Virtual cards also protect against common fraud scenarios that affect traditional payment methods. Skimming devices can’t capture virtual card data because the cards exist only digitally. Employees can’t accidentally leave cards in restaurants or shops where criminals might find them. Even if someone gains access to virtual card details, the built-in restrictions limit potential damage.

The integration with mobile apps provides another security layer. Biometric authentication through fingerprints or facial recognition adds protection beyond simple passwords. Team members must verify their identity before accessing card details or making payments, creating multiple barriers against unauthorized access.

Further Reading: Virtual Card Fraud Prevention: How Secure Are They?

How to track your expenses with virtual cards

Virtual cards simplify expense tracking by recording every transaction as it happens. Each payment is logged automatically, with full details sent to your accounting system.

Most virtual card platforms work with common accounting tools. When a team member makes a purchase, the system can tag the transaction with the right category, project code, or budget. That means less time spent sorting expenses and fewer mistakes in reporting.

Mobile apps make the process even smoother. Team members can upload receipts right after paying, linking them directly to the matching transaction. Some platforms pull out key details from the receipt automatically, saving even more time.

Here’s what effective tracking usually includes:

- Automatic matching of transactions to categories or projects

- Real-time syncing with accounting software

- On-the-spot receipt uploads through a mobile app

- Full audit trails for every purchase

- Clear reports for monitoring budgets and policies

Analytics tools show where the money goes and how teams are spending. You can compare departments, spot unusual trends, and find areas to cut costs or improve processes. These insights become even more valuable when paired with a structured expense policy.

Further Reading: The Complete Guide to Business Expense Management

Payments online are flexible with virtual cards

Virtual cards are built for online use. They work with digital wallets and browser checkouts, so payments can be made without typing in card details each time.

For subscriptions, a separate card can be used for each service. Costs stay visible, and unwanted charges stop immediately when the card is deactivated.

They’re also effective for international payments. Some providers offer better exchange rates than banks, and real-time tracking helps monitor foreign currency spending.

Common use cases include:

- Instant cards for last-minute purchases

- Separate cards for teams, projects, or suppliers

- Individual cards for each subscription

- Temporary cards with higher limits for large one-off purchases

- Cards for international vendors with built-in currency conversion

Virtual cards for expenses let companies control online payments without delays or manual processes. Each transaction follows the rules set by the business, with full visibility from start to finish.

How to integrate virtual cards into your business

Integration success depends on matching virtual card capabilities with your existing workflows and systems. Start by identifying the payment scenarios where virtual cards provide the most value, then gradually expand usage as teams become comfortable with the technology.

First, choose a virtual card provider that works with your current banking relationships and accounting software. Companies using established platforms like Xero, QuickBooks, or SAP should prioritise providers with proven integration capabilities. Test these connections thoroughly before rolling out cards to your teams.

Training becomes important for successful adoption. Team members need to understand how to request cards, make payments, upload receipts, and manage their allocated budgets. Create simple guides that cover common scenarios and establish clear policies about when to use virtual cards versus other payment methods.

Implementation steps:

- Assess current expense management processes and identify improvement opportunities.

- Select virtual card providers based on integration capabilities and security features.

- Develop company policies governing virtual card usage and spending limits.

- Train finance teams and end users on new processes and mobile app functionality.

Start with a pilot programme involving one department or project team. This approach lets you identify potential issues and refine processes before company-wide deployment. Gather feedback from early users to understand what works well and what needs adjustment.

Monitor usage patterns during the initial rollout period. Use this information to adjust policies and provide additional training where needed.

Explore Wallester’s virtual cards – bring your business to the next level

Wallester Business offers a virtual card platform built for companies that need control, speed, and visibility in one place. It supports everything from daily purchases to complex expense policies, giving finance teams the tools they need without adding extra steps.

Each virtual card is issued instantly and connected to your company account. You can set individual spending limits, block certain merchant types, and define expiry dates. Transactions appear in real time and are automatically categorised for reporting. Team members access their cards through a secure mobile app with biometric login.

Wallester’s virtual cards are accepted globally wherever Visa is supported and come with the controls required for business use.

The number of virtual cards you can issue depends on your plan:

- Free plan includes up to 300 cards

- Premium plan includes up to 3,000

- Platinum plan includes up to 15,000

- Enterprise plans are fully customisable

Physical cards are available without limits and are free to issue, regardless of plan.

The platform also includes:

- Real-time tracking of all company expenses

- Category and project-level spend rules

- Integration with accounting tools like Xero and QuickBooks

- Multi-currency support and detailed analytics

You can get started within days. The onboarding process is simple, and the Wallester team provides full support with setup, training, and integration. Visit Wallester Business to explore your options and start issuing virtual cards today.