Payroll is frequently one of the most significant expenditures for a company, and its management can be challenging for everyone involved. Payroll mistakes can be tedious to correct and can significantly impact employee morale. This is why numerous small businesses opt for payroll services to handle payroll processing.

However, not all payroll services for small businesses are alike. The most basic services will merely assist you in calculating figures, whereas the best ones provide automation for payroll and ease in tax submissions. When selecting a payroll service for your company, choosing one that can manage all of your requirements is essential.

To assist you in making an informed choice, we investigated the leading small business payroll service providers, identifying the top options and noting those that shine in particular areas.

Salaries in the UK are rising swiftly due to inflation. One way to manage staffing costs more effectively is to outsource payroll and essential business functions to an outside expert; payroll services are an excellent place to start.

What Is a Payroll Service?

Payroll services manage the payroll process for businesses, taking care of tasks such as employee payments and handling PAYE obligations. Providers of payroll services for small businesses can take control of the entire payroll process or just parts of it, allowing employers to maintain their desired level of oversight to ensure employees receive their payments.

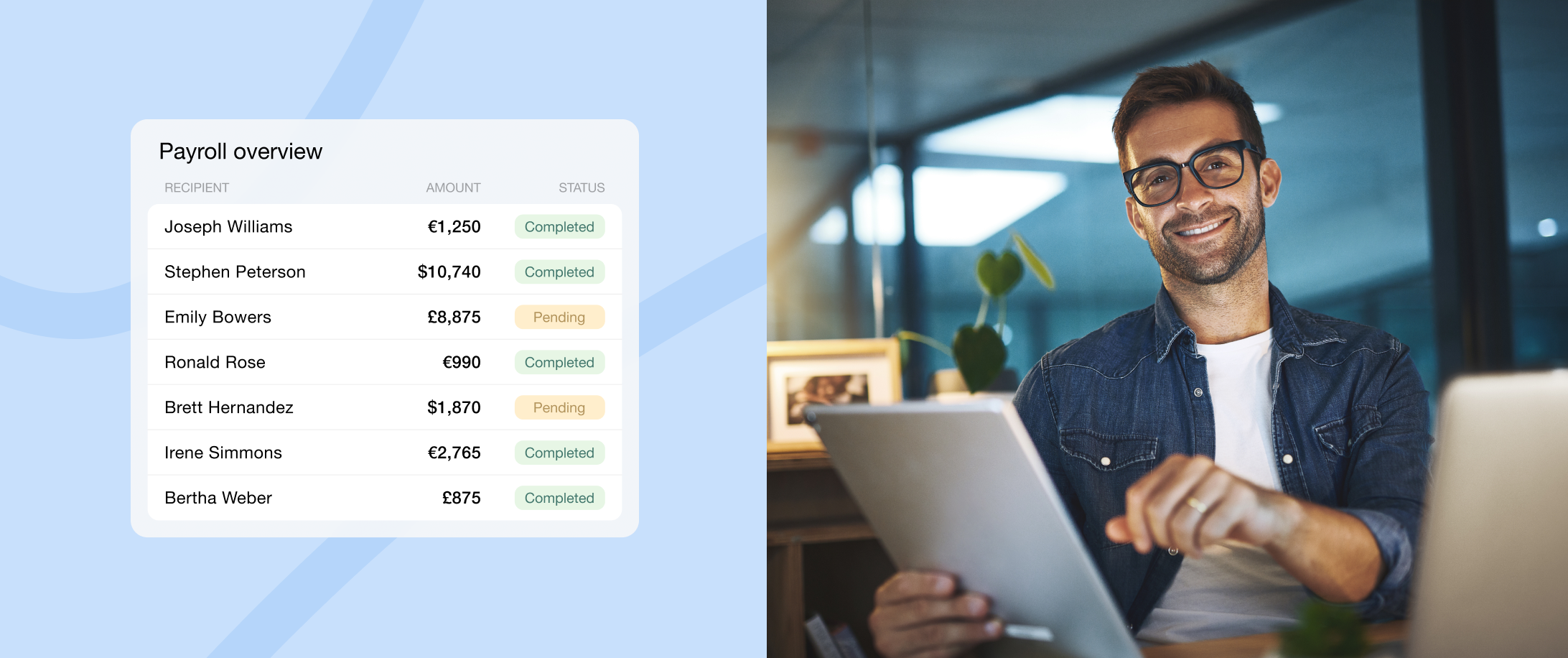

Typically, small business payroll services offer access to payroll software tools, enabling businesses to track when payroll is processed and the costs associated with each cycle.

What Is Payroll Software?

The payroll services listed on this page allow you to delegate some or all of your payroll tasks to these companies to handle on your behalf.

On the other hand, payroll software is generally more affordable and offers an alternative. It allows you to manage payroll internally with a straightforward tool that automates functions such as tax deductions and HMRC reporting.

Another advantage of using software for payroll outsourcing is that it gives you greater control.

The most effective payroll software seamlessly integrates with accounting programs and time and attendance systems, exchanging data to lessen the need for duplicate entries and reduce errors.

It is often packaged with top HR software, although leading providers offer their payroll solutions as independent products.

All payroll software that complies with HMRC regulations tracks PAYE obligations, while the best payroll services manage the necessary reporting paperwork for the relevant jurisdictions.

Additionally, employees can use the top payroll software solutions to view their pay stubs and other documentation through an employee self-service portal or mobile app.

Best Payroll Software Providers in 2025: Our Picks

Moorepay

Overview:

Moorepay is a cloud-based payroll and HR platform that enables easy employee data analysis and reporting. Established in 1966 and accredited by the CIPP Payroll Assurance Scheme, it offers both part-managed and fully-managed services and has garnered big clients like McDonald’s and Volkswagen.

Moorepay is a significant player in the payroll service industry, servicing one in six of the UK’s workforce. Its streamlined onboarding process makes it ideal for scaling small businesses looking for a more sophisticated tool. While many startups start with primary payroll vendors, they often seek more advanced solutions as they grow, and Moorepay ideally fits that need.

The platform easily handles complex pay processing and offers a “simple” switch guarantee. As a result, your company leverages ongoing support from an implementation consultant and expert checks on data migration for compliance. You can also harness a managed emergency payroll service, webinars, and staff onboarding training.

Key features include:

- Comprehensive reporting tools tailored for larger teams

- A self-service portal for employee management and access to payslips

- Robust support with an implementation team and account manager.

With high security through UK IBM data centres, Moorepay simplifies one of the most challenging tasks in the payroll sector: submitting payment data to HMRC.

Pros:

- Moorepay manages legislative changes when switching providers, making the transition straightforward for users.

- It provides CIPP-accredited payroll advice and valuable tax-related resources, which is particularly beneficial for small businesses.

- The platform offers custom reports that ease payroll management processes.

- Moorepay automates payroll and provides plenty of information, including paper payslips, P60, and tax and national insurance contributions.

- The payroll service has an intuitive and user-friendly interface.

Cons:

- It is not recommended for teams with fewer than three employees due to high costs.

- While onboarding assistance is provided, Moorepay lacks live training, which hinders troubleshooting. There are pre-recorded tutorials available.

- Moorepay doesn’t handle wage payments for international employees.

- No free trial is available, which makes purchasing a risk.

- There’s no chatbot support.

Xero Payroll

Overview:

Xero Payroll is an integral part of Xero accounting software. It offers a self-service employee portal which gives access to employees’ pay slips and applications for leave via the employee portal. Employees can update their personal details and stay informed about their earnings.

The platform allows weekly, bi-weekly, or monthly scheduled automated pay runs. Xero Payroll assists in tax calculation and deduction automation. It ensures compliance with HMRC regulations, tracking Pay As You Earn (PAYE) and National Insurance contributions.

The application enables auto-enrollment for workplace pensions and overseeing contributions. Software reports consist of payroll statements, including tax, PAYE summaries, and employee earnings.

Xero Payroll integrates with Xero accounting software and is available on mobile apps. Security features include encryption and compliance with the latest data protection regulations.

Pros:

- Xero Payroll solution is a user-friendly payroll management platform

- Xero Payroll seamlessly integrates with Xero accounting software

Cons:

- It has fewer features for an international payroll service provider than other payroll solutions.

Gusto

Overview:

Gusto is a modern payroll service provider for small-sized companies seeking how to outsource payroll. Its integrations allow the use of over 20 time-tracking applications, learning, performance management, and hiring platforms. Such connections and native Gusto features improve companies’ administration, payroll, and onboarding.

This cloud-based platform provides HR services. Its integrated interface is easy to use, and its features include direct deposit, new hire reporting, and comprehensive payroll analytics. Gusto also offers employee tax registration. The service facilitates payments to contractors in over 120 countries. Partnering with a remote team enables international payroll support in over 75 countries. Gusto’s capabilities include an e-signature, two dual-feature letter templates, and an onboarding checklist.

The provider offers four pricing plans. The Simple plan starts at £31,50 per month, plus £4.75 per employee. There are no hidden fees for syncing time-tracking tools or accounting applications. Your company will grow, so the following packages will allow you to leverage Gusto’s functionalities completely.

Pros:

- The platform provides numerous HR services and connects small businesses with HR experts.

- A small business can leverage Gusto’s pricing flexibility.

Cons:

- The pricing per person for sizeable businesses can be expensive.

ADP

Overview:

ADP offers a payroll platform with essential features for processing payroll and taxes. It caters to companies of all sizes, particularly those with sophisticated needs.

The provider has dedicated plans for companies with over 1,000 employees and customisable pricing for small businesses with fewer than 50 employees. Key functionalities include an employee self-service portal, direct deposit, onboarding tools, and additional HR support options.

ADP allows payroll processing in over 140 countries. The service is available via desktop, mobile, or phone. It automatically calculates employee paychecks, enhancing efficiency and minimising errors. This platform is notably advantageous for companies employing large teams of subcontractors, offering automation tools, project management features, and scalable pricing.

ADP is one of the UK’s most significant payroll software providers, serving over 920,000 customers. However, it requires a minimum of 25 employees. In 2023, the platform was recognised as the Global Payroll Supplier of the Year. ADP combines payroll and HR services, making it a cost-effective option for growing businesses.

While ADP excels in supporting growth and time tracking, it lacks a changes report feature for budget tracking, which is crucial for businesses hiring freelancers. Employees can also use their mobile apps for self-service. The platform allows numerous third-party integrations. With a focus on user flexibility, ADP is a reliable choice for comprehensive payroll and HR needs.

Pros:

- ADP is among the largest and most reliable payroll service providers.

- The platform is capable of assisting your business throughout every phase of development.

Cons:

- To find out the details about pricing, you’ll need to obtain a personalised quote.

Rippling

Overview:

Rippling payroll software is user-friendly and requires less time to train new users. The payroll processes are simple and can be done within 1.5 minutes.

The application integrates with over 500 third-party software providers, which enhances the payroll process, filing of tax documents, and other business tasks.

The software allows you to track metrics such as paid time off, labour expenses, and total hours worked per employee. Rippling enables bank transfers directly or paying employees using paper checks. The software automatically calculates all measurements, including National Insurance and employees’ taxes. It also supports the automatic filing of international taxes and Boolean rule processing. Approval can be automatically requested for specific expense types or values.

The platform also enables international payments, and billing payment services will be added soon. It will allow you to proceed with international invoices and expenses while domestic receipts can be viewed digitally.

The Rippling platform offers £6.35 per person per month. Nevertheless, you need to ask for custom quotes for the base fee. All payroll customers are required to use its workforce application called Rippling Unity. It collects all sensitive payroll data, including onboarding time, attendance, and benefits. This helps automate tasks such as box dispatch when departing employees can return hardware.

Pros:

- Rippling boasts over 500 integrations with top-notch software brands

- The application is straightforward and has an intuitive interface.

Cons:

- Pricing depends on the per-employee rate and other factors which are not always transparent.

OnPay

Overview:

OnPay’s platform enables entrepreneurs to manage payroll, HR functions and benefits efficiently. OnPay offers comprehensive small business payroll services, compliance features for all 50 states, and specialised payroll support for sectors like restaurants and nonprofits at no extra charge.

OnPay’s licensed in-house insurance brokers can assist you in setting up health and vision plans with providers and sync benefit costs with payroll. The company also supports 401k integration with employer matching options.

The platform is user-friendly and allows unlimited payroll runs and various payment methods. You can manage employees, be keen on running payroll, and oversee if everything is paid accurately. Key features include compliance checklists, automated workflows, and customisable documents.

OnPay’s package costs £31.50 per month, plus £4.75 per employee. It provides extensive reporting features, helping businesses to track their finances and make informed decisions.

Pros:

- OnPay provides transparent pricing for small businesses.

- Companies can process payroll anytime.

Cons:

- OnPay doesn’t offer a mobile app.

IRIS

Overview:

IRIS provides payroll software tailored for organisations of all sizes. It is highly appreciated in the UK, especially for small businesses in the UK construction industry.

The platform possesses a CIS Module that simplifies subcontractor payments by verifying tax status and managing tax returns to HMRC. Automated payroll processing reduces manual errors through automated calculations and statutory costs. Real-time reporting gives access to up-to-date payroll data on expenses, tax liabilities, and earnings. Employee self-service portal allows staff to view payslips and manage personal information and leave requests. The software offers auto-enrolment for pensions that manages workplace pension contributions and compliance.

IRIS ensures compliance with HMRC by adhering to its regulations connected with PAYE, National Insurance contributions, and RTI submissions. Data security guarantees the protection of sensitive information and compliance with data protection laws.

Custom reports are available. You can tailor reports to specific payroll needs. The platform integrates with various accounting software for a comprehensive financial view.

IRIS also provides comprehensive training, 24/7 employee access to payslips, and dedicated account management for clients. It delivers complex payroll solutions for medium—to large-sized enterprises with intricate payroll requirements.

Pros:

- It connects with numerous business software (including the complete Microsoft Suite), seamlessly sharing sensitive payroll data across various systems.

- Employees can access their payslips and pension documents anytime through the IRIS mobile app.

- The service provides users with a dedicated account manager to assist with any inquiries.

Cons:

- IRIS support is unavailable 24/7, meaning you won’t have access to customer support if you face an issue on weekends or after business hours.

- The IRIS platform is less user-friendly compared to some competitors.

MHR

Overview:

MHR was founded in 1984. It supports over 1,000 companies, including such titans as Microsoft Azure and Experian. The platform provides flexible options for payroll management, whether in-house, outsourcing payroll, or a combination of both.

MHR offers iTrent, one of the industry’s top-hosted payroll software programs. This powerful tool combines payroll processing with HR functions and serves as a central hub for employee data. In 2023, it won CIPP’s Software Product of the Year Award.

MHR’s payroll software features are ideal for remote companies across various regions. Their Emergency Payroll Support ensures employees are paid correctly during issues like power outages. The service includes replacement payroll management, data recovery, expert process improvement suggestions, and problem resolution.

Additionally, MHR iTrent provides a comprehensive dashboard for monitoring employee pay data, including for international hires. Pricing depends on factors like employee count and the company’s requirements.

Pros:

- MHR is an accredited CIPP Payroll Assurance Scheme (PAS) provider.

- The platform has an impressive accuracy rate of 99.9%, meaning only one in 100,000 employees might face incorrect payment issues.

- MHR allows payments to international employees if you recruit from overseas.

Cons:

- The service doesn’t offer 24/7 support, and the user guides can be overly complex, complicating issue resolution.

- MHR’s software lacks the capabilities of industry leaders like IRIS, and users frequently report problems with slow loading times.

QuickBooks Payroll

Overview:

QuickBooks Payroll is a part of the famous accounting software designed for small businesses in the US, Canada, Australia, and the UK. The platform enables expense tracking, invoicing, payroll, and tax management by automating payroll calculations and tax deductions, allowing businesses to set and review automatic payments.

Key features include:

- Automated payroll calculations that reduce errors and save time.

- Tax filing assistance for federal and state regulations.

- Direct deposit for timely employee payments.

- An employee self-service portal for accessing pay slips and updating information.

- Customisable payroll reports for financial analysis.

- Mobile accessibility through iOS and Android apps.

- Integration with over 450 business apps and QuickBooks accounting software.

QuickBooks Payroll provides scalable services, including multiple packages that support unlimited payroll runs and next-day direct deposits. The service enables various pay grades, handles earnings orders and PAYE, and is suitable for construction firms with CIS payments and pension submissions.

Pros:

- QuickBooks has several plans that offer diverse pricing options

- The payroll software seamlessly integrates with the QuickBooks accounting software.

Cons:

- Not every plan includes a guarantee for error-free taxes.

Paycor

Overview:

Paycor’s human capital management (HCM) software integrates various HR functions, including payroll processing, workforce management, and benefits administration.

The Paycor platform provides an automated payroll feature that is ideal for salaried workforces. It handles tax filings and W-2/1099 processing. A comprehensive employee self-service portal will be handy for updating personal information, requesting paid time off, and reviewing pay stubs. Robust employee self-service capabilities allow staff to access pay information via a mobile app and use the OnDemand Pay feature for early wage access, reducing the stress of payroll issues.

The provider focuses on simplicity, with automatic payroll runs and proactive alerts for missing information. Employees can review pay stubs up to three days before payment.

Paycor also includes expense-tracking tools and integrates with over 140 software applications through the Paycor Marketplace.

The service offers four plans, each with a flat base rate and per-employee fee:

Basic: £78/month + £3.95/employee

Essential: £117/month + £5.50/employee

Core: £159/month + £6.32/employee

Complete: £159/month + £11/employee

Pros:

- Paycor offers a user-friendly self-service portal that allows employees to verify their details and review their pay.

- The platform simplifies the preparation of PAYE and ensures that employers adhere to deadlines.

Cons:

- The plans’ pricing is higher than what other payroll providers offer.

Remote Payroll

Overview:

Remote is an all-in-one solution for international businesses working with multiple contractors worldwide. The service provides specific benefits packages available in over 60 countries. The platform is tax-compliant and allows payments in local currencies.

The typical solution offers an HR library, employee self-service portal, reporting, and analytics. The company’s specifics allow you to work with contractors and remote workforce.

You can apply to remote payroll and work as an umbrella agency. This implies that the service will manage payroll benefits and taxes in different countries to ensure you comply with tax regulations in those regions.

The umbrella option standard cost is £475. However, you must apply for a worldwide payroll quote from the company. Each contractor per month costs £23, including managing and paying international contractors with one-click approval for recurring invoices. Such a service doesn’t require paying exchange fees.

Pros:

- The Remote Payroll service offers a seamless onboarding process for contractors and employees

- The platform is well-suited for the globally distributed workforce.

Cons:

- Customer support is restricted only to the company Help centre and email.

Paychex

Overview:

Paychex Flex is a comprehensive HR service. Its payroll management system is suitable for businesses of all sizes, from small businesses to large organisations with over 1,000 employees.

The online payroll system automatically calculates and submits payroll taxes. It integrates HR and benefits deductions to minimise manual data entry. The system also includes a time and attendance tracking system that links hours directly to payroll.

To ensure compliance, Paychex employs over 200 experts who monitor changes in US tax laws. The software supports various payment options, such as direct deposit and pay cards, and offers extensive customer support, including an online chat feature and 24/7 coverage for US customers.

With over 300 integrations, including well-known applications like BambooHR and Microsoft Dynamics, Paychex Flex provides an API for custom software needs.

Paychex accommodates various payroll schedules (weekly, biweekly, etc.) and payment methods (bank transfer, cheque, prepaid debit card). The service allows payroll management via computer or mobile app and features a self-service option for employees to access pay stubs. The company extensively monitors regulatory changes in the UK and enhances its software.

Pricing plans start at £31 per month plus £3.95 per employee per month. They offer basic payroll processing and tax preparation. More advanced features are available at higher tiers.

Pros:

- Paychex provides several options for employee payments.

- The company offers various payroll scheduling possibilities.

Cons:

- Organisations with limited budgets might consider Paychex costly.

Isolved

Overview:

Isolved is constantly developing. This platform now combines HR, payroll and workforce management functions. This payroll software provides a unique learning system called People Heroes University, which offers advanced training and self-tuition.

The most useful Isolved features include filing and agency payments, automatic tax calculations, tax credit eligibility, and threshold-monitoring alerts and rules.

With Isolved software, you can access P60 forms, personal data pension schemes, and paid time off balances. The application automatically sends updates to insurance companies and pension providers. Your company managers can view consolidated HR data and payroll for each staff member with the help of an easy-to-comprehend interface.

Pros:

- Isolved is a payroll tool with a simple interface for HR payroll and workforce management.

- With Isolved applications, employees learn to be self-reliant, which reduces the manager’s burden.

Cons:

- Support and assistance are not the best part of this service.

Deluxe

Overview:

Deluxe customer service team provides general guidance and tax advice to ensure tax compliance. A helpful payment service makes reporting and document submission easy, saving you money and time.

Essential services for a small business include P60/P11D/P45 processing, full-service PAYE filings and submissions across the UK (including Scotland), and pension scheme contributions.

There are two core pricing tiers. Pricing plans start from £35 per month, plus £5.50 per employee monthly. Package with Payroll + HR essentials and Payroll and HR enhanced package, which contains customer reporting fields and endless workflow automation ability. The latter option costs £35 per month, plus £10.10 per employee per month.

As for the payroll software, you can perform payroll operations in three quick steps. The application provides the ability to pay for hours worked and offers paper checks and Direct deposits.

Deluxe works with third-party software providers such as accounting applications and point-of-sale (POS) systems. Integrations include in-house migrations with the capability to integrate HR and payroll seamlessly. Deluxe connects with popular accounting software such as Xero, QuickBooks, and Sage. You can also integrate it with Microsoft 365 Dynamics, providing an all-in-one solution and enabling sync between payroll and HR, streamlining your business processes.

Pros:

- Deluxe provides a dedicated customer service team that helps you with payroll and payroll process optimisation.

- The platform offers full-service payroll, including all implementation and configuration.

Cons:

- There are no available free trials.

How Much Does Payroll Software Cost?

Prices for payroll software can vary significantly. Monthly plans are often more cost-effective for businesses that frequently run payroll. Some online payroll services offer free trials to test the software. Most providers generate customised quotes based on factors like industry, team size, and benefits.

A business with ten employees can expect to pay between £70-£80 for a fully managed service and £40-£60 for simple outsourcing.

Usually, the pricing structure looks like this:

- Monthly plans typically have a base fee (£23 to £115) plus per-employee fees (£3.95 to £7.90).

- Per-payroll plans charge between £8 to £80 per payroll run, with additional per-employee fees (£1.60 to £11.80).

Estimated costs for small businesses are roughly £6 per employee per month; for example, 15 employees would cost about £90 monthly.

Types of Payroll Solutions

Payroll solutions include delegating part or all of your payroll management tasks to a specialised external company. You can choose between:

Hostedpayroll software

This solution is reliable and effective for storing and updating information. Even if you have a skilled bookkeeper on your team, your organisation might benefit from using cloud-based payroll software. You can create notifications for missing or necessary information or conveniently send payslips via email. Organisations can easily monitor expenses, claims, and benefits, knowing that all data is securely backed up on protected servers.

Part-managed payrollservice

A service offered by a ‘payroll bureau’ assists businesses wanting to maintain some oversight of the process. Picture this: you’re content handling payroll for your employees, but you might use some assistance with submitting paperwork at the end of the tax year. A payroll bureau provides that flexibility at a more affordable rate than a completely managed service.

Fully-managed payrollservice

Comprehensive payroll services manage every facet of payroll — from compensating employees to producing payslips, generating reports, and submitting documents to HMRC. You can relax, confident that your business is fully compliant with regulations.

What Are Payroll Software Features?

Payroll services provide various features and tools that simplify payroll management for small businesses. Here is a recap of the most valuable features to consider when choosing a payroll company.

- Limitless payroll management:Some managed payroll services let you run payroll multiple times a month, allowing you to set pay periods that suit your employees. This also allows you to pay third-party contractors under IR35 after completing a project without incurring extra fees for additional payroll runs.

- Payment methods: Many online payroll solutions enable you to compensate employees via bank transfers, paper checks, direct deposits into employee bank accounts, or prepaid debit cards, commonly called pay cards.

- Reporting: The reporting component comprises digital pay statements (pay stubs), yearly earnings statements, payroll summaries for each payroll cycle, and year-end reports.

- End-of-year tax documents: Small business payroll services prepare all required year-end tax forms for your employees and independent contractors and ensure they receive them.

- Enhanced payment functionalities:Many modern payroll systems offer pay-on-demand features, allowing employees to access earned wages before payday or receive payment in their local currency internationally. These features include global payroll processing in multiple currencies, same-day pay access (pay-on-demand), and the ability to include contractor payments in standard payroll runs.

- PAYE (Pay as you earn):Online payroll software calculates the amount your business is responsible for in terms of employee and employer PAYE. They will also prepare and submit the necessary documents to the relevant federal, state, and local tax authorities and make the essential payments on your behalf.

- Personal time off (PTO) management:Certain payroll services manage part or all of your PTO administration. This may involve monitoring the accumulation and usage of PTO or statutory annual leave by employees and enabling employees to submit time-off requests and managers to either approve or decline those requests.

- Employee self-service:Payroll software usually includes an online hub where employees can access their pay stubs, tax forms, and features like time-off requests and time tracking.

- Onboarding reporting: Numerous payroll services can prepare and submit the necessary documents whenever you bring a new employee on board, registering them with HMRC. These forms must be submitted in the jurisdiction where your business is located.

- Mobile access:Most payroll services offer a small business a specific mobile application or a website optimised for mobile use, making the platform reachable from smartphones and tablets.

- HR services: Most payroll service providers have expanded their offerings to include HR services like onboarding, employee benefits management, and payroll compliance support. Some also connect organisations with specialised HR professionals to tackle HR challenges. These services enhance payroll functionalities, including benefits management, corporate bookkeeping, and global HR or EOR support.

- Global coverage: Certain payroll software solutions may allow for payments to international freelancers and contractors, while companies such as Remote have been specifically developed to enable payments to foreign workers, freelancers, and clients.

- Compliance: Integrated functions that guarantee your payroll setup are designed to compute, gather, report, and submit all necessary tax payments as mandated. Numerous systems also offer supervision by teams of compliance and payroll experts.

- Automation:These tools enable payroll operations to function independently without requiring extensive human control. One example is the automatic deduction and submission of payroll taxes to government agencies, such as the IRS or CRA.

- Software integrations:To enhance productivity and minimise manual data entry for a small business, ensure the payroll company you select integrates with your current tools. Look for integrations with HR data management systems, time and attendance tracking software, benefits administration systems, and compensation management software.

- Customer support:You will be relying on an external organisation for one of your most crucial business operations — compensating your staff — so it’s essential to confirm they will be available to assist you when necessary. This support should include email communication, telephone assistance, online chat options, a personalised account manager, or a web-based knowledge base (for self-help solutions).

Many payroll systems offer unlimited payroll processing, various employee payment options, support for year-end tax documents, management of paid time off, employee self-service features, and mobile accessibility. Utilising a payroll service for additional HR requirements is also becoming more typical.

Choosing Payroll Software

Three main steps are in selecting the most suitable payroll service for your small business. We explain these stages below.

1. Identify the requirements of your business

Several factors must be considered when selecting online payroll software for your small business. For many companies, the budget will be crucial in deciding which provider to choose. What amount can your organisation allocate to payroll processing and related services? Which features are non-negotiable, and which ones can you forgo?

Numerous payroll platforms are part of broader HR and human capital management (HCM) software suites, making them unsuitable for businesses that prefer a standalone payroll solution.

You will also need to assess how frequently you run payroll. Is it every week, biweekly, or just monthly? Some payroll providers allow unlimited payroll runs, while others impose a fee for each run, making this a key consideration.

Consider your firm’s competing needs. Is same-day or next-day deposit crucial for you? Is it more important than other functionalities? Does your business require a platform that offers extra HR services? Compile a list of what you want your payroll software to achieve so you can seek out providers that align with your company’s requirements.

2. Explore Possible Solutions

Once you identify the specific characteristics you want in a payroll software provider, you can create a list of potential options. Evaluate the features offered by each vendor to gauge the compatibility of different platforms. Compare every system with your list of necessary functions and eliminate the ones that don’t meet your criteria.

After you have narrowed your choices to just a few options, arranging demonstrations with these providers can be beneficial. You can observe the software’s operation during a demo and ask the sales team relevant questions. For example, can you process payroll as frequently as needed each month? Does the package include a mobile application and a portal for employee self-service? It’s also essential to assess how user-friendly and accessible the software is.

The interface should be straightforward, enabling you to complete payroll within minutes. Remember that sales representatives will emphasise the advantages and downplay any drawbacks, so be diligent in your inquiries and ensure you obtain the information you require.

Ensure you fully understand how the provider’s pricing works and your monthly expenses. For example, many payroll providers implement a base fee and an extra employee charge for a small business. What pricing structure do they utilise, and are there any setup fees or charges for additional payroll runs? Will you be billed for the software once installed, a month after subscribing, or after conducting your first payroll run?

Lastly, consider the type of customer service the company offers. How do customers rate the payroll provider in online reviews, and how do they handle customer complaints? Is support available through phone, email, and chat, or is it restricted to just one of these methods? The responses to these inquiries further refine your options and the availability of support hours.

What other factors should you consider before choosing the best payroll software? Below, we break down all the components that may impact your decision.

Expertise

Understanding how complicated payroll can be for small business owners, it is vital to find seasoned professionals who can help. It’s essential to seek out providers with a decent track record of managing payroll requirements and adhering to established standards for compliance and security, such as CIPP and ISO:27001 accreditation.

Costs and pricing

Comparing payroll service prices is essential. Determine if the costs correspond with your business requirements and financial plan. Specific systems may impose charges based on employee count, while others could provide tiered pricing based on functionality. Be mindful of concealed expenses, such as extra services or assistance charges. Ensure the selected solution aligns with your current budgetary limits and is adaptable as your business expands.

Implementation

The simplicity of implementation is crucial when moving to a new payroll system. Choose a solution that ensures an easy onboarding experience and sufficient training and assistance. Seek out interfaces that are easy to navigate and uncomplicated setup processes. Evaluate the vendor’s support materials, such as guides, tutorials, and customer service, to ensure a smooth transition for your team.

Data security

Security breaches can have devastating consequences. Focus on selecting providers that implement robust data security protocols. Since you won’t have control over the location of your employee data when outsourcing payroll, assess each provider to ensure they safeguard sensitive information using encryption, secure servers, and strict access controls.

Payroll reports

Thorough and precise reporting forms the foundation of efficient payroll management. Evaluate the provider’s reporting features – customisable reports, real-time analytics, and compliance documentation should be included in their offerings. This guarantees that you aren’t merely carrying out payroll tasks but also utilising essential data.

Employee experience

A payroll system is not solely for small business administrators; it significantly affects employees. Select a provider that delivers intuitive interfaces and easy-to-use employee portals to boost employee satisfaction and lighten the load on your HR department.

Setup and trainingpayroll processes

The complete process of implementing payroll software can take anywhere from 30 days to over 3 months. This duration can lead to significant distractions for business owners, hindering their ability to focus on essential operations. A service provider should deliver thorough training to your team, guaranteeing that all members are proficient in using the system to streamline the implementation process—the faster the setup, the better—without sacrificing thoroughness.

Customer support

Having responsive customer support is crucial when problems occur that could hamper timely or accurate employee payments. Choose providers that offer various support options, including email, phone, and live chat. Quick and efficient assistance is crucial in resolving a technical issue.

Integrations

Payroll is connected to other critical business management components, such as accounting, human resources, and recruitment. Assess the provider’s ability to work well with your company’s other software to create a unified system where all information can be recorded, shared, and updated in one central location. This approach will significantly reduce time spent and minimise the likelihood of data entry mistakes.

Choosing a fully managed payroll solution that integrates smoothly with HR software can significantly boost efficiency. Seek out systems that provide a unified platform, combining HR and payroll capabilities. Simplifying data transfers across different systems eliminates redundancies, eases payroll processes, and offers a complete overview of employee information, from attendance logs to salary specifics. This integration guarantees consistency and precision in managing both payroll and HR responsibilities.

HR services

Although choosing the most affordable payroll provider for a small business or medium-sized enterprise may be appealing, it’s advisable to consider the long-term implications. Opting for a provider that offers a broader selection of HR software enables you to seamlessly incorporate additional features like benefits administration, performance management, or applicant tracking systems (ATS) as your team expands.

Tax administration and automatic tax filing

An effective payroll solution should automate the payroll processes related to payroll tax filing. Look for systems that accurately manage tax calculations and deductions, ensuring adherence to local payroll legislation. Confirm that the software allows for the direct submission of tax reports and payments to the appropriate authorities, making navigating the typically complicated and time-sensitive tax filing requirements easier.

In addition to the critical cost factor, what other key elements should be considered when evaluating payroll service providers?

The first point is that HMRC compliance is essential when choosing a provider. Please verify that your selected service meets this vital requirement, providing you with assurance regarding their devotion to regulatory standards and your business’s compliance. Thankfully, all the providers mentioned in this article comply with HMRC, so that concern is alleviated.

Likewise, a skilled payroll service provider should be adept at managing tax regulations. They will keep up to date with changes in tax laws, thereby reducing compliance risks. A good provider will have dedicated personnel who consistently monitor these updates and ensure all payroll automation is submitted correctly and punctually.

Global payroll management

For companies operating internationally or employing remote staff, choosing a payroll system that can effectively manage global payroll, such as Employment Hero’s Global Teams Employer of Record (EOR) service, is essential. Look for platforms that can handle multi-currency transactions, adhere to different tax regulations in various locations, and include features for localisation. A perfect solution should offer centralised management while being flexible enough to meet other regulatory demands and currencies, ensuring efficient payroll processes around the globe.

3. Choose Your Solution

After considering each provider’s pros and cons, you can pinpoint your leading choices and register with your selected vendor. If possible, utilise demos or free trials to gain practical experience. Numerous providers also offer introductory deals and discounts. Check if you can negotiate the listed price, and always inquire about available discounts; previously available offers or incentives may still be accessible upon request. Once you’ve selected the software that best suits your business, you can proceed with the configuration phase.

Benefits of Payroll Software

Here are some of the advantages of payroll service usage for a small business:

- Increased efficiency:Utilising comprehensive payroll software allows you to avoid hiring an in-house employee to manage all of your business’s payroll requirements.

- Ease of use:The software handles most complex tasks, including calculating pay amounts, withholding the correct taxes and National Insurance contributions, and alerting you about when and how much HMRC needs to be paid.

- Ensured tax compliance: Payroll companies manage onboarding new employees, submit PAYE notifications, and more on your behalf, helping you fulfil your legal responsibilities.

- Reduced expenses: High-quality payroll services can help your company save money by simplifying the submission process for each pay run and end-of-year reports for every employee and the business.

- Reliable processing: Payroll companies provide a highly dependable method for running payroll weekly. If you enable automatic payroll, it will execute without your input. However, even with manual operation, the system can still send you weekly reminders, ensuring that employees receive accurate and timely payments.

- Wide accessibility: Employees can effortlessly access necessary information if your payroll service includes a self-service application. By logging into the app, they should be able to view their payslips, P60s, and BACS payments. Some platforms even permit employees to review their payslips before payroll processing, offering a valuable opportunity to correct payroll errors beforehand.

- Manage remote workforces:Payroll services equip you with the resources to comply with regulations in nearly every jurisdiction. Some providers also offer umbrella agency services for third-party contractors working under IR35 rules and for overseas employees.

How Wallester Can Help You

Avoid havoc in your payroll management. Consider Wallester as your go-to payroll service provider to organise everything effectively. Our business payroll solution helps you save time and reduce staffing expenses while simplifying your payroll process. Wallester’s business offerings include:

- no transaction fees for employees and affiliates,

- fast payments of up to 1,500 transactions simultaneously within your accounting software,

- instant payroll deposits to cardholders’ accounts,

- 24/7 customer support.

For your organisation, our service enables smooth integration with your accounting application, immediate payroll disbursements for numerous program participants, and an easy process for inviting new cardholders. This enhances control for payroll teams and minimises time-consuming tasks.

Your employees receive a dependable, user-friendly app that allows easy top-ups, multiple payment options, including Google Pay and Apple Pay, and complete financial visibility.

Explore Wallester’s business payroll solution for free here. We offer payroll services that are fully accessible for your business.