Running paid advertising across several channels works best when your payment method matches the pace of digital campaigns. Virtual cards give advertisers quick issuance, spending limits that fit each budget, and clear reporting that helps keep ad spending under control. This guide compares the best virtual cards for ad spend and explains how they fit Google Ads, Facebook Ads, and TikTok Ads, with a focus on the factors potential clients actually weigh when choosing a provider.

Key takeaways

- Virtual cards help media buying teams keep ad budgets separate, set spending limits, and replace blocked cards quickly.

- The best virtual card providers support multiple cards per user, work with Apple Pay or Google Pay, and give real-time tracking in an app or dashboard.

- Look closely at acceptance on major advertising platforms, funding methods, currency coverage, monthly fees, and transaction fees before you choose.

- Separate virtual cards for clients, products, or multiple ad accounts help you track payments and avoid mistakes that can stop active virtual cards during a live campaign.

What is a virtual card?

A virtual card is a digital version of a payment card that lives online. It has unique card details, including number, expiry date, and security code, and it links to a funding source such as a bank account or business accounts within a provider. You can use a virtual payment card for online payments and online services in the same way as a physical card during online purchases or online shopping. For advertisers, the draw is simple. You issue separate virtual cards for ad campaigns and control spending limits without exposing a primary debit card or credit line.

Further Reading: The Complete Guide to Virtual Cards for Business

How does a virtual card work?

You create the card inside a provider’s web app or mobile app and choose how it is funded. Some providers offer virtual debit cards that pull from a balance, others issue a virtual credit card with credit limits, and many support virtual prepaid cards that you top up in advance. Once created, you copy the card details into the ad platform and set limits that match the advertising budget. Transactions appear instantly in the dashboard, which helps you track spending, reconcile ad payments, and spot problems before payments fail. Many providers also connect to Apple Pay or Google Pay, so you can handle digital ads or other online advertising costs where digital wallets are accepted worldwide.

Further Reading: How Virtual Cards Work: The Technology Behind the Solution

Types of virtual cards

Virtual payment cards come in a few flavours, each suited to a different job. If you know how they differ, choosing what to use for ad spend becomes much easier. Here are the main types and when they make sense.

- Virtual credit cards give you a digital line of credit, just like a traditional card, but without the plastic. You set a limit that fits your needs and can change it as budgets shift. They work well when you want to keep advertising costs separate from everything else, whilst still using credit. For teams that value float and tidy month-end reporting, this is a comfortable route.

- Virtual prepaid cards are loaded before you spend. You can only use what you’ve put on the card, which keeps budgets tight and prevents overspending. Many advertisers like this because it creates a clear ceiling for each campaign. It’s a simple way to ring-fence money for a specific goal.

- Virtual debit cards draw straight from your bank balance or business account. You get the security of a virtual card with immediate access to available funds. This suits companies that prefer to spend from cash flow rather than credit. It keeps things straightforward and makes day-to-day control feel natural.

Why use virtual cards for Google and Facebook ads?

Google Ads and Facebook Ads both support virtual cards, and they reward clean billing with steady delivery. With separate virtual cards for each account or campaign, you can protect a larger budget from a single billing issue and keep multiple ad accounts working. If an account is paused for review or a card is flagged, you replace the card that belongs to that one account and leave other advertising campaigns untouched. This is a practical way to control spending across major ad platforms while avoiding disruption in busy periods.

Another advantage is clarity for reporting and tracking. When every ad account has its own virtual card, you can match month-end statements to the exact ad payments that ran that week. This helps agencies that handle several advertisers and need efficient financial transactions that make sense to clients. It also helps in-house teams keep each target audience, product group, or region aligned with its own payment card and spending limits.

Further Reading: The Best Virtual Cards for Google and Facebook Ads in 2025

Benefits of virtual cards for media buying

- Control over budgets. Assign a dedicated card to each platform, account, or campaign. Set daily, weekly, or monthly caps and keep live spend inside a safe range.

- Speed and continuity. Create cards instantly and swap a blocked card without waiting for plastic, so ads keep running.

- Accuracy in reporting. See spend in real time, match charges to the right account, and close the books with fewer errors and less rework.

- Stronger security. Avoid sharing a primary physical card across services. Limited or single-use cards lower exposure to fraud and card testing.

Drawbacks of virtual cards

- Acceptance can vary. Check how the provider performs with Google Ads, Facebook Ads, TikTok Ads, and any other platforms you use.

- Fees can add up. Some plans have a monthly fee, and foreign currency transactions may cost more, which matters if you run multi-currency accounts.

- Prepaid top-ups need discipline. If the team forgets to top up a balance, spend can stall during a live campaign.

- No physical companion in some plans. Not every provider offers a matching physical card, which is a drawback if you want one system for travel and online ads.

The 20 best virtual card providers for Ad spend compared

1. Wallester

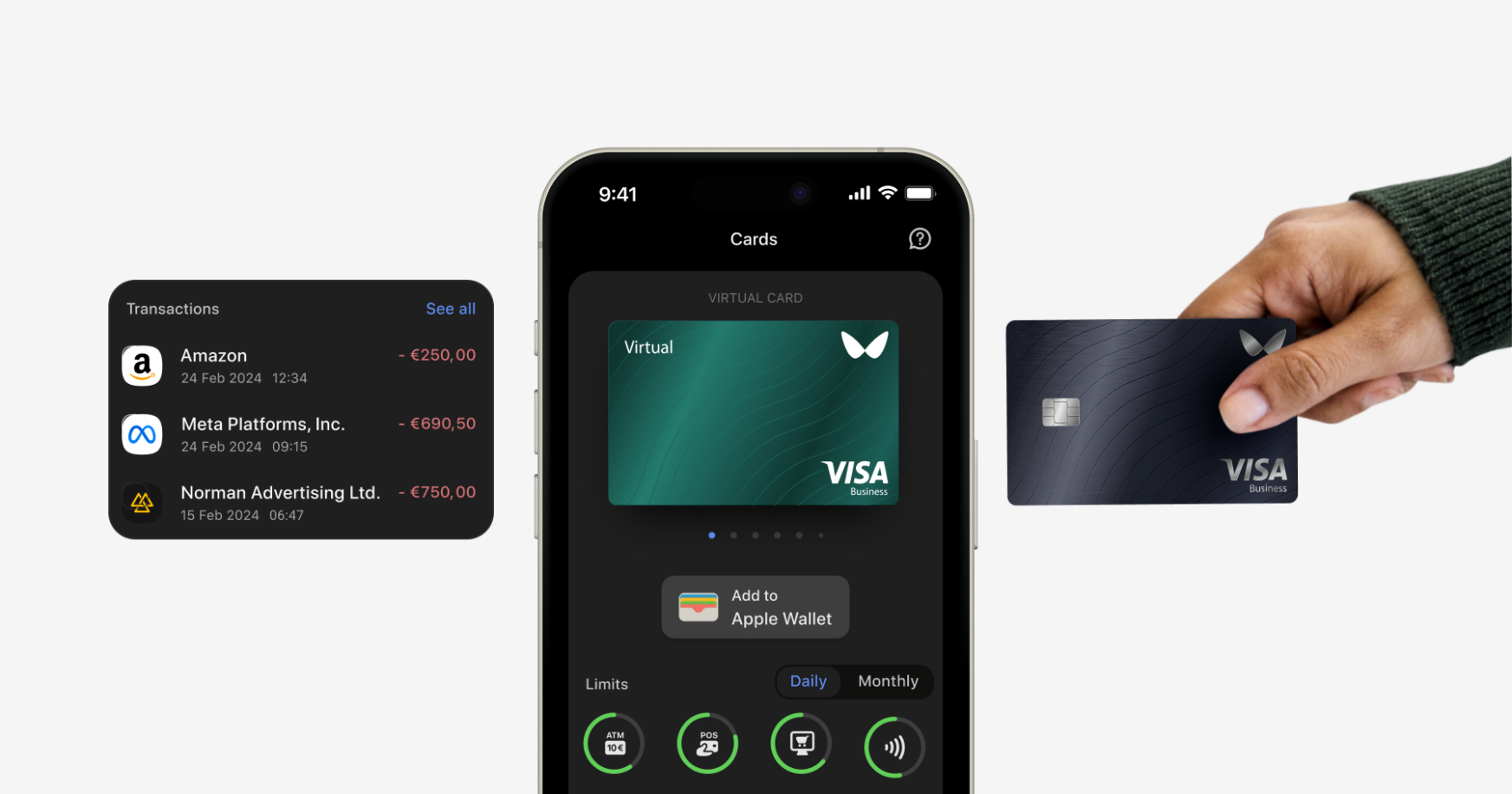

Wallester issues virtual and physical Visa cards with instant issuance, card-level limits, and tools aimed at media buying.

Key features:

- Instant virtual cards

- Separate cards per client/campaign with spend caps and merchant rules

- Dashboard for real-time tracking

- Media-buying specific product page

- Apple Pay/Google Pay support

Best for – Agencies and in-house teams that need fast replacement and lots of cards for ad accounts.

2. Revolut

Revolut Business provides multi-currency accounts and large virtual-card allowances per user.

Key features:

- Up to 200 active virtual cards per team member

- Spend controls and alerts

- Creation limits for new virtual cards

- 30+ currency balances with interbank FX

Best for – Teams paying platforms in several currencies and issuing many team cards.

3. Wise

Wise links virtual debit cards to multi-currency balances with transparent FX.

Key features:

- Hold/spend in 40+ currencies at mid-market rates

- Up to 3 digital (virtual) cards per person

- Freeze/unfreeze in-app

- Apple Pay/Google Pay support

Best for – Debit-funded international ad spend with simple controls.

4. Airwallex

Airwallex issues virtual Visa debit cards that draw from held currency balances.

Key features:

- Instant issuance

- Spend globally in multiple currencies

- Employee cards with category/limit controls

- API issuing options

- Corporate cards free to create from held balances

Best for – Cross-border campaigns where FX and multi-currency handling matter.

5. Pleo

Pleo combines virtual cards with expense management and accounting integrations.

Key features:

- Instant virtual cards with adjustable limits

- Freeze/unfreeze

- Receipt capture, categorisation, and reporting

- Works alongside physical cards for travel/subscriptions

Best for – Advertisers wanting cards and expense workflows in one tool.

6. Airbase

Airbase offers policy-based virtual/physical cards with robust approvals and audit trails.

Key features:

- Rapid virtual card creation with built-in controls

- Role-based approvals

- Audit trail and analytics

- Security/fraud-monitoring features for card spend

Best for – Mid-market/enterprise teams that need strict finance governance.

7. PST.net

PST.net focuses on virtual cards for online advertising and affiliate use.

Key features:

- Card products tailored for Facebook, Google, and TikTok Ads

- Multiple BINs

- Instant issuing

- Dashboards for spend tracking

- Funding via bank transfer, cards and (in regions) crypto

Best for – Performance marketers needing cards tuned for ad-platform acceptance.

8. Monzo

Monzo supports virtual cards with clear limits on live and newly created cards.

Key features:

- Up to 5 live virtual cards

- Up to 9 new cards every 30 days (max 100/year)

- Add to Apple/Google Wallet; real-time notifications

Best for – UK teams needing simple bank-led virtual cards with predictable limits.

9. Skrill

Skrill offers virtual prepaid cards that spend from your Skrill wallet.

Key features:

- Virtual Mastercard/Visa options for online payments

- Works online and in mobile wallets (where supported)

- Prepaid model – load before spending

- US-availability note for Visa variant

Best for – Prepaid-funded ad spend and wallet-based controls.

10. iCard

iCard provides EU e-money accounts with quick virtual card issuance.

Key features:

- 2 free virtual cards (Visa & Mastercard)

- Up to 20 total per account

- Set custom daily/weekly/monthly limits

- Freeze/unfreeze

- Published fees/limits pages for transparency

Best for – Low-cost virtual cards with straightforward controls in the EEA.

11. US Unlocked

US Unlocked issues virtual cards with a genuine U.S. billing address.

Key features:

- Everyday/merchant-locked/one-time virtual cards

- Clear pricing

- Admin dashboard for sub-accounts & reporting

- Updated terms (July 2025)

Best for – Non-US advertisers needing reliable US-merchant acceptance.

12. Intergiro

Intergiro offers business accounts with physical/virtual Mastercard cards, but note current regulatory status.

Key features:

- Virtual and physical cards

- Analytics and exports

- Important: Swedish FSA licence revoked (June 18, 2025)

- SEPA temporarily reinstated until 19 Sep 2025 while they appeal – plan cautiously

Best for – EU businesses comfortable with a changing regulatory situation; consider risks before relying for ads.

13. Starling

Starling’s virtual cards are tied to “Spaces” pots, but currently not available for business accounts.

Key features:

- Create virtual cards for personal/joint accounts

- Spend from a specific Space

- Up to five virtual cards at once (personal)

Best for – Personal setups; business users should note lack of business virtual-card support.

14. Monese

Monese offers virtual cards inside the app alongside personal and business accounts.

Key features:

- Virtual card with its own 16-digit number; add to Apple/Google Pay

- Fees & limits pages confirm virtual card availability

- Business T&Cs cover card issuance

Best for – Simple, mobile-first virtual cards for small teams/sole traders.

15. Mesh

Mesh provides virtual/physical cards with granular spend controls.

Key features:

- Vendor locks, category rules, and real-time alerts

- Automatic receipt matching and reporting integrations

Best for – Teams needing tight subscription/vendor controls for ad and SaaS spend.

16. Stampli

Stampli Cards sit within an AP-first workflow.

Key features:

- Create virtual and physical cards with policy controls

- AP approvals, real-time details, and optional cashback on eligible spend

Best for – Finance teams that want virtual cards governed by AP rules and audit trails.

17. Tribal

Tribal focuses on emerging-market SMEs with virtual/physical corporate Visa cards and spend controls.

Key features:

- Generate multiple cards

- Control by user/vendor/category

- Corporate cards plus local/SWIFT payments and financing options

Best for – LATAM/MENA startups needing credit + virtual cards under one platform.

18. Karta

Karta (karta.io) issues virtual corporate cards aimed at online advertising and subscriptions.

Key features:

- Create many cards for ad accounts; set per-card limits; pause any card

- Budgeting/teams features

- Visa prepaid/credit programmes via partners

Best for – Agencies/startups that need lots of controllable virtual cards for media buying.

19. Extend

Extend lets you create virtual cards on top of your existing corporate card from participating banks.

Key features:

- Unlimited virtual cards from a single line of credit; set limits/expiry

- Web/mobile/app & API

- Apple Pay/Google Pay support

Best for – Companies that want granular virtual cards without changing issuers.

20. Emburse

Emburse pairs virtual/physical cards with spend policies and expense integration.

Key features:

- Instant issuance with built-in controls

- Policy/category/vendor rules

- Real-time tracking; reconcile spend inside Emburse solutions

Best for – Teams needing policy-driven card spend tied tightly to expense management.

Top Virtual Cards for Facebook Ads

Facebook Ads favours steady billing and clear budget control. Pick providers that issue and replace cards quickly and give per-card caps with simple reporting.

Wallester – instant virtual cards at scale with clear per-card limits and real-time tracking. Easy to split spend by account and to replace a card without stopping campaigns.

Airwallex – strong multi-currency balances and competitive FX. Good for cross-border campaigns that need firm control and quick issuance.

Revolut – multiple cards per user with simple caps and alerts. Practical for in-house teams running several Facebook accounts.

Wise – debit-funded spend with transparent FX and live notifications. Suits brands paying in several currencies without using credit.

PST.net – advertising-focused setup with fast scaling. Handy when you spin up many cards for new ad sets and want a purpose-built dashboard.

Top Virtual Cards for Google Ads

Google bills in bursts as you hit spend thresholds, so you want cards that clear recurring charges, scale across multiple ad accounts, and keep FX simple for global campaigns.

Wallester – instant virtual cards in large numbers with per-card caps and merchant rules. Good when you need a fresh card for a flagged account and want the rest of your campaigns to keep running.

Soldo – virtual cards tied to budget pots with clear controls for subscriptions and recurring charges. Handy for agencies that split Google Search and Google Shopping across clients and want tidy month end reporting.

Payhawk – strong multi-currency support with card-level limits and real-time tracking. A solid fit for teams that move budgets between regions and need predictable FX on Google’s automated billing.

Spendesk – vendor-specific virtual cards that keep each Google Ads account isolated. Useful for approval flows, receipt capture, and a clean audit trail without slowing daily work.

Ramp – fast card creation with per-vendor limits and live alerts. Works well for US teams that run several Google Ads accounts and want tight control over thresholds and renewals.

Top Virtual Cards for TikTok Ads

TikTok spend can spike fast when a creative lands. You need instant issuance, firm caps for each card, and quick swaps if billing is flagged.

Wallester– instant virtual cards at scale with clear limits and merchant rules. Easy to replace a single card while the rest of your campaigns keep running.

PST.net – built around online advertising with quick issuing and card setups that aim for strong platform acceptance. The dashboard is tuned for rapid testing across many ad sets.

Airwallex – multi-currency balances and competitive FX for cross border pushes. Helpful when you test several markets in short windows and want predictable costs.

Karta – virtual Visa cards suited to online payments and subscriptions. Simple to create many cards and set hard caps for each ad set to stop runaway spend.

Revolut – multiple cards per user with easy limits and real time alerts. A practical choice for teams that manage several TikTok accounts and need fast replacements.

How to use virtual cards for ad spend

Follow these steps as a quick, practical workflow.

- Map your setup

List platforms, accounts, regions, and target daily or weekly budgets. Decide which campaigns need their own card.

- Create and name cards

Issue one virtual card per account or campaign. Use clear names that match the ad account to keep reports tidy.

- Set limits and rules

Apply daily or monthly caps. Lock the card to the ad platform where possible. Pick the right currency for each market.

- Fund and test

Load funds or link a credit line. Make a small test charge in the ad account to confirm billing works before launch.

- Add backups

Keep one spare, pre-verified card on each platform. If billing is flagged, switch the payment method and keep delivery steady.

- Monitor daily

Check the dashboard each morning. Compare provider charges with platform spend. Turn on alerts for high spend or declines.

- Handle issues fast

If a payment fails, raise the limit if needed or replace the card. Check currency settings and recent platform activity.

- Close and tidy up

Pause or close cards when a campaign ends. Archive notes and receipts. Export a monthly report for finance.

How to choose the best virtual card provider for Ad spend

Picking a provider comes down to steady acceptance, clear limits, and clean reporting. Use this quick checklist to compare options for your setup.

- Acceptance and platform fit. Check performance with Google Ads, Facebook Ads, TikTok Ads, and any other channels you use.

- Funding and currencies. Look for multiple currencies, strong FX, and funding that suits your cash cycle, whether debit, credit, or prepaid cards.

- Controls and scale. Confirm limits, merchant locks, multiple cards per user, and tools for multiple ad accounts and multiple campaigns.

- Fees and terms. Compare monthly fee levels, transaction fees, and any charges for card issuance or top-ups.

- Reporting and integrations. Make sure tracking, reporting, and exports let finance match charges to campaigns without guesswork.

Further Reading: 7 Must-Have Features in a Virtual Card Platform for Agencies

Streamline your media buying with Wallester

Wallester is built for teams that run paid campaigns across several accounts and need fast card issuance, tight per-card controls, and clear visibility of daily charges. It fits agencies and in-house marketers who want to isolate risk by account, replace a flagged card in minutes, and keep reporting tidy at month end.

What you get with Wallester for ad spend

- Instant virtual cards at scale. Create fresh cards for new accounts, ad sets, or markets without waiting for plastic. Keep a spare, pre-verified card ready so delivery continues if one method is paused.

- Per-card limits and merchant rules. Set daily or monthly caps, restrict where a card can be used, and lock cards to advertising platforms to prevent accidental spend elsewhere.

- Real-time tracking and alerts. See charges as they land, match spend to the right account, and spot billing issues before they affect delivery. Export statements and filters for quick reconciliation.

- Wallets and acceptance. Add cards to Apple Pay and Google Pay where supported. Use 3-D Secure for online payments and keep primary card details off ad platforms.

- Multi-currency coverage. Pay in several currencies and keep a clear view of FX so regional campaigns stay predictable.

- Team access and roles. Issue employee cards with named ownership, set approvals where needed, and keep audit trails for finance.

- Security by design. Tokenised wallets, card freezing, and instant replacement lower exposure to fraud and card testing.

Why it works for media buyers

Recurring billing on Google Ads and social platforms can trigger at odd hours and at different thresholds. Separate cards per account reduce knock-on risk, and fast replacement keeps the rest of your campaigns live. Clear, per-card limits help you hold daily spend where it should be while you test new creative or scale to a new region.

Create your first virtual card, map cards to individual ad accounts, and review live spend in the dashboard. If you prefer a walkthrough, book a short demo with the Wallester team and test it on a small campaign before rolling out across all accounts.