Managing ad spend with traditional cards is often slow, messy, and full of limitations. Payments fail without warning, accounts get blocked, and there’s no easy way to separate budgets across platforms or clients. These tools weren’t designed for the pace and structure of modern media buying. This guide looks at a better option: virtual cards built for advertising. We’ll cover how they work, why they solve real problems, and how to use them effectively in day-to-day campaign management.

Key takeaways

- Traditional cards often cause failed payments, blocked accounts, and limited control over ad budgets

- Virtual cards give media buyers precise control over spending and campaign separation

- They work reliably with all major ad platforms, including Google, Facebook, and TikTok

- Wallester lets you create unlimited cards instantly, with real-time limits and detailed tracking

- Multi-BIN access and smart controls help prevent rejections and keep campaigns running smoothly

How did traditional cards fail at online advertising?

Traditional cards were never built for media buying. When you’re managing campaigns across platforms like Google Ads, Facebook, and TikTok, using one or two cards across all accounts quickly leads to trouble.

The most common issue is declined transactions. Ad platforms are sensitive to payment activity, and even a small inconsistency can result in blocked payments or account bans. If several accounts share the same card, a problem with one campaign can end up disrupting everything else.

Another challenge is the lack of visibility and control. With a single card tied to multiple campaigns or clients, it’s hard to know exactly where money is going. You can’t assign limits per campaign or track spend in real time. If something goes over budget, you usually don’t find out until it’s too late.

Scalability is also limited. As your campaigns grow, you’re forced to manage more payments without proper tools. Most traditional cards come with hard monthly caps, so you either need to request more cards, spread spend across different banks, or rely on workarounds that slow things down.

Reporting suffers too. Without clear separation between clients or campaigns, reconciling spend takes hours. You’re left digging through transaction histories, trying to figure out which charges belong to which campaign. None of this fits the needs of modern performance marketing.

Further Reading: European Business Cards for Digital Advertising: 2026 Guide

What are virtual cards?

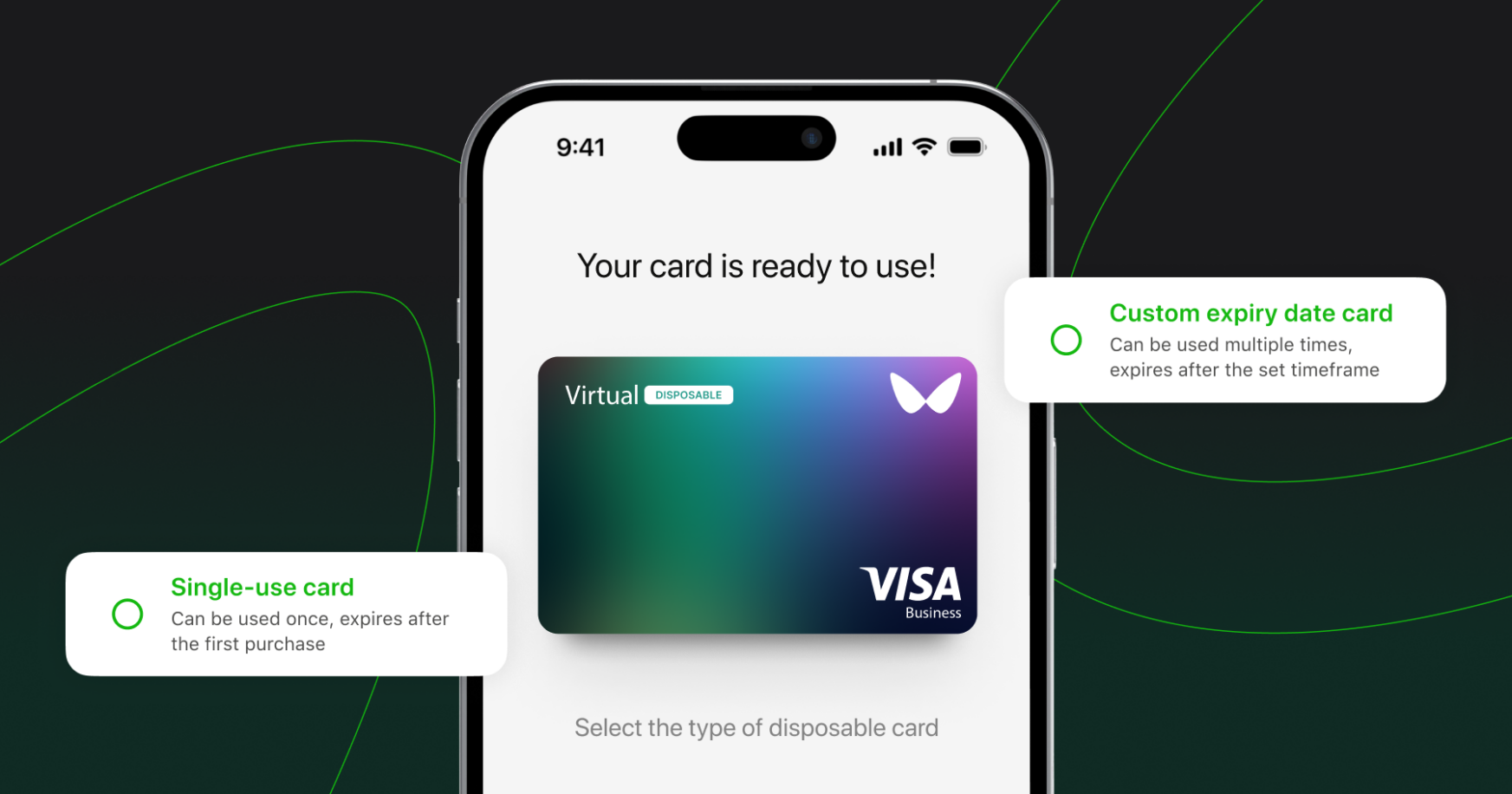

Virtual cards are digital-only payment cards linked to your main account or funding source. They work just like regular credit or debit cards, with a card number, expiry date, and security code, but they exist entirely online. There’s no plastic involved and no need to wait for delivery. You can start using them as soon as they’re created.

These cards are either reusable or made for one-time use, depending on your needs. You can set specific spending limits, choose where they can be used, and control how long they stay active. This flexibility makes them especially useful for advertising, where budgets need to be precise and separated by campaign or client.

You can create as many cards as needed. For example, one for Google Ads, another for Facebook, or separate cards for each team member or client. If a card ever gets blocked or compromised, the rest of your campaigns continue without disruption.

Virtual cards are built for online use, which means they also come with added features. You can limit them to specific websites, adjust limits based on campaign performance, or use them for short-term tests on new platforms. This level of customisation gives you far more control than a physical card ever could.

How do virtual cards work?

Virtual cards are created through payment platforms such as Wallester and linked directly to your main account. When you set one up, the system generates a unique card number, expiry date, and security code. You can start using it immediately for online transactions.

You decide how each card works. That includes where it can be used, how much it can spend, and how long it stays active. Once a transaction is made, the system checks if it meets your rules. If it doesn’t, the payment is blocked automatically.

Here’s how the process typically works:

- Log into the virtual card platform or connect via API

- Set rules such as spending limits, expiry dates, and allowed platforms

- Create the card instantly and assign it to a campaign, client, or team

- Use the card for ad spend like any regular card

- Track transactions and update settings in real time through your dashboard or integrated systems

For larger teams or automated workflows, cards can also be managed through API. This makes it easier to issue cards in bulk, monitor usage, and sync payment data with internal tools.

Each card runs independently, which helps avoid cross-campaign issues and keeps spend clearly separated.

Further Reading: How Virtual Cards Work: The Technology Behind the Solution

Virtual cards for media buyers: use cases

Virtual cards solve several day-to-day problems media buyers face when managing large and complex campaigns. Here are some of the most common and effective ways to use them:

- One card per platform

Assigning a separate card to each ad platform, such as Google Ads, Meta, or TikTo, makes it easier to track spend, monitor performance, and troubleshoot payment issues without affecting other campaigns.

- One card per client

For agencies managing multiple clients, separate cards help keep budgets fully isolated. This simplifies reporting, avoids billing mix-ups, and protects other clients if one account runs into trouble.

- One card per campaign or ad set

Setting up dedicated cards for each campaign or ad set improves budget control. You can cap spending precisely, adjust limits based on performance, and pause or cancel cards as needed without affecting unrelated activity.

- Test campaigns with capped budgets

New platforms or experimental strategies often require cautious spending. Virtual cards allow you to set strict limits on test campaigns, reducing risk while giving you space to explore new channels.

- Emergency backup cards

Ad accounts sometimes get flagged or frozen due to payment issues. Having backup cards ready to go allows you to keep critical campaigns live without delays or lost revenue.

You can also explore other common ways businesses are using virtual cards in Top Use Cases for Virtual Cards in Business.

Benefits of virtual credit cards for media buyers

Virtual cards give media buyers the control and visibility they need to manage ad spend across fast-moving campaigns. Traditional payment methods often fall short, especially when scaling accounts, tracking budgets, or reacting to changes in real time. Virtual cards solve these problems with features built specifically for performance marketing.

- Fewer rejected payments

When each campaign or platform has its own card, there’s less chance of transactions being declined or accounts being flagged. If a card does get blocked, replacing it takes seconds – there’s no need to pause the campaign or contact the bank.

- Better control over ad spend

Each card comes with configurable limits, expiry dates, and merchant restrictions. You can stop a card after it hits £3,000, lock it to a single platform like Meta Ads, or set time-based usage rules. This helps keep every campaign on budget.

- Real-time visibility and tracking

Spending data updates instantly in your dashboard, so you always know how campaigns are performing financially. Every charge is tied to a specific client, team member, or platform, so it’s easy to spot problems or opportunities early.

- Simpler reconciliation and reporting

Clear separation between cards makes end-of-month reporting easier. You no longer need to dig through mixed transaction lists or chase down approvals. Billing clients becomes quicker and more accurate.

- Faster scaling across teams or clients

Need to onboard a new client or spin up a new campaign? Create a dedicated card in seconds, assign it to the right team, and set spending parameters from the start. There’s no waiting period or back-and-forth with banks.

What platforms accept virtual cards?

Virtual cards are widely accepted across all major advertising platforms. Since they’re processed as standard Visa or Mastercard transactions, most platforms treat them the same way as traditional payment methods. Wallester cards are Visa-backed, which guarantees broad compatibility across regions and channels.

- Google Ads.

Google supports virtual cards without any issues. You can assign different cards to separate campaigns or accounts, making it easier to manage budgets and keep billing organised.

- Meta (Facebook and Instagram)

Virtual cards are accepted across Meta’s entire ad network. There’s no need for special setup: cards can be added and used just like regular debit or credit cards.

- TikTok Ads

TikTok processes virtual card payments across all supported countries and campaign formats. This is especially helpful for agencies testing new markets or working with short-form video ads.

- LinkedIn Ads, Microsoft Ads, Snapchat, X (Twitter), Pinterest

All of these platforms use standard payment gateways that work with virtual cards. Compatibility issues are rare, and payments typically go through without delays.

- Amazon Advertising

Both sponsored product campaigns and display ads on Amazon work smoothly with virtual cards. For e-commerce advertisers, this allows tighter control over spend across different product lines or regions.

- Programmatic platforms and DSPs

Most demand-side platforms support virtual card payments, although some may require pre-approval or have specific terms. It’s worth confirming details when planning larger campaigns.

With Wallester virtual cards, media buyers can work confidently across nearly every major platform. Compatibility is strong by default, and rejections are uncommon when cards are properly assigned and verified.

Tips on how to seamlessly integrate virtual cards into your media buying

Introducing virtual cards into your media buying setup works best when you approach it with a clear structure. Rather than replacing everything at once, begin with areas where your current payment system slows you down or creates avoidable problems.

- Start with high-volume or high-priority campaigns

Choose a few campaigns where spend is significant or where issues with traditional cards are most frequent. This gives you a chance to test how virtual cards fit into your workflow and adjust as needed.

- Use clear naming conventions

Label each card based on its purpose – by client, campaign, or ad platform. A consistent naming system makes it easier to stay organised as the number of active cards grows.

- Set up daily spend monitoring

Enable alerts for low balances, failed transactions, or unusual activity. Most platforms, including Wallester, offer these features to help catch problems early without needing constant manual checks.

- Document internal processes

Create a short internal guide that explains how your team should create, assign, and monitor virtual cards.

- Assign cards by team, client, or campaign type

Match your setup to how your business runs. Whether it’s one card per media buyer, one per ad channel, or one per client, structuring card usage around your reporting needs improves clarity and accountability.

- Keep backup cards ready to go

Have a few pre-created cards on hand in case a primary one gets blocked or delayed. This allows campaigns to continue without interruption.

- Start with conservative limits, then scale

Use low limits at first and adjust based on real activity. This approach reduces risk while still giving your team the flexibility they need.

Further Reading: How to Implement Virtual Cards in Your Company

Wallester: unlimited virtual cards for media buyers

Wallester Business gives media buyers the control and flexibility they need to manage ad spend efficiently across platforms and clients. The system supports growing teams and high-volume campaigns without the limitations of traditional payment methods.

- Unlimited cards

You can create as many virtual cards as needed. Each campaign, platform, or client can have a dedicated card, making budgets easier to track and protecting other accounts if one gets flagged.

- Fast issuance

Cards are created instantly and ready to use right away. This is especially helpful when a campaign needs to launch on short notice or when scaling quickly across new ad platforms.

- Smart controls

Set spending limits, expiry dates, and platform restrictions for each card. Cards can be paused or cancelled at any time, giving you full control without needing to contact support or rely on your bank.

- Multi-user access

Wallester supports teams of any size. You can assign different roles and permissions to team members, so each person sees only what they need while managers keep full oversight.

- Custom card naming

Cards can be labelled by client, platform, campaign type, or any system that fits your reporting structure. This makes reconciliation faster and keeps everything clearly organised.

- Real-time spend visibility

All spending data appears in your dashboard as it happens. You can track campaign activity, spot unusual transactions, and download reports without delay or confusion.

What Wallester can do to improve your media buying

Wallester gives media buyers more control, faster decision-making, and better visibility across every campaign. It solves the everyday problems that come with managing multiple budgets, platforms, and clients.

- Clear spend control for every campaign.Each card can be created with its own rules – spend caps, expiry dates, and merchant restrictions. You can match limits to campaign goals and prevent overspending before it happens.

- Live data and instant alerts.The dashboard shows real-time spend across all cards. You can track campaign performance, get alerts when limits are close, and make adjustments before small issues grow into larger ones.

- Faster scaling with no delays.If a campaign starts performing well or a client increases budget, you can create a new card immediately. There’s no need to wait for bank approvals or risk campaign downtime.

- Better control behind the scenes.Wallester simplifies back-office tasks as well. Each card’s data is cleanly separated, which makes reconciliation faster and billing easier to manage. Campaign-specific cards also reduce the risk of fraud or accidental spend.

- Built for automation and flexibility.The platform integrates with your existing systems through API. You can automate card creation, sync spend data with reporting tools, and keep everything consistent across teams and platforms.

- Support for multiple BINs.If one card range runs into issues on a platform, you can switch to another. This helps avoid rejections, keep ads running smoothly, and maintain a stable payment setup as you grow.

Further Reading: What Is a Virtual Card – and Why Media Buyers Need One Now

Case studies

- Performance agency cuts failed transactions by 90%

A digital agency managing ad spend across Meta, Google, and TikTok was facing constant issues with blocked payments and flagged accounts. Shared cards made it difficult to isolate problems or track campaign-level spend. After switching to Wallester, the team created separate virtual cards for each client and platform. Within a few weeks, rejected transactions dropped by 90%, and the team was able to manage budgets more accurately with far less manual oversight.

- Global brand maintains uninterrupted campaign flow

A travel company running over 40 active ad campaigns in multiple regions struggled with budget tracking and sudden payment blocks. Using Wallester’s multi-currency virtual cards, they assigned one card per campaign and activated real-time alerts. The result: zero campaign downtime due to payment issues, simpler reconciliation at the end of each billing cycle, and faster adjustments when campaigns needed scaling.

Streamline your media buying strategy with Wallester

Managing ad spend across multiple platforms doesn’t have to be complicated. Wallester gives media buyers a clear, flexible system that simplifies payments without slowing anything down. You can issue cards in seconds, assign them to the right campaigns or clients, and track every transaction as it happens.

There’s no need to overhaul your workflows. Wallester fits into what you’re already doing – only with more control, better tracking, and fewer delays. Teams stay focused on performance instead of fixing payment issues or chasing down missing data.

Getting started is simple. Setup takes minutes, and onboarding is quick for teams of any size. If you’re ready to bring more structure and visibility to your media buying, Wallester is built for that. Try it now or reach out to learn more.