Managing company expenses can become complex when contract employees are involved. Traditional methods, such as reimbursements, often cause delays, lead to paperwork overload, and create issues with tracking business spending. An expense card specifically designed for contract employees offers a solution that simplifies these processes. By providing immediate access to company funds, better control over spending limits, and improved tracking capabilities, these cards improve efficiency for both employees and employers.

What is a business expense card for contract employees?

A business payment card is a payment tool provided by a company to employees or contractors to cover business-related expenses. These cards eliminate the need for employees to use their own money and then seek reimbursement. They are integrated into cost management systems, allowing real-time expense tracking and better oversight of approved spending categories such as travel, office supplies, and other recurring payments.

For contract employees, these cards provide the flexibility to handle business purchases without delays or the burden of collecting receipts for later claims. Businesses can choose between two main types of cards – corporate credit cards and prepaid cards – depending on their needs.

Corporate credit cards

Corporate credit cards are issued under the company’s credit account and allow contractors to make approved purchases. They are beneficial for organizations with frequent business travel or larger expenses since they offer higher credit limits. Employers maintain control by setting individual spending limits and monitoring employee expenses through detailed transaction reports. Corporate cards often require businesses to meet certain financial criteria and may come with annual fees.

Finance teams appreciate corporate credit cards for their ability to centralize business expenses. These cards reduce the need to manually account for recurring payments, such as software subscriptions and vendor services. They also provide businesses with a simplified expense reporting process, improving cash flow management.

Prepaid cards

Prepaid cards operate differently by limiting spending to the amount loaded on the card. These cards offer better control for companies with smaller budgets or temporary projects, as employees cannot exceed the pre-set balance. Prepaid expense cards are commonly used by businesses that prioritize predictable spending and want to avoid risks associated with credit.

Many companies find prepaid debit cards ideal for contractors since they allow precise allocation of funds based on project needs. Real-time transaction monitoring gives finance teams visibility over business expenses, helping them track employee spending and prevent unauthorized transactions.

How does an expense card work?

This card works by linking company funds to a card that is issued to authorized employees or contract workers. Employers set spending limits, approved expense categories, and real-time transaction monitoring. Once a cardholder makes a purchase, the transaction data is automatically sent to the company’s software.

This process removes the need for manual reimbursement claims. Contractors can use the card for business-related expenses without waiting for approvals or payments. Additionally, many providers offer mobile apps for capturing receipts, simplifying the expense reporting process.

Employee expense cards also allow companies to maintain control over their spending policies by restricting purchases that fall outside approved business expenses.

Why an expense card for contract employees is important in expense management

These cards are particularly beneficial when managing a remote or project-based workforce. Contractors often face delays when using personal funds for business-related purchases, which can disrupt workflows. By providing a direct payment solution, companies can eliminate these delays and improve operational efficiency.

Businesses also gain better control over employee spending. The cards provide real-time tracking, allowing finance teams to monitor and analyze business spending across multiple contractors or departments. This visibility is important for maintaining cash flow and making sure that only approved expenses are charged to the company account.

Additionally, employee expense cards reduce administrative tasks, such as processing reimbursements and collecting paper receipts. Automated transaction syncing between cards and accounting software improves overall financial management.

Key benefits of using expense cards

Employee expense cards offer a practical solution for managing business expenses, reducing reliance on reimbursements, and improving financial oversight. By eliminating the need for employees to use personal funds for work-related purchases, companies can create a more efficient and transparent expense management system. These cards simplify transaction tracking, helping businesses maintain accurate records while reducing the risk of errors and unauthorized spending.

For the employers

Expense cards provide employers with increased oversight and reduced administrative burdens. With real-time tracking, finance teams can identify spending trends and monitor transactions as they occur. Customizable limits and restrictions on spending categories allow employers to maintain better control over company funds.

Additionally, automated reporting tools save time spent on paperwork. Businesses no longer need to verify receipts manually, process reimbursement claims, or chase employees for missing documentation. This efficiency supports improved cash flow and resource allocation.

For the contract employees

For contractors, the solution offers immediate access to funds for approved business purchases. This eliminates the need to use personal credit or cash, which can be particularly important for travel or high-cost project expenses.

Many expense card providers also offer mobile apps that allow employees to easily capture receipts and categorize expenses in real-time. This reduces the hassle of keeping physical receipts and speeds up the expense reporting process. Ultimately, these cards help contractors focus on their work without financial distractions.

Challenges in using expense cards for contract work

Despite their advantages, the cards can present challenges if not managed properly. Companies must establish clear policies regarding spending limits, approved expenses, and reporting procedures. Without proper guidelines, employees may inadvertently make unauthorized purchases.

Another challenge is maintaining accurate records. Businesses need regular oversight from finance teams to reconcile discrepancies between card transactions and accounting data. Integrating the cards with existing cost management software may require technical adjustments, particularly for larger companies with complex financial systems.

Regular training and audits can help mitigate these risks, making sure that both employees and management follow the company’s expense policies effectively.

What is the best time to choose a corporate credit card?

A corporate credit card is most beneficial for companies that handle recurring expenses, large purchases, or frequent travel. These cards provide flexibility through higher credit limits and are suited to businesses with stable cash flow. Organizations that need to consolidate spending across multiple departments often rely on business credit cards for better financial management.

Before choosing a corporate credit card, businesses should evaluate factors such as interest rates, repayment terms, and cardholder fees. Companies with irregular spending patterns or limited credit may find prepaid cards more practical for certain use cases.

Factors to consider when choosing the right expense card provider

Selecting the right expense card provider involves assessing various factors based on the company’s needs. These include:

- Spending controls. Providers should offer customizable spending limits and transaction restrictions to manage employee expenses effectively.

- Expense management software integration. Integration capabilities allow for automated transaction syncing and real-time expense reporting.

- Fee structure. Compare providers to identify hidden costs such as transaction fees, foreign exchange fees, and annual charges.

- Security features. Providers should offer real-time transaction monitoring and fraud prevention measures, such as virtual cards.

- Flexibility. Some providers offer both virtual and physical cards, allowing businesses to handle both online and in-person transactions seamlessly.

The best expense cards for contract employees

Choosing the right expense card can make a significant difference for contract workers, offering them flexibility, convenience, and better financial management. The ideal card should provide easy access to company funds, strong tracking features, and security measures to prevent unauthorized spending. Below are some of the best options available.

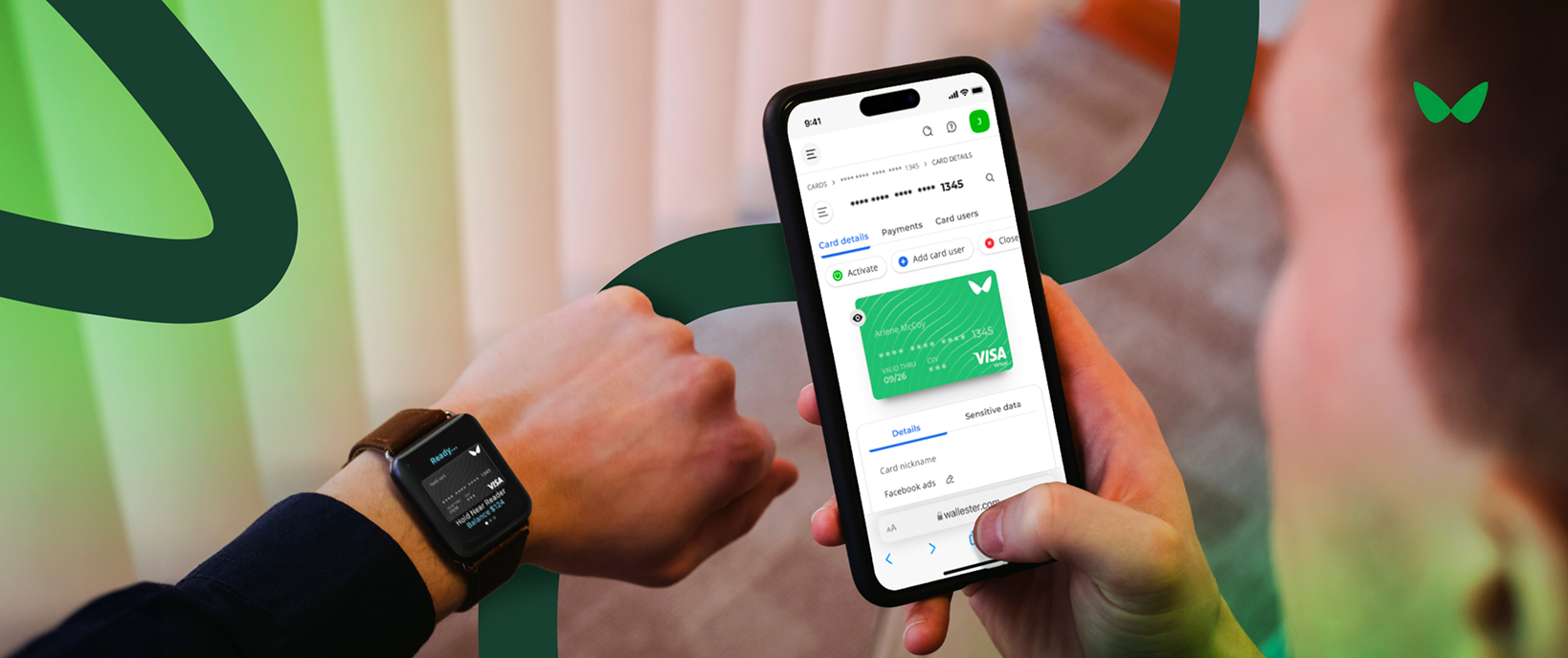

1. Wallester

Wallester provides both prepaid and virtual cards with advanced customization options, making it easy to control spending and track transactions in real-time. Businesses can issue instant-use virtual cards for online payments, while physical prepaid cards work for in-store purchases. The platform supports automated expense categorization, real-time spending insights, and flexible limits to prevent overspending. Wallester also integrates with accounting software, improving financial management.

2. Wise

Wise offers multi-currency business cards suitable for international transactions, allowing users to spend in multiple currencies (over 40) with real exchange rates and no hidden markups. Contractors working with global clients benefit from low foreign transaction fees, while businesses can fund employee cards directly from their Wise account. The Wise app provides detailed transaction breakdowns, helping users monitor spending in real time.

3. Pleo

Pleo specializes in automating cost management, offering corporate cards with features like receipt capture, category tagging, and real-time transaction syncing with accounting tools. Employers can set individual limits for each contractor, reducing the risk of unauthorized expenses. Pleo’s platform also includes AI-driven expense insights, helping businesses analyze spending patterns and optimize budgets.

4. Ramp

Ramp provides corporate credit cards with built-in finance automation tools, making it ideal for companies with high transaction volumes. The platform offers AI-powered expense tracking, allowing businesses to monitor spending across multiple categories. Ramp also provides automatic savings recommendations, helping organizations cut unnecessary costs. Additionally, its integration with accounting platforms simplifies reconciliation.

5. Moss

Moss is tailored for small and medium-sized enterprises, offering both virtual and physical employee expense cards with flexible spending controls. Businesses can issue unlimited virtual cards for specific purchases or team members, reducing fraud risks. Moss also features automated approval workflows for better budget control. Its integration with major accounting software guarantees efficient financial tracking and reporting.

6. Finly

Finly focuses on full-cycle expense management, providing companies with corporate prepaid cards that integrate with approval workflows, real-time tracking, and automated expense categorization. The platform simplifies reimbursements, minimizing the need for manual expense claims. Businesses can set custom rules for spending, making sure contractors stay within budget while maintaining control and complete visibility over company expenses.

7. PEX

PEX offers prepaid card solutions for project-specific handling employee expenses, making it a great option for contractors working on short-term assignments. Employers can assign custom spending rules for each card, making sure funds are only used for approved purchases. PEX also provides real-time transaction monitoring and funding controls, allowing companies to adjust budgets on the go.

8. Spendesk

Spendesk provides an all-in-one cost management platform, offering budgeting tools, transaction monitoring, and automated reporting. Companies can issue individual and team cards, track spending in real-time, and enforce category-based spending limits. The platform also features automated receipt collection, helping maintain compliance without manual data entry. Spendesk integrates smoothly with accounting software, simplifying financial reporting.

Automated expense reporting and mobile receipt capturing

Automated expense reporting improves efficiency by eliminating manual data entry. Expense card transactions are synced directly with the company’s expense management software. Many providers offer mobile apps that allow employees to capture receipts on the go, improving accuracy. This automation makes it easier to track expenses and categorize them in real-time.

Integrations with accounting software

Linking employee expense cards with accounting software takes the hassle out of tracking business expenses. Instead of manually entering transactions, costs sync in real time, keeping financial records accurate without the extra effort. This cuts down on errors and makes it easier to stay on top of cash flow. With automated categorization and reporting, finance teams can spot trends, reconcile accounts faster, and close the books with less stress. Whether you’re managing day-to-day expenses or preparing for audits, a smooth integration helps keep everything organized and under control.

Top tips for managing employee spending

Keeping employee spending under control requires a mix of clear policies, smart tools, and ongoing oversight. A well-structured approach helps to avoid unnecessary costs, improve financial transparency, and guarantee that company funds are used appropriately. Here’s how to do it effectively:

- Set clear expense policies. Outline which expenses are approved, define limits, and specify any restrictions on certain categories (e.g., travel, dining, or office supplies). Make sure employees understand these guidelines to prevent confusion.

- Use real-time tracking. Monitoring transactions as they happen helps spot unusual spending patterns before they become a problem. Many expense card providers offer instant alerts for out-of-policy purchases.

- Establish spending limits. Assign customized limits based on roles or departments to prevent excessive or unauthorized spending. Some platforms allow dynamic limits that adjust based on budget availability.

- Automate expense reporting. Integrating employee expense cards with accounting software reduces manual work and provides accuracy. Automating receipts, categorization, and approvals helps speed up reconciliation.

- Provide employee training. Educate employees on how to use company expense cards responsibly. Cover topics like when to use personal funds versus corporate cards, how to submit receipts, and the consequences of policy violations.

- Require approvals for high-value transactions. Implement an approval workflow for large or non-routine purchases. This extra layer of control prevents budget overruns.

- Encourage accountability. Regularly review spending reports and address any inconsistencies. Making employees accountable for their expenses fosters responsible spending habits.

- Conduct periodic audits. Regular audits help identify compliance issues, flag policy breaches, and uncover potential fraud. Reviewing expense patterns also allows for ongoing policy improvements.

By combining these strategies, businesses can maintain complete control over employee spending while giving their teams the flexibility they need to operate efficiently.

Use cases of expense cards for contract employees

Company cards give contractors a practical way to manage work-related expenses without using personal funds. Whether working remotely, traveling for business, or handling project-related purchases, these cards make spending more efficient while giving companies better oversight and control.

Common Use Cases

- Project-based purchases

Contractors often need materials, equipment, or software for assignments. Company cards let them make approved purchases without waiting for reimbursement or disrupting workflows. This is useful for freelancers handling marketing campaigns, IT services, design projects, or on-site construction work.

- Travel expenses

Many contract workers travel for business meetings, site visits, or training sessions. The cards cover flights, accommodation, transportation, meals, and other travel costs, keeping spending within budget.

- Office supplies and equipment

Contractors working from home or temporary office spaces often need supplies like laptops, peripherals, office furniture, or software licenses. Instead of dealing with reimbursement claims, a card provides quick access to necessary tools, improving productivity.

- Client and team meetings

Whether covering coffee shop meetings, entertaining a client, or hosting a brainstorming session, expense cards make it easier for contract employees to represent the company professionally without financial strain.

- Remote and field work

Contractors in industries like construction, logistics, event planning, and consulting often need to pay for fuel, tools, rental equipment, or temporary permits. Corporate cards allow them to cover field expenses without delays while giving companies real-time tracking of purchases.

- Subscription and software costs

Many contractors use premium SaaS tools, cloud storage, and industry-specific software to complete projects. Companies can issue limited-use virtual cards for these subscriptions, keeping spending under control while maintaining smooth operations.

- Last-minute and emergency purchases

Unexpected costs can arise during a project – replacing broken equipment, securing additional resources, or covering urgent transportation costs. Corporate cards give contractors immediate access to funds, allowing them to act quickly without waiting for approvals.

Why use virtual expense cards?

Virtual cards boost security by generating unique card numbers for each transaction. These cards can be issued instantly and are easy to deactivate, making them ideal for temporary contractors and online purchases. Companies use virtual cards to reduce the risk of fraud and keep tighter control over online spending.

When virtual cards are preferable

Virtual cards are preferable for businesses that handle a large volume of online payments or work with short-term contract workers. Their instant issuance and transaction-specific controls provide flexibility and security, particularly for recurring payments. Unlike traditional company cards, virtual ones can be created and assigned instantly. They also allow companies to set expiration dates, limit usage to specific vendors, and track spending in real time.

Virtual and physical cards: how do they work together?

Virtual and physical cards complement each other by addressing both online and in-person transaction needs. Employees can switch between the two depending on their work requirements, while organizations maintain consistent spending controls across both formats. Virtual cards are ideal for online purchases, software subscriptions, and remote work expenses, while physical cards are useful for travel, office supplies, and in-store payments. By using both, companies can create a flexible and secure expense management system that adapts to different scenarios.

The future trends of using expense cards for contract employees

The future of expense management includes increased use of AI-driven tracking, mobile-first platforms, and deeper integration with financial systems. Providers are expected to offer more advanced customization options, so the cards will be even more versatile for managing both contract and full-time employees. Real-time data analytics will play a larger role, helping to predict spending patterns and optimize budgets more effectively. Additionally, strong security features, such as biometric authentication and dynamic spending controls, will further improve overall financial transparency.

Choose Wallester expense cards for contract employees

Wallester provides a comprehensive platform for managing business expenses, offering both prepaid and virtual Visa cards designed for flexibility and security. These cards help companies control spending in real time, automate expense reporting, and integrate with leading accounting software for efficient financial management.

With instant card issuance, companies can provide contractors with immediate access to company funds without delays associated with reimbursements. Spending limits, merchant category restrictions, and detailed transaction monitoring keep expenses within policy guidelines.

Wallester’s virtual cards are ideal for online purchases, software subscriptions, and digital services, while physical cards support travel, office supplies, and in-store payments. The platform also offers real-time notifications, customizable approval workflows, and expense categorization tools, making financial tracking more straightforward.

For contractors and remote teams, Wallester’s solution brings transparency, security, and better control over company expenses while giving employees the flexibility they need to perform their work effectively.