Virtual cards have become an important financial tool for businesses in 2025, offering improved security, better control, and practical convenience for online purchases and managing expenses. This guide reviews the top 20 virtual card providers of 2025, highlighting their latest features, practical capabilities, and various use cases to help you choose the best option for your business needs.

Virtual cards explained

A virtual card is a digital, temporary credit, debit, or prepaid card number that acts as a proxy for your physical credit card details when transacting online, in-apps, or at contactless retailers. The virtual card is linked back to the main account but keeps the real card number protected. A virtual card differs from a physical card since only temporary card details are shared without exposing permanent account numbers – adding a layer of security.

Virtual credit cards as well as debit and prepaid ones are generated using a service provided by fintech companies or digital banks. Instead of exposing your physical card number, you use these disposable virtual credit card numbers when transacting. The virtual card replicates key details like the card network, security codes, and expiration date which allows it to work seamlessly for payments.

Once a virtual card is used, it can be set to expire immediately or within a customized duration. This makes virtual cards ideal for subscription services you may want to cancel without the hassle later. They also enable easy allocation limits and spending controls.

Overall virtual cards promote security, anonymity, and financial control when handling sensitive online transactions, recurring payments, or unfamiliar merchants. Top providers make obtaining virtual credit cards quick and simple using mobile apps.

How does a virtual card work?

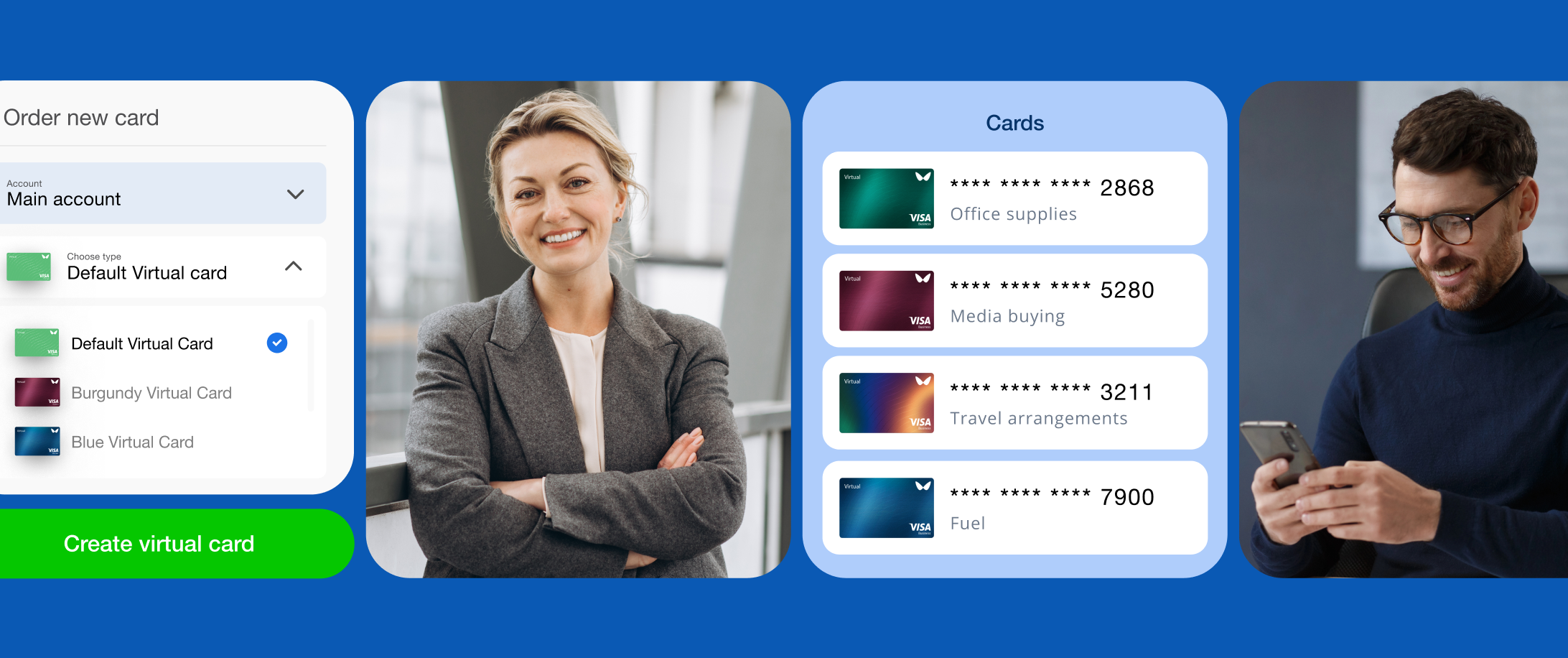

A virtual card works by acting as an instant, temporary substitute for your real payment card details. When you need to make an online or offline purchase, virtual card providers generate a one-time disposable card for you instantly. Once created, virtual card details can be saved into payment services like Google Pay or Apple Pay, or any other mobile wallet to enable convenient tap-and-pay transactions using mobile devices, while still protecting your actual card details.

Simply open your virtual card app or account, create a card within preset limits tailored for that transaction, and the card details can then be auto-filled at checkout. Virtual card numbers are randomly generated and linked back to the balance on your actual payment card or bank account. However, your real card number is never exposed or shared with the merchant.

Once the virtual card transaction goes through, the purchase amount is deducted from your underlying source of funds. Virtual cards can be set to expire immediately after a single use or have short-term validity. They offer greater control, security, and convenience compared to a physical card.

Virtual cards provide the flexibility to set spending limits, expiration dates, and Usage policies customised to each transaction for improved financial control compared to physical cards. Limits help minimise risks in case details are accidentally leaked while also avoiding overspending.

As you can see, it’s quite simple to create virtual cards and use them as intended.

How virtual card programmes are built

From a product perspective, virtual card providers follow two main approaches. Some rely on fully packaged banking apps, while others build proprietary card products using modular fintech software. In this model, platforms such as SDK.finance provide the underlying ledger, APIs, back office, and card management logic, while licensed issuers and card networks handle regulatory and scheme-level responsibilities.

Why use virtual cards instead of physical cards?

There are several excellent reasons for businesses and individuals to use virtual credit cards rather than traditional physical cards:

Stronger security – Virtual cards protect your permanent card details from fraud and exposure when you shop online or use them at stores. There is no risk of physical card data being skimmed or copied. Virtual card details expire quickly minimizing impact if compromised. Many people today shop online routinely whether at a big online store or smaller shops. Virtual cards facilitate purchase online frequently by letting users generate a unique card number for each website which contains no identifiers traceable to their permanent accounts. In addition to number expiry and access freezing, some virtual card services provide two-factor authentication using biometrics for managing virtual credit card accounts safely, especially when linking to bank transfers or ATM withdrawals.

Increased convenience– Virtual cards can be easily added to digital wallet services like Google Pay or Apple Pay for improved checkouts and the use of contactless payment methods. As digital wallets grow popular for in-store contactless payments, appropriately some virtual card providers allow card details to be uploaded for mobile usage while retaining the ability to freeze access instantly for security.

Optimized management – Issue and manage virtual cards quickly for staff, contractors, or automated processes like ads or subscriptions. Since virtual cards are temporary, they help control cash flow and allow setting spending limits per card aligned to a specific budget or purchase. Some services provide handy integrations that automatically create new virtual cards with predefined limits using popular expense management apps. Virtual cards from a digital bank can also help control corporate spending by allowing managers to set a distinct credit line per card used by staff and contractors. This contains expenses alongside strong oversight.

Limited losses – If a virtual card is compromised, you simply deactivate it instantly without having to replace the physical card. Losses are contained within the preset spending limit.

Credit score rebuilding – For individuals lacking a credit history or in search of rebuilding their credit score gradually, specialized virtual credit card providers report card activity to agencies like Experian. This allows consumers to use virtual credit responsibly thereby demonstrating financial trustworthiness for credit reference agencies’ records over time.

Customizable controls – Businesses can set spending limits, tailor monthly limits, and define usage duration per card. This prevents overspending in case the numbers are leaked.

Simplified accounting – Transactions are cleanly grouped under assigned virtual cards, enabling precise accounting, tracking, and reconciliation.

All these make the use of virtual credit cards safe and convenient.

Benefits and drawbacks of virtual cards

Virtual payment cards unlock immense advantages but also have some limitations to be aware of:

Benefits

- Stronger security and lower fraud risk

- Greater control over spending limits and validity period

- Protection of permanent card details

- Reduced risk when transacting on unfamiliar sites

- Limit losses due to theft or breaches

- Improved expense tracking and accounting

- Avoid forgotten subscriptions turning into recurring charges

- Easy card issuance for employees and automation

- Some virtual card providers offer cashback rewards or discounts for purchases

Drawbacks

- Cannot be used for offline transactions requiring physical cards

- Temporary card numbers may not be accepted in some scenarios

- Additional step compared to directly using actual payment cards

- Potential lag in setting up new virtual cards on short notice

- Low balance visibility on some providers

The 20 best virtual card providers compared

Choosing the right virtual card platform depends on your business needs and how you plan to use it. Different providers offer features designed for specific purposes, like online shopping, managing team or contractor expenses, balancing security and convenience, or handling international transactions. Most top virtual card services use strong encryption to create secure, temporary cards for each transaction or set period, keeping your personal and financial information safe from fraud.

This comprehensive review compares 20 excellent virtual card providers across essential criteria to match your unique priorities:

1. Wallester

Wallester offers virtual cards for businesses to manage expenses and payments. It allows companies to create cards with Wallester offers virtual cards for businesses to manage expenses and payments. It allows companies to create cards with spending limits and track transactions in real time. Their cards work in multiple currencies and can be added to digital wallets for easy use.

- Issue single-use or reusable cards with controls.

- Track spending instantly through the app.

- Supports payments in various currencies.

- Integrated with Apple Pay and Google Pay.

- A trusted solution for media-buyers managing high-volume ad spend across multiple platforms.

- A practical choice for businesses needing travel cards.

- Ideal for resellers, allowing controlled purchasing while optimizing cash flow.

- Suitable for corporate spending, providing better financial oversight.

- A reliable option for payroll management, offering quick disbursement of salaries.

Why choose: Wallester is a solid choice for companies looking for flexible and secure payment tools. You can access a free demo without registration through the Wallester Business Demo Portal.

2. Revolut

Revolut gives users virtual cards to shop online safely and manage their money. Disposable cards are great for one-time purchases, and their app makes it easy to handle budgets and subscriptions. It also supports multiple currencies.

- Disposable cards for one-time use.

- Works with 28+ currencies at real exchange rates.

- App-based management of cards and expenses.

- No hidden fees for international payments.

Why choose: Revolut is perfect for frequent travelers or anyone wanting better control over their online spending.

3. Wise

Wise is known for its multi-currency accounts and virtual cards. You can pay in over 50 currencies at real exchange rates. It’s a great option for freelancers, businesses, and travelers working across borders.

- Pay or withdraw in multiple currencies.

- Low, transparent fees for transfers.

- Works with Google Pay and Apple Pay.

- Manage spending through the Wise app.

Why choose: Wise makes international payments simple and affordable for users worldwide.

4. Monese

Monese provides virtual cards for people who travel or live abroad. It’s great for families or groups, thanks to its shared account feature. The app also lets you set goals and save for them easily.

- Instant virtual card creation.

- No credit check required for accounts.

- Shared accounts for families or teams.

- Budgeting and savings tools included.

Why choose: Monese is ideal for expats or travelers who need flexible banking options.

5. Monzo

Monzo’s virtual cards make managing group expenses easy. You can split bills, track spending in real time, and save automatically with its app. It’s a user-friendly option for personal or shared finances.

- Customizable spending limits for each card.

- Share expenses with the “tabs” feature.

- Get instant notifications for every purchase.

- Save automatically by rounding up transactions.

Why choose: Monzo is perfect for groups or individuals who want simple tools to manage their money.

6. Skrill

Skrill is created for online shoppers and gamers. It offers virtual cards with no monthly fees and supports cryptocurrency trading. Rewards and cashback programs make it a great choice for frequent users.

- No monthly or foreign transaction fees.

- Supports buying and selling cryptocurrencies.

- Cashback rewards on purchases.

- Easy card management through the app.

Why choose: Skrill is a good pick for people who shop online regularly or trade in cryptocurrencies.

7. iCard

iCard offers virtual Visa debit cards for secure online payments. It’s simple to use and supports multiple cards under one account. There are no extra fees for international purchases.

- Multiple virtual cards for different uses.

- No charges for foreign transactions.

- Desktop and mobile app for easy management.

- Instant issuance for immediate use.

Why choose: iCard is a reliable option for secure and cost-effective online spending.

8. US Unlocked

US Unlocked provides virtual cards linked to U.S. bank accounts, allowing international users to access U.S.-only services like Amazon or Hulu. It makes shopping on American websites simple.

- Cards work with U.S. merchants and subscriptions.

- Supports ACH transfers for added flexibility.

- Easy setup and management through their portal.

- Options for recurring payments.

Why choose: US Unlocked is a great option for anyone needing access to U.S.-specific services.

9. Starling

Starling Bank offers virtual cards that work well for families and individuals. Its app helps users track expenses, set goals, and deposit checks by taking a photo.

- Shared savings accounts for families or groups.

- Youth accounts available for kids and teens.

- Contactless payments with Google and Apple Pay.

- Check deposits through the mobile app.

Why choose: Starling Bank makes money management simple for both families and individuals.

10. Airbase

Airbase provides virtual cards to help businesses control spending and automate expense reports. It’s ideal for finance teams looking to simplify company payments.

- Advanced spending controls for teams.

- Works with accounting platforms like Xero.

- Real-time tracking of transactions.

- Automated expense reporting.

Why choose: Airbase is a great tool for companies managing large-scale expenses.

11. Intergiro

Intergiro focuses on virtual cards for digital marketing and ad expenses. It’s created to help agencies and businesses manage ad budgets easily.

- Integrates with platforms like Google Ads.

- Provides analytics to track spending.

- Allows custom workflows for budgeting.

- Easy creation of multiple cards.

Why choose: Intergiro is a smart choice for marketing teams managing online ad campaigns.

12. PST.net

PST.net provides virtual cards for international business payments. It’s useful for recurring transactions and managing vendor contracts.

- Scheduled payments for easier management.

- Options for wire transfers and ACH payments.

- Strong anti-fraud measures in place.

- Set limits for each card.

Why choose: PST.net is ideal for businesses handling global payments and vendor expenses.

13. Pleo

Pleo simplifies business spending by offering virtual cards for employees. Managers can track expenses in real time, and the app automatically syncs with accounting tools.

- Instant receipt capture through the app.

- Employee-specific spending limits.

- Integration with QuickBooks and Xero.

- Real-time notifications for purchases.

Why choose: Pleo is perfect for companies looking to improve employee expenses.

14. Mesh

Mesh Payments provides virtual cards for growing businesses. Its detailed analytics and customizable spending controls help teams stay on budget.

- Create unlimited cards for different needs.

- Real-time tracking and analysis of expenses.

- Integrates with financial management software.

- Spending limits for better control.

Why choose: Mesh is ideal for startups and companies needing flexible payment options.

15. Stampli

Stampli offers virtual cards that simplify accounts payable processes for businesses. It focuses on automating invoice payments and tracking spending for better financial control. Stampli integrates with popular ERP systems to manage large volumes of transactions efficiently.

- Automates invoice payments and approvals.

- Provides detailed insights into spending by category.

- Works with ERP systems like Oracle and SAP.

- Offers real-time tracking for all transactions.

Why choose: Stampli is a smart choice for businesses looking to improve accounts payable and gain visibility into expenses.

16. Tribal

Tribal is built for enterprises needing a comprehensive spend management platform. It helps businesses manage team expenses with virtual cards and provides tools for global payments. Customizable APIs make it flexible for larger organizations.

- Centralized dashboard to track company expenses.

- Mobile wallet integration for contactless payments.

- Supports payments across multiple currencies.

- Offers APIs for custom integrations.

Why choose: Tribal is perfect for large teams and enterprises requiring centralized financial management tools.

17. Karta

Karta provides virtual cards for startups and fast-growing companies. It helps businesses control spending while offering detailed insights into how money is being used. Karta’s features are scalable, making it a flexible option for growing teams.

- Offers team-specific expense controls.

- Provides category-based spending insights.

- Scalable features suitable for businesses in growth phases.

- Easy card issuance for team members.

Why choose: Karta is a reliable solution for startups looking to keep expenses in check while scaling operations.

18. Extend

Extend is perfect for businesses managing recurring payments and SaaS subscriptions. It allows unlimited virtual card creation and offers tools for controlling subscription costs in real-time.

- Create unlimited cards for flexible payment options.

- Adjust or pause subscription payments instantly.

- Get detailed spending reports for better oversight.

- Ideal for managing multiple SaaS subscriptions.

Why choose: Extend is great for companies handling recurring expenses and subscriptions with ease.

19. Airwallex

Airwallex provides virtual cards linked to multi-currency accounts, making it a favorite for businesses dealing with international payments. It combines competitive foreign exchange rates with an easy-to-use platform.

- Borderless accounts supporting global transactions.

- Low FX fees with competitive exchange rates.

- Syncs with tools like Xero for bookkeeping.

- Offers real-time payment tracking.

Why choose: Airwallex is an excellent choice for businesses that frequently manage international suppliers or payments.

20. Emburse

Emburse combines virtual cards with automated expense reporting for businesses. It allows users to categorize spending easily and integrates with accounting software for smooth financial tracking. OCR receipt scanning makes expense management quick and accurate.

- Automates receipt tracking with OCR technology.

- Categorizes expenses for detailed insights.

- Works with accounting platforms like SAP and QuickBooks.

- Provides group spending management features.

Why choose: Emburse is ideal for companies wanting efficient and accurate expense tracking.

A quick guide on how to use virtual cards

Using virtual cards issued by leading fintech providers generally follows three simple steps:

Step 1: Open your virtual credit card or debit card management dashboard on your computer or mobile app.

Step 2: Generate a new virtual card instantly with defined controls like limits and expiry.

Step 3: Enter the disposable virtual card details at checkout just like a physical card.

Top virtual card providers allow the creation of single-use or multi-use cards in seconds. Virtual card numbers can be auto-filled into online forms using browser extensions. Analytics provide real-time oversight of virtual credit card transactions and spending. The virtual credit card details can be safely stored in services like Apple Pay or Google Pay after one-time use for No-touch payments.

Team cards may be shared securely with predefined limits. Upon first use, be sure to reference the CVV and expiry date which are randomly generated for security.

Virtual card providers – final thoughts

In 2025, virtual cards will become essential for businesses to make secure online payments, manage expenses easily, and stay in control of their finances. Top fintech companies now offer virtual credit, debit, and prepaid cards designed for specific needs, such as managing online ads, paying contractors, handling SaaS subscriptions, or working with global suppliers.

These cards keep your main card details safe and make it easier to track spending. Disposable virtual cards, which can be created with a click, are especially useful for secure, one-time transactions. With virtual cards growing more popular, businesses should explore how these tools can simplify payments, improve accounting processes, and enhance financial security.