Regularly updating the cash book upon receiving payment helps in minimizing discrepancies caused by unpresented cheques and outstanding lodgements, aligning the recorded transactions with the actual bank balance. These situations represent timing gaps between transactions occurring versus clearing through the banking system. By adjusting for deposits not yet credited and cheques not yet deducted, businesses can accurately match internal cash records to the bank statement. This article explains what outstanding lodgements are and why they matter for precise financial reporting and fraud prevention.

What is an outstanding lodgement in accounting?

An outstanding lodgement, also termed an uncleared deposit, refers to any funds paid into bank accounts that have not yet been officially credited and reflected on the corresponding bank statement as of the cut-off date. This situation, often resulting from unpresented cheques and outstanding lodgements, can cause a discrepancy in the bank balance until the transaction is processed and properly accounted for. Identifying these transactions is important for maintaining an accurate record of all banking activities and ensuring that the bank balance truly represents the available funds.

For example, if a business makes a cash or cheque deposit on the very last day of the month, but the statement period technically ends the previous day, that deposit will be an outstanding lodgement. It is in the process of transiting through the banking system but has not yet been posted to the statement balance at the closing date.

How to deal with unpresented cheques?

In the context of bank reconciliation, understanding the implications of unpresented cheques and outstanding lodgements is important for achieving an accurate cash book balance. Unpresented cheques involve cheques written by the account holder before the bank statement cut-off, but still pending clearance through the banking channels and not yet cashed by the payee. Unpresented cheques also require adjustment during reconciliation to pinpoint the true account balance. To address them, compile a listing of all cheque numbers and amounts drafted before the statement end date but absent from the deductions shown on that particular statement. Subtract the collective sum of these unpresented cheques from the balance.

In addition to unpresented cheques, a business must also monitor outstanding payments – transactions authorized but not yet deducted from the bank account. These payments, similar to outstanding lodgements, impact the reconciliation process by affecting the cash book balance. Identifying outstanding payments is necessary for ensuring the accuracy of financial statements, as it helps in distinguishing between the timing differences of various transactions and the actual available balance.

Effective financial management involves establishing protocols to pay out and reconcile transactions promptly, which aids in accurately tracking and reflecting all financial activities within the company’s records. It is considered best practice to regularly monitor and reconcile unpresented cheques and outstanding lodgements to ensure that each payment is accounted for promptly and that the bank balance accurately reflects all transactions, including those not yet processed by the bank.

How does an unpresented cheque affect a balance sheet?

Unpresented cheques reduce the cash amount visible on the bank statements but initially have no bearing on the company’s accounting records. This variance between the statement balance and cash book tally must be reconciled. On the balance sheet, unpresented cheques indicate the bank account asset is temporarily inflated while accounts payable are understated, until the cheques are ultimately clear in the following period. The presence of unpresented cheques also means certain cash receipts are not yet reflected in the bank statement.

What’s the difference between outstanding lodgements and unpresented cheques?

The primary distinction is that outstanding lodgements constitute funds deposited into the account but not yet evident on the bank statement, whereas unpresented cheques are written by the account holder and still unrecorded. When reconciling, outstanding lodgements lift the true account balance compared to the statement, while unpresented cheques lower the real balance.

What’s the difference between an uncredited cheque and an unpresented cheque?

An uncredited cheque is an alternate terminology for an outstanding lodgement or deposit – money paid into the account but not yet officially credited at the statement date. Conversely, an unpresented cheque is one drafted by the account holder to a recipient that remains unprocessed and not yet deducted from their account. It’s important to note that an uncredited cheque refers to a deposit, while an unpresented cheque is one written by the account holder.

Differences between the cash book and the bank statement

Typically the balance indicated in the company’s cash book fails to match the bank statement tally due to:

Errors in the cash book

Common cash book mistakes like omitted or duplicate entries, number transpositions, and incorrect amounts recorded. A £500 deposit is logged as £505 for instance. These errors generate discrepancies that reconciliation must identify and fix. Proper record keeping and double-checking when making cash book entries can help minimize such errors.

Errors in the bank statement

Banks may also make processing errors that appear on the statement, such as showing incorrect deposit or withdrawal amounts or duplicating transaction entries. The company should spot unlikely or duplicated items, and then notify the bank to correct them.

Unrecorded items

Cash transactions like ATM withdrawals or electronic payments conducted but not yet logged in the company’s books will differ from the statement. These unrecorded activities must be pinpointed and entered.

Timing differences

Lags between transactions happening and recording in the cash book, often from paperwork delays, produce timing gaps between company records and the statement. Reconciling by comparing dates can match up transactions.

Unpresented or outstanding cheques

Cheques issued in one period but still unbanked and unsettled by the recipient at statement cut-off become unpresented cheques. These must be itemized and deducted from the balance.

Outstanding receipts and payments

Anticipated deposits or debits like standing orders and direct debits with pre-statement transaction dates that remain unprocessed will also cause variances needing adjustment.

Outstanding deposits/lodgements

Any deposits made on the final statement day or shortly prior still awaiting clearance and credit at closing constitute outstanding lodgements to be added to the balance.

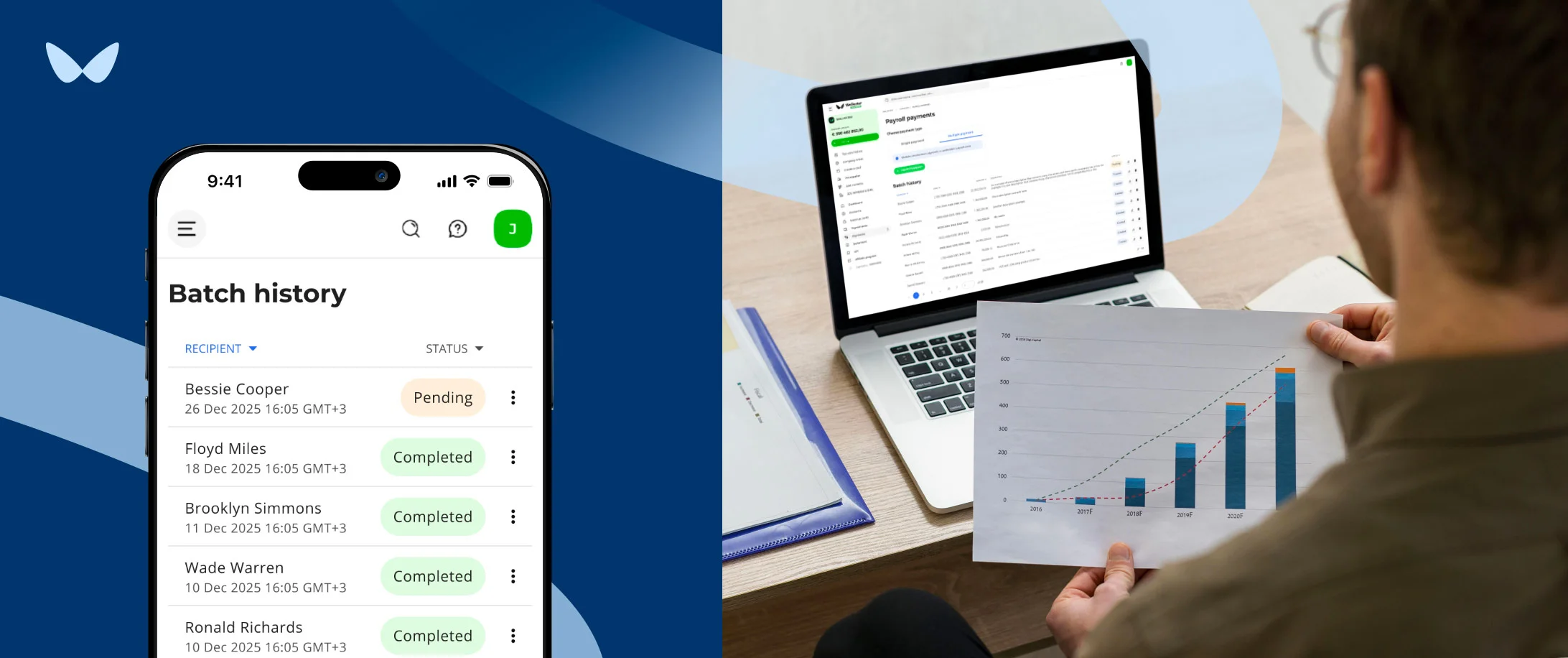

Supporting accurate reconciliation with Wallester

Reconciling outstanding lodgements and unpresented cheques requires timely and reliable financial management tools. Wallester offers services that assist businesses in managing payment cycles effectively. Their platform provides real-time transaction tracking and automated reconciliation, reducing errors related to timing differences between recorded payments and bank statement balances. By using Wallester’s solutions, businesses can keep their cash book aligned with actual bank data, minimizing discrepancies and providing smoother financial control processes.

Conclusion

Appropriately identifying outstanding lodgements and unpresented cheques is imperative for accurate bank reconciliations. Modifying for these timing discrepancies ensures alignment of the cash records to the statement, satisfying reporting standards while also reducing potential errors or fraud. Careful bank reconciliation of outstanding items is fundamental to robust cash management and financial control.