Managing company expenses effectively is important for any business operation. Prepaid business cards offer a practical solution for controlling spending while maintaining flexibility in day-to-day transactions. These cards provide businesses with a secure way to handle expenses, manage employee spending, and keep track of financial operations without the need for traditional credit facilities or extensive banking relationships. For companies seeking better financial control, prepaid business expense cards represent an increasingly popular choice in the UK market.

What is a prepaid business card?

A prepaid business card works similarly to standard debit cards but with additional business-focused features. Unlike business credit cards or company credit cards, these cards can only be used up to the amount loaded onto them. Traditional debit cards, by contrast, are directly linked to a business account, while prepaid ones operate independently, allowing businesses to allocate specific funds for designated purposes. They function as a specialized expense card that helps maintain control over their finances while giving employees the freedom to make necessary purchases.

The primary difference from regular business bank accounts is that a prepaid card doesn’t require a credit check or extensive financial history to obtain. This makes them particularly attractive for new businesses or those looking to establish their credit rating. Most prepaid cards come with reliable expense management tools and accounting integrations that help track spending efficiently.

Business prepaid cards work as a bridge between traditional payment services and modern financial needs. They offer businesses the ability to manage expenses without the complexity of multiple business accounts or the risk associated with credit facilities. Many providers now offer both physical card and virtual cards options, giving businesses flexibility in how they handle payments and manage business spend.

How does a prepaid business card work?

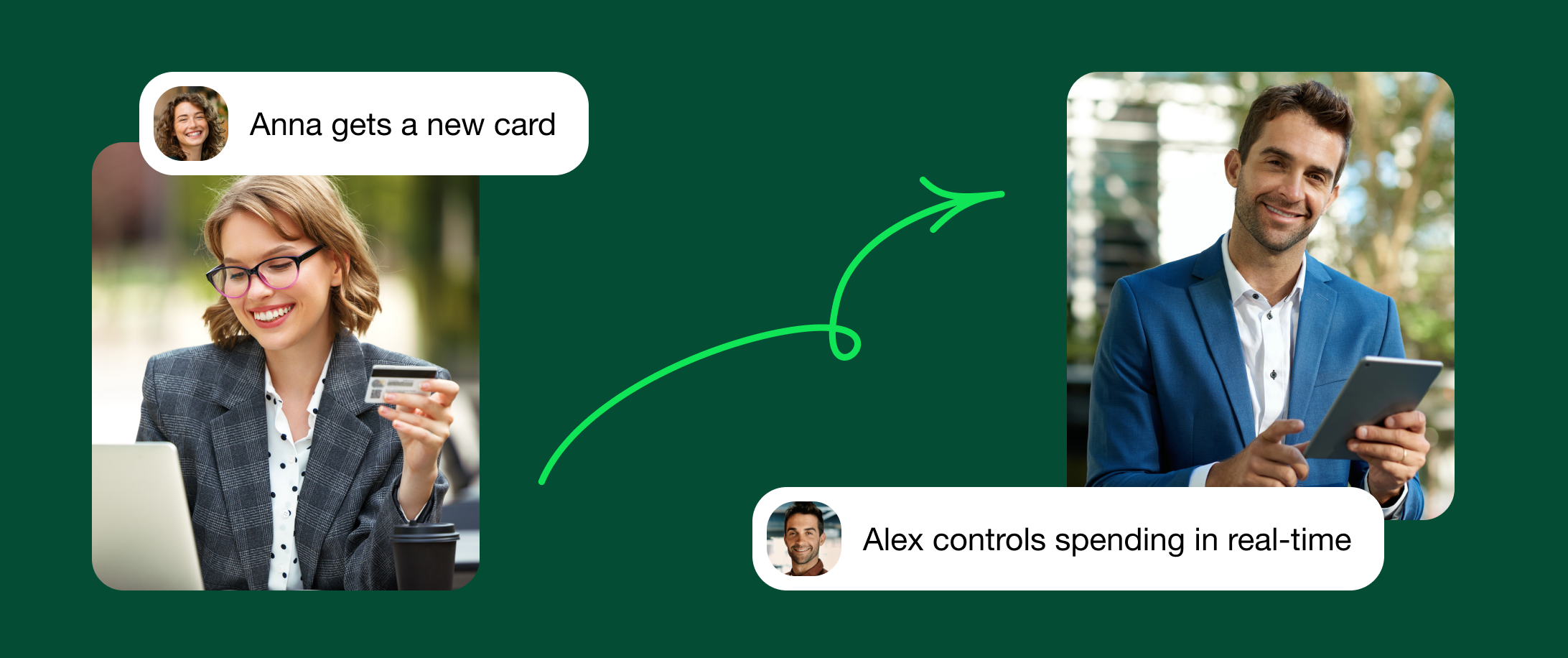

When you open a prepaid business account, you receive a physical card that can be loaded with funds from your company wallet or business account. Prepaid cards can be conveniently loaded online, offering businesses a quick and efficient way to manage employee expenses in real-time. With these cards, companies can instantly send money to employees, ensuring quick access to funds for necessary expenses. By allocating company money, prepaid expense cards provide a flexible and secure way to manage business finances without relying on traditional credit facilities. The process typically starts with transferring money to the card through just a few clicks in an online portal. Many providers also offer virtual cards for added flexibility in managing digital payments and business expenses.

You can set spending limits for each card and monitor transactions in real-time through dedicated apps. These cards support both domestic transactions and international payments, though some may charge a foreign exchange fee for overseas use. Most modern prepaid business cards integrate with Google Pay and Apple Pay for convenient mobile payments, making them ideal for employees who prefer digital payment methods.

The cards can be used for ATM cash withdrawals, online purchases, and standard card payments at merchants worldwide. Many providers offer free top ups and the ability to load multiple currencies, making them ideal for businesses with international operations. Some services even provide accounting software integration to streamline expense tracking and simplify reconciliation processes.

Business prepaid cards typically come with management tools that let you capture receipts directly through a mobile app, and it makes expense reporting much simpler. You can track employee spend in real-time and adjust individual spending limits as needed. The best prepaid card also offers features like automated categorization of expenses and integration with popular accounting platforms.

When are prepaid business cards useful?

Prepaid cards prove particularly valuable for managing business expenses in various scenarios. Small businesses often use them to control how employees spend money without opening multiple business bank accounts. By functioning as a dedicated expense card, it simplifies the process of tracking and managing company spending. The cards are excellent tools for business trips, allowing companies to provide staff with specific amounts for travel expenses while maintaining oversight of spending.

These cards work well for companies that need to delegate purchasing power to employees while keeping tight control over budgets. The ability to set individual spending limits makes them perfect for managing team’s expenses across different departments or projects. They are also useful for large and small businesses that want to separate specific expense categories from their main business account.

For companies dealing with international transactions, a prepaid card offers competitive exchange rates and the convenience of multiple currencies. They help reduce the risk of expense fraud and simplify the process of capturing receipts and reconciling expenses. Prepaid corporate cards are particularly useful for businesses that want to maintain strict control over their finances without limiting operational flexibility.

The cards excel in situations where traditional business accounts or company credit cards might be impractical or risky. They are ideal for managing recurring expenses, controlling subscription payments, and handling emergency purchases. Many businesses use them to set up separate funds for marketing expenses, office supplies, or team events.

Choosing prepaid business cards

Selecting the right prepaid card requires careful consideration of several factors. Look for providers offering comprehensive expense management features and strong accounting integrations. The best prepaid business cards typically come with minimal account fees and transparent pricing structures.

Consider whether you need features like unlimited cards for your team, the ability to withdraw cash from ATMs, or support for international payments. Some providers offer additional benefits like cashback on eligible transactions or specialized expense tracking tools through their app. The ability to load multiple currencies can be essential for businesses operating internationally.

Check if the banking provider supports integration with your existing accounting software and what kind of customer support they offer. The minimum fee structure and any charges for cash withdrawal or foreign transactions should also factor into your decision. Pay attention to whether the provider offers free top ups and what limits might apply to card loading.

Look for services that provide strong security features and clear visibility of all transactions. The best providers offer instant notifications for card usage, the ability to freeze cards immediately if needed, and detailed reporting tools. Consider whether the service includes features like receipt capture and expense categorization that can save time on administrative tasks.

What are the benefits and drawbacks of using prepaid business cards?

Managing company operations effectively requires financial tools that are both practical and flexible. Prepaid cards are exactly the solution, which has become a popular choice for businesses of all sizes. As these cards are not tied to traditional credit systems, it makes them an accessible option for startups and small enterprises. Offering improved control over expenditures, they empower businesses to streamline financial management without overextending their resources.

However, like any financial product, the cards come with both benefits and drawbacks. Understanding these aspects in greater detail can help businesses make informed decisions about whether this tool aligns with their operational needs.

Benefits:

Prepaid cards offer many features aimed to simplify company spending while improving control over allocated budgets. Here are some of the most notable benefits:

- Enhanced accessibility

Since they don’t require credit checks or extensive financial histories, these cards are accessible to businesses that may not qualify for traditional credit facilities. This is especially advantageous for new ventures and small companies looking to establish their footing in the financial world. - Customizable spending controls

With the ability to set individual limits for cardholders, companies can ensure that employees spend only within the allocated amounts. This feature is particularly useful for delegating spending power without risking budget overruns. - Real-time monitoring

Modern prepaid solutions come with apps or online platforms that allow businesses to monitor transactions as they happen. This transparency makes it easier to keep an eye on daily spending and identify potential issues promptly. - Fraud protection

Unlike traditional accounts, funds on these cards are limited to preloaded amounts, reducing the risk of significant financial loss in the event of fraud or unauthorized transactions. Many cards offer features like instant freezing and transaction notifications for added security. - Ease of use in global transactions

Many cards support payments in multiple currencies and offer competitive exchange rates, making them an excellent tool for businesses with international operations. This eliminates the hassle of dealing with cash or currency conversion while traveling or conducting overseas business. - Simplified expense reporting

Some cards come with integrated receipt-capture tools and automatic expense categorization, significantly reducing the time spent on manual reconciliation. These features are particularly valuable for teams on the go, such as sales personnel or project managers. - Cost-effective alternative

Compared to other financial tools, prepaid cards often have lower associated costs. They eliminate interest charges and the complexities of credit management, providing a straightforward solution for daily operations. Unlike traditional company cards, which often come with credit checks and high fees, prepaid cards provide a cost-effective alternative for managing expenses.

Drawbacks:

While prepaid cards come with numerous benefits, it’s essential to be aware of their limitations. Depending on the provider, businesses may encounter the following challenges:

- Ongoing fees

Many cards come with monthly maintenance charges or transaction fees. While these fees are often minimal, they can add up over time, particularly for businesses using multiple cards. - Limited features

Not all cards offer advanced integrations or comprehensive management tools. This could pose challenges for companies with more complex financial needs or those seeking full automation in their expense tracking. - Cash withdrawal restrictions

Although some prepaid solutions allow ATM withdrawals, providers may impose limits or additional fees on these transactions. This can be inconvenient for businesses that require ready access to cash. - Foreign transaction costs

While cards designed for international use may offer competitive rates, others charge significant fees for cross-border transactions. Businesses engaging in frequent international dealings should consider this factor carefully. - Inflexibility with unexpected expenses

Unlike credit-based options, prepaid cards are restricted to the loaded balance. In emergencies or unplanned situations, businesses may find this lack of flexibility problematic. - Cost of additional cards

Some providers charge for issuing extra cards, which can be a concern for larger teams or businesses with multiple departments needing access to funds. - Compatibility issues

Prepaid cards may not integrate seamlessly with all accounting software or business systems, creating additional manual work for finance teams.

While no financial tool is perfect, prepaid cards strike a balance between cost-effectiveness and ease of use. For businesses focused on strict budget control and transparent spending, the advantages often outweigh the limitations. However, companies should evaluate their unique needs to determine if these cards align with their financial strategies.

A key factor in deciding whether to adopt this solution is the provider’s offerings. Businesses should research options thoroughly, comparing features such as fee structures, integration capabilities, and additional tools like spending analytics. Opting for a service that matches operational requirements can maximize the benefits while minimizing drawbacks.

One of the most significant advantages of this solution is its adaptability. Whether for managing travel budgets, handling department-specific costs, or controlling project expenditures, these cards provide a versatile way to meet diverse business needs. For small businesses, they offer an accessible entry point into more sophisticated financial management. For larger organizations, they act as a supplementary tool for streamlining specific processes.

When combined with sound financial planning, prepaid solutions can become a base of effective expense management. By understanding the benefits and limitations, businesses can make choices that empower growth, provide accountability, and maintain operational efficiency.

What are alternatives to prepaid business cards?

Traditional business accounts remain a popular alternative, offering comprehensive banking services and often including debit cards as standard. Business credit cards provide another option, especially for companies seeking credit facilities and rewards programs.

Corporate cards from established financial institutions might suit larger organizations with more complex needs. These typically offer higher spending limits and more sophisticated expense management tools, though they usually require a strong credit rating.

Virtual cards are gaining popularity as a digital-only alternative, particularly for online purchases and subscription management. Some businesses also opt for expense management platforms that combine various payment methods with advanced tracking features.

Prepaid business cards vs. Business credit cards

Prepaid cards and business credit cards serve different needs. Business credit cards require a credit check and often a personal guarantee, while a prepaid card doesn’t affect your credit rating. Prepaid cards limit spending to loaded funds, whereas credit cards provide a credit facility with predetermined limits.

Business credit cards typically offer rewards programs and cashback benefits but come with interest charges on unpaid balances. Prepaid cards charge upfront fees but have no interest payments since you are using your own cash. Credit cards might offer better purchase protection, while a prepaid card excels at expense control.

The choice between them often depends on your business finances, credit history, and specific needs for expense management. Some companies use both: credit cards for major purchases and business prepaid cards for day-to-day employee expenses.

What is the best prepaid card for business?

Several providers offer outstanding business prepaid cards with varying features. Top contenders typically provide strong expense management tools, reasonable fees, and good accounting integrations. The best prepaid business cards are those that suit your specific business needs and usage patterns.

Look for cards offering free top ups, competitive foreign exchange rates, and useful features like receipt capture and expense categorization. Some providers stand out by offering unlimited virtual cards or specialized tools for managing team expenses.

Consider providers that offer both physical and virtual cards, support for Google Pay and Apple Pay, and comprehensive reporting tools. The ability to integrate with popular accounting software can save significant time in managing business finances.

How much does a prepaid card for business cost?

Costs vary between providers but typically include several components. Typically, fees start at a low monthly rate, making cards an affordable option for companies of all sizes. Basic account fees might range from free to several pounds monthly per card. Some providers charge for ATM withdrawals or international transactions, while others include these services in their base fee.

Additional costs might apply for extra physical cards, though virtual cards are often unlimited. Watch for foreign exchange fees if you make international payments regularly. Some services charge for features like accounting integrations or advanced expense management tools.

Many providers offer tiered pricing based on the number of cards and features needed. Compare the total cost including all necessary features rather than just the basic account fee to find the best value for your business needs.

How much money can I put on a prepaid card for business?

Loading limits vary by provider and account type. Most cards allow significant amounts to be loaded, often tens or hundreds of thousands of pounds. The maximum balance and loading frequency depend on your chosen service and business verification level.

Many providers offer flexible top-up options, allowing additional funds to be added as needed. Some services provide free top ups up to certain limits, with fees applying beyond those thresholds. Consider whether the loading limits align with your typical business spend when choosing a provider.

Checking both minimum and maximum loading amounts is important, as some services require minimum balances or have caps on individual loads. The ability to quickly add funds when needed can be important for managing business expenses effectively.

Wallester Prepaid Business Cards

Wallester offers comprehensive business prepaid cards designed for modern company needs. Their solution includes both physical and virtual cards, with strong expense management features and accounting integrations. The platform provides real-time transaction monitoring and flexible spending controls.

Users can manage multiple cards through a single dashboard, setting individual spending limits for different employees or departments. The service supports international transactions and offers competitive exchange rates for foreign payments. Integration with major accounting software helps streamline expense tracking and reporting.

Security features include instant card freezing and advanced fraud protection measures. The platform offers detailed spending analytics and custom reports to help businesses optimize their expense management processes.