Most ERP platforms are closer to fintech than they realise. Their users already handle payments, manage invoices, reconcile accounts, and monitor expenses, yet every transaction still occurs elsewhere. The next evolution for ERPs is clear: bring payments inside the platform.

That shift used to mean years of development, complex compliance processes, and banking partnerships. Now it can happen in weeks through a few clean API calls to Wallester’s licensed, developer-first infrastructure.

Why ERPs Are Adding Embedded Payments

Business users expect more from their ERP tools. They want to pay suppliers instantly, issue virtual cards to employees, and manage spend in real time – without switching to external banking apps.

ERPs that provide these features don’t just improve user experience. They create entirely new revenue streams through transaction fees, premium tiers, and increased customer stickiness.

The barrier has always been the same: regulation and infrastructure. Building a compliant card-issuing system from scratch is a multi-year project involving Visa or Mastercard certification, KYC/AML procedures, and integration with payment processors.

Wallester changes that.

One Integration — Full Fintech Functionality

Wallester provides a complete card-issuing and payment platform ready to embed inside any ERP or SaaS environment.

Through REST APIs, developers can integrate everything from card creation to transaction monitoring in a modular, scalable way.

How It Works

1. Connect via REST API

Start with Wallester’s RESTful API endpoints to create and manage card programs directly within your ERP. Authentication is handled securely through token-based access, and detailed documentation ensures a smooth onboarding process.

Example call:*

POST /api/v1/cards

{

“type”: “virtual”,

“currency”: “EUR”,

“limit”: 5000,

“user_id”: “12345”

}

*These are examples only, actual API calls may differ

This single call can issue a virtual Visa card instantly — linked to your ERP user or department.

2. Add Smart Controls

Set spending limits, merchant whitelists, or usage rules directly from your ERP interface.

Wallester’s APIs make it easy to sync those parameters with your existing roles, permissions, or project codes.

Example call:

PATCH /api/v1/cards/12345

{

“spend_limit”: 3000,

“allowed_merchants”: [“Google Ads”, “AWS”, “HubSpot”]

}

3. Monitor and Reconcile Transactions

Real-time transaction data can flow directly into your ERP’s reporting and accounting modules.

This enables instant reconciliation and eliminates manual data imports.

Use Cases for ERPs

1. Virtual Cards for Expense Control

Finance teams can issue virtual cards to employees for travel, subscriptions, or project expenses – all directly from the ERP.

Each card can have specific limits and categories, ensuring complete visibility and compliance.

2. Supplier Payments

Automate vendor payments through instant virtual or physical card transactions, streamlining procurement and removing dependency on external bank accounts.

3. Client Wallet Systems

Offer stored-value or wallet functionality to your ERP users, enabling them to fund accounts, issue cards, or manage internal budgets – securely and under Wallester’s license.

Bypass Compliance Burden Entirely

Wallester operates under its own EU-issued Visa license, covering all card-issuing, AML/KYC, and reporting requirements.

That means your ERP never needs to become a regulated financial institution.

You focus on building product features and user experience – Wallester handles the legal and operational complexity.

No banking license. No compliance department. No delays.

Scale Instantly — No Limits

Whether you’re onboarding your first 100 users or issuing thousands of cards per client, Wallester’s architecture scales seamlessly.

- Unlimited cards: Issue thousands of Visa virtual or physical cards instantly.

- Multicurrency support: Operate across currencies and regions with a single integration.

- Real-time controls: Freeze, adjust, or reassign cards instantly.

- Whitelisting and restrictions: Allow or block merchants by category or region.

- Flexible BIN options: Use Wallester’s European BIN or request a custom setup for brand consistency.

All features are accessible via the same unified API layer — no extra integrations required.

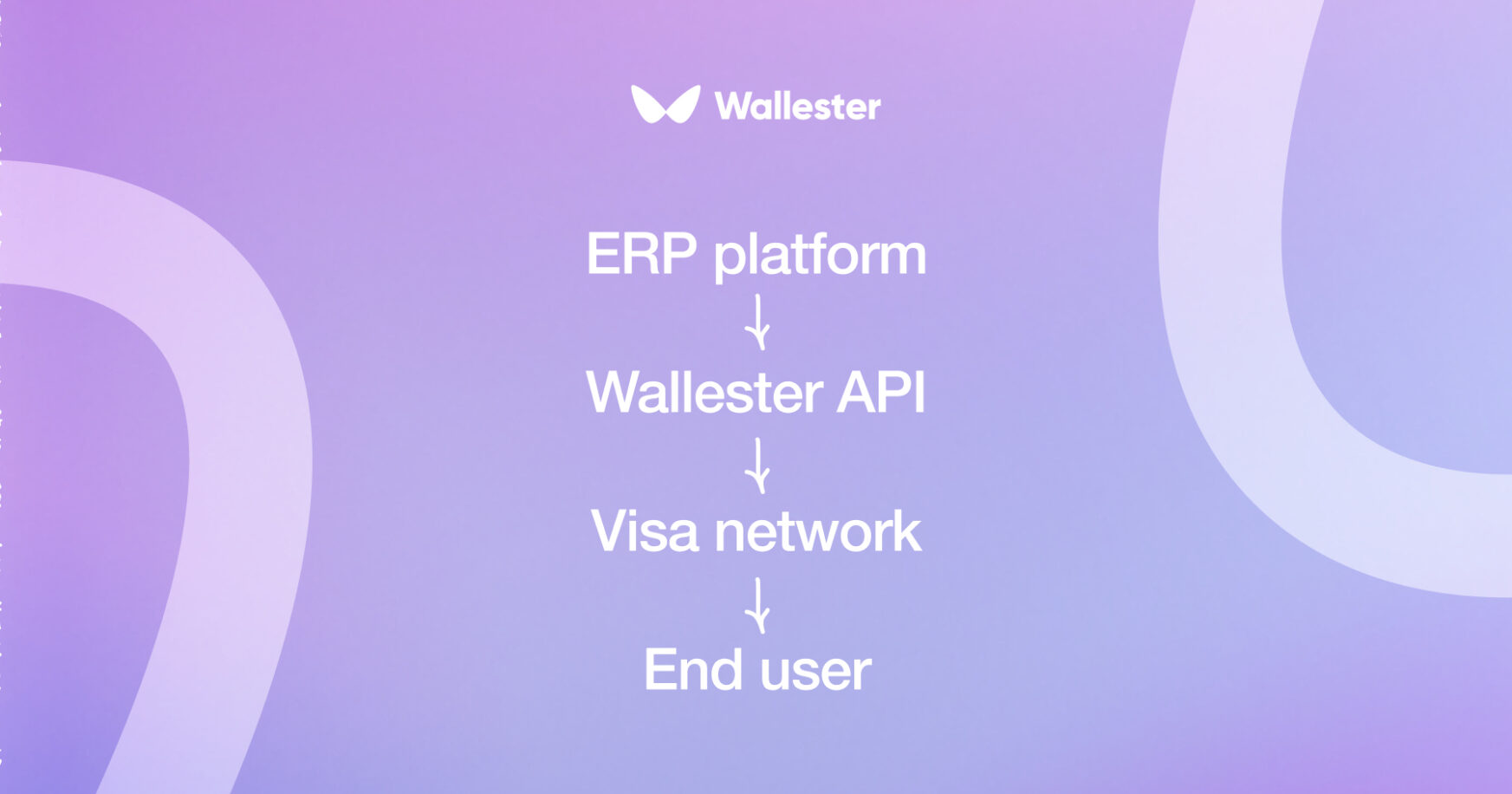

What the Integration Looks Like

This flow shows how your ERP interacts with Wallester’s API to issue and manage cards, while Wallester manages the compliance and Visa network connectivity in the background.

From your user’s perspective, everything happens inside your ERP — smooth, instant, and branded.

Launch in Weeks, Not Months

Typical financial integrations can take 6–12 months to reach production. With Wallester, ERPs can launch a live card program in under 30 days.

Our onboarding process includes:

- Sandbox testing environment.

- Dedicated integration support.

- Compliance setup handled end-to-end.

Once connected, your ERP can issue, fund, and manage cards immediately.

Start Building Today

Your users are already managing finance through your platform. Now you can give them the financial tools to act — securely and seamlessly.Transform your ERP from a management system into a fintech platform.

Integrate Visa card issuing and embedded payments with just a few API calls.