There are many expense tracker apps that you can discover on the Play Market or App Store. It’s hard to choose the best expense tracker app, right? But no worries. You can find 10 of the most desirable expense tracking and management tools here. Learn how those expense trackers work.

This article also teaches you what features to consider when selecting the right solution. A concise extract of the best practices for efficient business expense tracking, provided in this guide, will be helpful for you after the choice is made.

So, let’s start without any further ado.

Top 10 expense tracker apps for business: Overview

1. Wallester Expense Management

Overview:

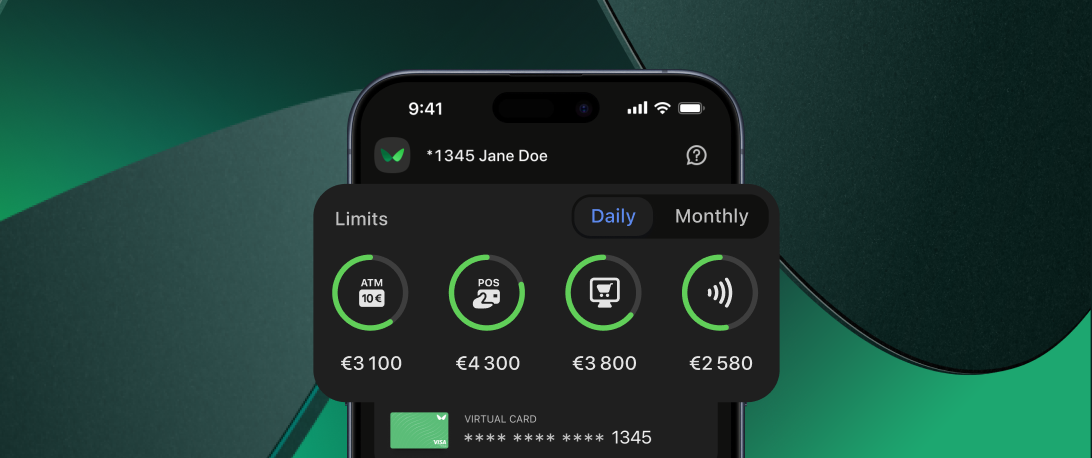

Wallester Expense Management is one of the best expense tracker apps for custom business card issuance. This platform provides businesses with several tools for efficient expense tracking. Moreover, the solution offers different kinds of cards for regular use. Wallester issues physical and virtual cards. Employees can spend money using debit, credit, and prepaid cards. Users make purchases up to the established spending limit. Company managers can customise this limit anytime. They can set card spending limits for employees, merchants, spending categories, and countries.

Team members receive push notifications after every purchase, reminding them to take a photo of a physical receipt. Wallester’s service is highly customisable and may be free to use depending on the specific features you need for your business. The approval system notifies business owners about business card usage, allowing monitoring of employee spending in real-time. You can integrate applications with ERP and accounting software through REST API. Seamless integration enables fast expense tracking and timely reporting.

Wallester Expense Management Tracker is an ideal solution for small, medium, and large-sized businesses that prefer the best expense tracker app with multiple financial accounts and customised cards to track daily expenses.

Features:

- Real-time issuing: The platform enables the issuance of physical and virtual cards.

- Custom integrations: Integrations are available via REST APIs with accounting and planning software.

- Customised spending limits: Set limits for specific employees, countries, or retailers.

- Invoice upload: Uploading is done via mobile app.

- Push notifications: Employee receives an alert after each purchase.

- Payment approval system: This functionality is designed to confirm payment requests.

- Budget management: Track and plan expenses through API integrations.

- Reporting: Detailed spending analytics are available for data-driven decision-making.

- Multi-currencysupport: Users can choose from numerous currencies. Exchange rates are affordable.

Pricing:

- A free trial is available

- Prices start at £0

Visit Wallester’s website to see tariffs in more detail.

Pros:

- Ability to save money on physical and virtual card issuance

- Convenience in using prepaid credit and debit cards

- Timely notifications after each purchase

- More control over spending with card limits customisation

- Gaining high-quality insights because of reporting and seamless custom integration with accounting software

- Depending on team size and chosen features, certain features may be free.

Cons:

- No reimbursement system

- You need a full-price breakdown

- You need to customise integrations.

2. Expensify

Overview:

Expensify is the best expense tracker for small and mid-sized businesses. It helps manage your money and allows employees to track business expenses and scan physical receipts with one click. They can track mileage as well. Personnel can also import credit card transaction reports. You can also import general ledger codes and assign them to expenses for better synchronisation with the accounting system.

The application has an intelligent payment approval system. A particular administrator will be alerted when a staff member spends money depending on a specific expense category. The free plan has a 25 receipt scans limitation, while a $5-9 per monthly subscription allows you to upload an unlimited number of invoices. Additional paid features include accounting sync, tax tracking, and extra reporting capabilities.

Expensify is an excellent option for businesses of all sizes. It has an intuitive interface and AI-powered scan for smooth business expense tracking. The application also provides customised reporting.

Features:

- One-click receipt scanning: Intelligent scan captures the receipt details automatically and conveys them into an expense report.

- Corporate card reconciliation: Users can track and manage their corporate spending with the paid app.

- Credit cardimport: Employees can import credit card transaction reports.

- Approval system: You can customise approval workflows and business expense rules.

- Extensive number of integrations: Expensify has a vast number of integrations with accounting and budgeting apps.

- Tax filings: Allows to monitor tax rates and policies.

- Compliance and audit: AI-based auditing identifies expense duplicates and errors with exchange rates.

- Automatic mileage tracking: Staff members can track mileage automatically.

- Automatic reimbursements: Employees can submit auto reports for expense reimbursements.

- Multi-currencysupport: Users can choose the relevant currency for transactions.

- Reporting: Customised reporting is available with a paid subscription.

Pricing:

- A free trial is available

- Prices start at $5 per user per month

Visit the Expensify website to see tariffs in more detail.

Pros:

- Automates business expense tracking with the intelligent AI scanning

- Ensures compliance with tax tracking and AI.

- Saves time on expense reimbursements

- Facilitates decision-making process with customised reports

- Ability to choose the currency you need with multi-currency support

- Makes the approval process more manageable with an intelligent approval system

Cons:

- Expensive for Expensify’s card non-users

- Limited features on a free plan, i.e. 25 auto scans per month

3. ExpenseIn

Overview:

ExpenseIn is one of the best expense tracker apps for business expense tracking that suits companies of all sizes that seek automated expense-tracking solutions. This app provides real-time receipt scanning with the use of AI. Users can harness automatic mileage and carbon emissions determination. ExpenseIn calculates mileage through integration with Google Maps and analyses carbon emissions, which is critical for eco-conscious organisations.

A customised approval system helps you confirm employee requests according to established requirements. ExpenseIn automates expense claims, reducing manual efforts for submission approval and reimbursements.

Detailed reports allow you to determine spending patterns and assist in making informed decisions. The app seamlessly integrates with ERP and accounting software systems. ExpenseIn complies with HMRC tax regulations and provides the necessary level of security for transactions.

Features:

- Digital receipt scanning: Using AI technology, an employee can instantly capture receipt details with a mobile device to categorise expense data.

- Automated expense claims: Automation touches all components of the expense claim process, starting from submission and approval to reimbursement.

- Real-time analysis and reporting: Customised reports fuel management with insights and foster data-driven decisions.

- Customised approval: Businesses can set approval processes and hierarchies and ensure compliance with automatic policy checks that point out discrepancies.

- Automatic carbon emissions and mileage calculations: Mileage tracking is organised with Google Maps integration, while carbon emission computing provides the necessary reports to environmentally friendly organisations.

- Software integrations: ExpenseIn offers plenty of opportunities for seamless integrations with planning and accounting applications.

- Compliance with tax regulations: The app complies with HMRC tax rules and all the data protection regulations.

Pricing:

- A free trial is available

- Pricing starts at £0

Visit the ExpenseIn website for more detailed information.

Pros:

- Saves employees time with automated solutions for scanning, automatic expense claims, and mileage and carbon emissions calculations

- Provides insights and facilitates informed decision-making by company management

- Enables the VAT tax deductions with business expense tracking and reporting

- Saving money on receipt tracking

- Ensures compliance with company policies and tax regulations.

- Available at Play Market and App Store.

Cons:

- The steeper learning curve for beginners

- Slightly expensive for small businesses.

4. QuickBooks Online

Overview:

QuickBooks Online is a convenient expense-tracking software with business expense-tracking features. You can automatically connect your credit, bank card, and other accounts to import your expenses. This app automatically categorises expenses according to established rules. Custom reports provide you with insights into your finances. A user-friendly dashboard informs subscribers about spending in real time.

With QuickBooks Online, you can also capture information from receipts and link it to your business account. The accounting application helps you bill clients, attach the necessary files to the message and track invoices.

QuickBooks Online is compliant with HMRC tax regulations. Pricing is a bit expensive for small businesses, starting from £14 per month. Other packages come with £28, £38, and £90 per month, allowing you unlimited reports for users, tracking time capabilities, and other valuable features. QuickBooks Online is well-suited for small and mid-sized businesses.

Features:

- Financial data integration: Users can integrate bank and credit card data

- Automatedexpense trackingand categorisation:The app provides you with functionality for customised expense categorisation and automatic expense tracking

- Real-time dashboards:Allows real-time tracking of spending

- Invoice creation:You can create invoices from your phone

- Automatic reminders:Users can get notifications in case their payments are overdue

- Custom reports:You can gain insights into your finances by project, job, or location

Pricing:

- A free trial is available

- Pricing starts at £14

Visit the QuickBooks Online website for more detailed information.

Pros:

- Saves up to 6 hours per week on financial management.

- Company management stays informed with comprehensive reporting

- Streamlines invoice management and expense tracking with automated recurrent expenses and other invoicing features.

Cons:

- Restricted to 25 unique users

- Reimbursement is possible only through payroll

- The learning curve is steeper, requiring additional support.

5. Zoho Expense

Overview:

Zoho Expense is one of the best expense tracker apps for expense tracking and management. Employees can submit their expenses instantly with automated expense reporting. Scanned receipts are stored in the cloud, so you don’t have to worry about losing your receipts. An established approval system controls purchase requests and spending. Your staff members can receive direct deposit reimbursements.

The well-versed solution allows credit and corporate card reconciliation. Receipts can be grouped in a single report and submitted to create specific entries in accounting software. The app is compliant with the latest HMRC tax rules. VAT and mileage are calculated automatically at the HMRC rate. This allows to maximise tax deductions.

Zoho Expense provides users with an extensive reporting functionality. 25 reports are available for end-users. The free plan enables a 5 GB limit on receipt storage, three users, and 20 monthly receipts or scans. Additional functionality requires a paid subscription at £5 to £9 per user. This offer sounds budget-friendly for many small businesses.

Zoho Expense can be integrated with different applications and other Zoho tools, such as budgeting apps, CRM and marketing apps and simplifying company management. This is one of the best expense tracker apps for small, medium and large businesses.

Features:

- Automated receipts: Auto scans and cloud storage streamline receipt management.

- Payment approval system: The tool enables automated request approval according to established rules.

- Automatedexpense tracking: The application provides functionality for the automatic creation of different expense types.

- Corporate card reconciliation: Offers reconciliation between corporate card transactions and expenses.

- Automaticexpense reports: Employees can create and submit expense reports automatically.

- Multi-currencysupport: Users can choose the relevant currency for transactions.

- Compliance with tax laws: The solution ensures audit and compliance with regulations and tax laws.

Pricing:

- A free trial is available

- Pricing starts at £5

Visit the Zoho website for more detailed information.

Pros:

- Streamlines business expense tracking and reporting

- Saves time for employees and company management for business expense monitoring and accounting.

- Provides business owners with comprehensive information about business spending for informed decisions.

- This convenient tool is suitable for employees, allowing them to receive direct debit reimbursements.

- Budget-friendly solution for organisations of different types.

Cons:

- The free plan is limited to three users

- Auto scanning allows only JPEG, PNG and PDF files.

6. Xero Expense

Overview:

Xero Expense is one of the best expense tracker apps on the web. A cloud-based software for business expense tracking suits small businesses and employees well. Staff members can capture receipts, scan photos and send emails. The tool provides automated bank reconciliation. The solution can be integrated with multiple bank accounts and fetch data from scans, emails, or photos. Then, the details collected from receipts are reconciled with your bank account daily. Additionally, Xero offers tools for invoice and bill payment and reporting.

The business tracker enables integration with various financial management, payroll and payment applications. Subscription plans start from £16 per month. A free version of this expense-tracking app is available for 30 days. The solution ensures compliance with tax regulations.

Features:

- Bank accountsreconciliation: The application allows automated transaction import and synchronisation with bank accounts

- Cloud storage: You can consolidate contacts and accounts and track invoices online

- Real-time collaboration: The tool enables communication with financial advisors

- Third-party integrations: Xero Expense provides custom integration with an extensive number of apps.

Pricing:

- A free trial is available

- Pricing starts at £16

Visit the Xero website for more detailed information.

Pros:

- Automates invoicing

- Saves time on bank reconciliation

- Connects with multiple other tools for invoice management, billing, and reporting

- Streamlines invoice management

- Additional support from financial advisors.

Cons:

- A limited number of tools

- No reimbursement

- No AI scan

- Expensive for small businesses.

7. FreshBooks

Overview:

FreshBooks is one of the leading expense tracker apps widely used by small business owners, self-employed persons, and freelancers. This expense tracker app works with personal expenses and manages money spent on business purposes. Users can create multiple accounts to track personal expenses, improving cash flow. This business expense tracker connects your credit card and bank accounts, updating your expenses automatically.

The uploading paper receipts feature is also available for users. They can scan and email digital receipts. Subscribers can also easily categorise recurring expenses with 14 default expense categories and over 40 expense subcategories, adding new categories if needed. Users can pinpoint billable expenses and invoice them to clients. All your receipts can be stored in the cloud. You can set automatic payment reminders for reimbursements.

Pricing starts at £15 per month, including five billable clients and expense tracking without any limit. Subscription plans with higher tags offer custom prices and unlimited billable clients. FreshBooks has a user-friendly interface and convenient dashboard and reporting.

Features:

- Automatic invoicing: Users submit to clients their billable expenses automatically

- Bankintegration: The tool seamlessly updates information from the credit card and bank account.

- Time tracking: Freelancers and self-employed persons track their billable hours, calculating projects cost-efficiency

- Custom reporting: Set reports to track expenses and financial transactions

- Multi-currencysupport: Helps users with various currency options.

Pricing:

- A free trial is available

- Pricing starts at £15

Visit the FreshBooks website for more detailed information.

Pros:

- Saves time for monthly bills to clients with an invoicing feature

- 30-day money-back guarantee

- Simplifies business expense tracking

- It has a user-friendly interface

- Well-suited for managing cash flow and personal finances.

Cons:

- No in-app reimbursement

- No workflow management capabilities

- Requires additional costs for each new team member.

8. Rydoo

Overview:

Rydoo, previously known as Xpenditure, is one of the most convenient expense tracker apps for business expense tracking, which ideally suits medium and large companies with overseas offices. Employees can track their mileage and tax rates depending on a specific country or region. Rydoo provides you with per diem rates for over 20 jurisdictions. Staff members can scan and submit receipts, uploading them to the app or emailing them. A company can set an automated approval flow based on specific rules. Insightful reporting indicates how much you spend and highlights cost-saving opportunities for you.

Rydoo offers seamless integration with many apps. Prices start at £8 per user per month.

Features:

- Automatedbusiness expenseapproval:You can set policies for automated business expense confirmation

- Mileage tracker: The expense tracker app helps with accounting for mileage in 20 jurisdictions

- Invoice uploading: Employees can scan and upload receipts via the app and email them

- Integrations with other services:You can connect enterprise resource planning software or external services such as Dropbox

- Reconciliation ofbank statements: Simplifies credit card reconciliation

- Expense cards:Provides both physical and virtual corporate cards for enhanced spending management

- Multi-currencysupport: Users are free to choose from numerous currencies.

Pricing:

- A free trial is available

- Pricing starts at £8

Visit the Rydoo website for more detailed information.

Pros:

- Streamlines approval process with automated expensive approval

- It has attractive pricing

- Provides international expense tracking

- Simplifies business expense tracking and reimbursement

- You can connect Rydoo to your ERP system.

Cons:

- 15 pages limitation for PDFs or receipts

- Sometimes, OCR scanning is inaccurate.

9. Shoeboxed

Overview:

Shoeboxed is one of the most unusual expense tracker apps for business expense tracking. One of the top features of this app is the “Magic Envelope”, which enables business travel expense receipts to be mailed in prepaid envelopes. Employees can fill those prepaid envelopes with receipts, which will later be converted into digital copies.

The app provides expense reports and integrations with other accounting tools like QuickBooks and other popular accounting software. This business tracker is available at App Store for iOS users only. Tariffs start from $23 per month for 300 physical documents monthly or 600 documents in digital format annually. Service also helps with data extraction, categorisation, and integration with other software.

Features:

- Data collection: OCR scanning and human data verification are available to extract all your data from receipts automatically

- Receipt digitisation: You can scan and convert paper receipts digitally using mail-in, mobile device, desktop upload, or email.

- Automatic archiving: Emailed receipts can be archived

- Expense reporting: The tool provides comprehensive reports for users

- Compliance: Digital copies of receipts are compliant with IRS and CRA regulations

- Integration: Shoeboxed connects with different ERP and accounting software.

Pricing:

- A free trial is available

- Pricing starts at $23

Visit the Shoeboxed website for more detailed information.

Pros:

- Various options for receipt submission

- Compliance with IRS and CRA

- Saves time for business expense tracking.

Cons:

- Limited number of tools compared with other business expense records

- Expensive option for small businesses

- Available at the App Store only for iOS users.

10. SAP Concur Expense

Overview:

SAP Concur Expense is one of the best expense tracker apps, and it is highly customisable for tracking expenses. It is the best app for medium and large-sized enterprises. The tool comprises the following capabilities: receipt capture and upload, report processing, personalised travel expense policy creation, and other expense management features. The latter function allows you to specify mileage, hotels, meals, flights, and other travel expense information for developing policy templates as a part of corporate rules. Employees can also track outside bookings within specific travel programs.

The SAP Concur Expense provides over 100 third-party integrations with accounting applications, ERP systems, payment platforms and other apps. With the use of this solution, your company will be compliant with the latest tax regulations. A free trial is available for 15 days.

However, the user interface of this app is hard to grasp, and many functions may seem unnecessary for any small business owner.

Features:

- Receipt capture: The app allows you to capture and upload receipts and proceed with them automatically.

- Auto-categorised expenses: Categorise monthly expenses automatically

- Corporate cardintegration: Connects with your bank account and multiple accounts for corporate spending to streamline bank reconciliation and manage your money efficiently

- ROI calculator: Calculate return on investment (ROI) for conscious spending and tracking your business net worth

- Automatedexpense management: Enhanced process of expense oversight according to established policy

- Real-time reporting: Provides insights into your spending patterns

- Integrationcapabilities: Over 100 software systems are available for custom connection.

Pricing:

- A free trial is available

- Pricing Not disclosed

Visit the SAP Concur website for more detailed information.

Pros:

- Automates expense reporting

- Streamlines currency exchange

- Provides reimbursement via the app

- Fully customised solution for medium and large enterprises

- Tax compliant.

Cons:

- The steeper learning curve for users

- The user interface is complicated

- It doesn’t provide insights into spending patterns

- The price depends on various factors

- Too complex for small businesses.

What to consider when choosing a business expense app

The most essential factors to consider when choosing a business expense tracker are price and the app’s capabilities. Small businesses and self-employed persons prefer free or low-cost tools, while medium and large-sized businesses seek cost-effective and comprehensive expense tracker apps that fit their needs.

Pricing primarily depends on the number of users. So, keep in mind how many employees are going to use this app. Determine how many users the app allows. Avoid adding up unnecessary costs and limit the use of the app to specific employees.

As for expense tracker apps, several features are critical for smooth work. One such functionality is an automated expense policy. When you have a lot of staff members who constantly use the app, automated request approval is vital for more productive use of the expense tracker app. Multi-currency support will be a must-have feature if your company is involved in international trading.

A user-friendly interface eliminates the need for teaching new users how to operate the app. Existing integrations with other software streamline connectivity between apps and avoid redundant export/import or converting operations.

Large businesses seek all-in-one expense-tracking apps that significantly improve their workflows, expense management and accounting.

Follow your business needs and choose expense trackers available at Play Market and App Store. Don’t spend your time and money on applications that don’t fit your requirements.

How do you track business expenses most efficiently?

The best practices for efficient business expense tracking include:

- Establishexpense managementpolicies first: Write down your expense tracking and management rules, creating comprehensive documentation that sets the necessary limits, norms, and access permissions for specific employees and eliminates discrepancies.

- Categorise yourmonthly expensescorrectly: Teach your employees how to categorise costs to simplify expense tracking and accounting.

- Regular control: Track expenses made by your employees daily and weekly, which is also helpful for reconciliation and control of your business’s monthly income and net worth.

- Ensure the necessary level of security: Establish permissions for employees to avoid data leakages and fraud.

Automate your business expense tracking with Wallester

Our business expense tracker provides all the necessary expense tracking and reporting features. Invoice uploading via mobile app, budget management, detailed reporting, and payment approval system streamline your business expense monitoring. Custom integrations via REST API with different software simplify your accounting and expense management.

Issuance of physical and virtual cards, whether corporate, prepaid, debit or credit cards, is free. Convenient control of spending with custom spending limits helps you to stay on top of your finances.

Choose our innovative custom business expense tracker for free.