Money laundering generates large sums through illicit activities, such as corruption, embezzlement, tax evasion, and drug trafficking. The money made from criminal activity is seen as dirty, and the process “launders” it to disguise it as clean. It is conducted through countless means but usually involves three stages: placement, layering, and integration. Placement is the first step, where black money is put in banks or other financial institutions. In layering, different financial transactions are done by purchasing and selling monetary and non-monetary assets to manipulate the original placement of money. Lastly, illegal money is turned into white money through legal channels, which either shows it as a profit of the parent company or earnings from the sale of assets.

Money laundering is a severe monetary crime done by street-level and white-collar criminals. Most financial companies today have anti-money laundering measures to prevent this illegal practice.

History of Anti-Money Laundering

Efforts to regulate illegal monetary gains have a history that dates back centuries. In contrast, “money laundering” is only around a century old and has gained popularity in the last 50 years. The United States was one of the first nations to effectively implement an anti-money laundering law when it founded the Bank Secrecy Act in 1970. The Financial Crimes Enforcement Network is now the official administrator of the BSA – intending to protect the financial system from the effects of financial crime.

In 1989, various countries and firms established the Global Financial Action Task Force (FATF). The primary aim of this organisation is to foster international AML measures. During the 1980s and 1990s, additional legislation was passed to expand financial monitoring and fight drug trafficking. After the 9/11 attacks in 2001, more laws were passed to cut off funding for terrorist organisations.

Action on a European level began in 1990 when the European Union released its first anti-money laundering Directive. Introducing this directive made it compulsory for all financial institutions to confirm the identity of all customers opening business relations with them. Employees had to be trained regarding AML compliance, and suspicions of money laundering had to be reported via a designated officer. This legislation has been repeatedly revised to eliminate any risks related to terrorist financing and money laundering.

The Proceeds of Crime ACT 2002 imposed the UK AML legislation, and different organisations were created to prevent financial crimes, such as SFO, FCA, NCA, and HMT. Although the UK is no longer a part of the European Union, its laws still comply with FATF suggestions and the EU’s Anti-money Laundering directives.

AML Meaning: What Is AML (Anti Money Laundering)?

Anti-money laundering or AML refers to a cluster of procedures, laws, and regulations designed to uncover efforts that disguise illegal funds as legal income. AML laws responded to the growing financial industry, lifting capital controls and increasing the ease of complex financial transactions.

Anti-money laundering is primarily used in the legal, financial, and compliance industries to develop the standard controls organisations must carry out to identify, avoid and report suspicious money laundering activity. It works in the following ways:

- AML processes seek to make it more challenging to hide profits from criminal activity

- AML regulations mandate financial companies develop sophisticated customer due diligence programs to analyse money laundering risks and detect unusual transactions.

Why is Anti-money Laundering Important?

The purpose of anti-money laundering policies and procedures is to assist financial companies in tackling the issue of money laundering by preventing criminals from engaging in transactions to disguise the origins of illegal funds. Besides preventing criminal activity, AML measures help to set the tone for the company and reinforce a culture of compliance. Non-compliance leads to massive losses, such as fines and financial loss due to serving money launderers. The penalties of non-compliance not only result in financial losses and damage credit rating and can cause temporary or permanent closure of the business.

Another critical reason AML is vital for companies is that their customers can feel secure. If a financial institution has a tarnished reputation related to anti-money laundering, it can lose its credibility and market value. To avoid such significant setbacks, businesses need to have a solid AML compliance program.

Who’s Using Anti-money Laundering?

Many organisations and financial institutions have developed an anti-money laundering program best suited for their internal and external needs to avoid heavy fines, loss of reputation, and criminal charges. Listed below are some high-risk sectors that diligently abide by AML compliance.

🏦 Banking

The banking sector is most susceptible to money laundering. Electronic payments, such as internet transactions, ACH, remittances, wire transfers, and prepaid cards, can be easily manipulated by money launderers since there is no natural way to verify the consumer’s identity in person. Nowadays, AML-compliant banks use AI models to detect suspicious activity and stop illegal activity before it can incur huge losses. Machine learning also automates due diligence document reviews, which minimises weeks’ effort into a few minutes.

🏢 Capital Markets

Capital markets are increasingly investing in AML technology, which enables them to identify, investigate and report any illegal activity from security and fraud systems. At the same time, these markets can cut costs related to investigations.

🌐 Insurance

Insurance fraud is widespread as money launders usually buy the insurance and then submit claims to receive the funds. Often, they will use products disguised as investments, such as life insurance policies and variable annuities. By overfunding and moving money in and out of different insurance policies, fraudsters create a stream of “clean” checks or wire transfers for the minimal costs of early withdrawal fines.

🏪 Retail & Consumer Goods

The retail and consumer goods sector is often the victim of money laundering activities since launderers use these storefront companies or their websites to process money for money laundering. Due to this, retailers can generally become an unsuspecting disguise for suspicious activity. For example, money launderers can create a fake e-commerce storefront merchant account to process financial transactions from somewhere else. This process is called transaction laundering.

🏛️ Public Sector

Corrupt public sector officials often use money laundering methods to embezzle money for their benefit. They disguise their ownership through trust companies and corporate vehicles and use nominees and gatekeepers to launder proceeds through both local and international financial institutions.

When crooks receive funds from extortion, fraud, or robbery, the only way to identify and report the stolen money is by opening a money laundering investigation.

AML Checks, KYC (Know Your Customer), and Other Related Concepts

AML compliance checks are safeguarding measures businesses require to comply with money laundering rules and prevent financial crime. These AML checks help prevent companies from directly or indirectly engaging in criminal activity. Regulated organisations that fail to follow these checks will likely face heavy penalties and serious consequences. These checks include the following:

KYC (Know Your Customer)

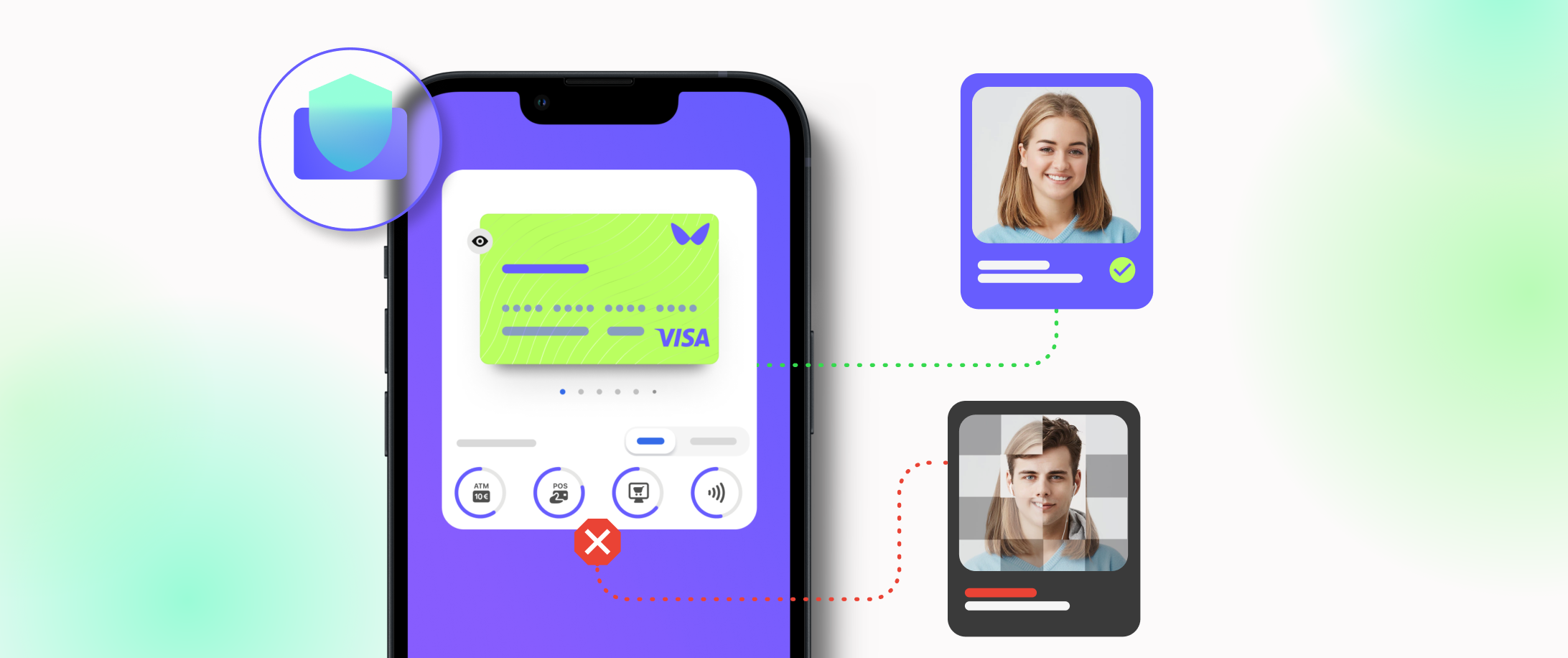

Know Your Customer, or KYC, is a control procedure for money laundering that financial institutions use to verify the identities of their current and new customers, to find out more about customer investment and financial profile, and to recognise and prevent any customer risks.

Under KYC, customers must meet its requirements by providing complete proof of their identity and address, such as facial verification, ID verification, fingerprint verification, and other important documents like passports and driver’s licenses. The central legal foundation of the KYC check and verifications in the EU and USA are as follows:

- 3rd, 4th, 5th, and 6th EU money laundering Directives

- UK Bribery Act

- The US Patriot Act

eKYC Standards

eKYC is a type of digital Know Your Customer process that is remote and paperless and designed to reduce the costs and bureaucracy associated with traditional KYC processes. To ensure that eKYC follows the same safety standards as conventional ones, organisations must employ electronic identification processes with high levels of reliability and safety. eKYC enables employees to complete their identity verification online through automatic video identification from anywhere, open a bank account, and sign for a loan.

KYB (Know Your Business)

Know Your Business, or KYB, is a process not much different than Know Your Customer. The only difference is that KYB focuses on suppliers and companies, then on customers. As part of AML compliance, any organisation dealing with money transfers must check the KYB of the companies they engage with.

KYB verification is part of an organisation’s AML compliance program that protects its interests before corporate transactions with another business. Companies should know when their income is misused by corrupt shareholders, business owners, and money launderers. KYB confirms the companies’ potential customers’ business information and the personal information of the senior management that controls those operations. KYB procedures are done to prevent money laundering or terrorist funding activities, thus complying with compulsory international AML regulations. It requires collecting and analysing data from other companies, such as registration documents, company addresses, licensed documents, and personal identities of owners and managers.

Due Diligence

The buyer carries out the process of due diligence to confirm the accuracy of the seller’s claims. Financial due diligence seeks to verify whether the financial records showcased by the seller company in the Confidentiality Information Memorandum are correct. Due diligence as part of AML compliance aims to provide a comprehensive understanding of all the organisation’s financials, including, but not limited to, audited financial statements for the past three years, current unaudited financial statements with last year’s comparison, the organisation’s projections and their basis, capital expenditure plan, schedule of stock, creditors, and debtors, etc.

How does Anti-Money Laundering work?

To recognise and report a potential incident of money laundering and address AML compliance requirements, companies must possess a deep understanding of how this crime works. To avoid the risk of becoming a victim of money laundering, companies and financial institutions must create a comprehensive AML compliance program and establish the appropriate customer and business due diligence systems. AML is most effective when banks and other organisations do proper screenings against trade and economic sanctions and also establish fool-proof monitoring and reporting strategies for suspicious activity.

Regulations, Compliance & AML

The fundamental obligations of AML compliance in Europe derive from the AML Directives, especially AMLD4. The AMLD4 lays down the primary obligations and states the basic AML measures, such as:

- Obligations to take customer due diligence steps on previously unregulated entities, including e-money services, financial institutions, gambling services, etc.

- Obligations to assess the geographic location, product/service specific risks, and delivery channels when analysing customer risk profile.

- Obligations to scrutinise politically exposed people, such as local and foreign politicians.

In general, AML rules differ depending on the jurisdiction, but some of the main steps to meet AML compliance program requirements include:

- KYC and KYB: Financial institutions must ask for customer and business identification and other essential documents to gauge their legitimacy.

- Reporting large currency transactions: Institutions are obligated to file a complaint against a single customer who makes a transaction higher than a specific limit during a business day.

- Regulating and reporting suspicious activities: Many AML guidelines published by regulatory bodies teach companies how to monitor and report suspicious activities immediately. This includes making numerous cash withdrawals or deposits over several days to avoid a transaction limit. Suppose an AML compliance officer detects unusual behaviour that exceeds reporting limitations and lacks an apparent business purpose. In that case, they file an STR with the financial intelligence unit to fulfil the regulatory requirements.

- Sanctions compliance: Regulatory bodies like the European Union and FATF have laid down AML requirements that mandate financial institutions to thoroughly check transaction companies against lists of blacklisted persons, organisations, countries, and institutions. Ensuring the party you are dealing with has not already been sanctioned will minimise the risk of future money laundering.

Technology & Anti-Money Laundering

An effective AML compliance program uses analytics and data to identify suspicious activity. This is done by continuously monitoring customers, businesses, financial transactions, and entire behaviour networks. As AI technologies such as machine learning become more widespread, they will automate many manual procedures. This will help better recognise any financial crime risk more quickly and easily. Technology is also being used to verify identity, examine behavioural patterns and expedite KYC and KYB, reducing the expenses on AML and improving overall efficiency.

Four Types of Money Laundering

According to the United Nations Office on Drugs and Crime, global money laundering is a billion-dollar business, making about 2 to 5% of the worldwide GDP. There are four main types of money laundering:

- Trade-based money laundering: This type of money laundering takes advantage of the complexity of trade systems, specifically in international contexts where the involvement of multiple parties makes AML checks a lot more challenging to execute. TBML comprises exported and imported goods and works to exploit cross-border trade finance instruments.

- Virtual currency money laundering: Virtual currencies such as crypto have become increasingly popular recently. In this form of money laundering, the proceeds of a cyber-fraud are collected on Bitcoin, traded via different cryptocurrencies, and cashed out.

- Drug trafficking and money laundering: Drug trafficking makes up 8% of global trade and is estimated to be worth $400 billion annually. Drug smugglers seek to convert the revenue from their criminal activity into income with a seemingly legal source. They hide the income’s origin and identity via avenues like the dark web. Some of the techniques used by drug traffickers involve structured deposits, bulk cash smuggling, and currency exchanges.

- Terrorist financing: Terrorist financing involves using funds with an illegal origin to finance terrorist activity. This kind of money laundering is usually made “clean” by exploiting the weaknesses of the financial system. Detecting these funds can be difficult unless they are connected with a well-known terrorist organisation.

What are the Differences between KYC and AML Processes?

Know Your Customer (KYC) is acquiring information about a customer and confirming their identity. On the other hand, Anti-money Laundering (AML) is a blanket term containing various complex measures used by financial institutions and other organisations to prevent financial crimes. KYC can be used as part of AML to avoid money laundering activities.

In short, KYC and AML are not clashing concepts. KYC falls within AML and is one of the many mechanisms that can simplify compliance with the broader AML framework. KYC explicitly includes identity verification and risk assessment, whereas AML involves many measures to regulate risks during and after KYC checks.

What are Some Ways that Money is laundered?

Money is laundered in three primary stages. In the first – or placement – phase, the launderer brings illegal profits into the financial system. This can be done by dividing large sums of money into smaller, less suspicious amounts deposited directly into a bank. Another way is by purchasing a series of financial instruments, such as money orders, checks, etc., that are then deposited into bank accounts of another location.

The second or layering- stage begins once the funds have entered the financial system. This is where the launderer gradually and carefully distances the funds from their source by buying or selling investment instruments or simply wiring the funds via a series of accounts at various global banks. Some of the most common money laundering activities include:

- Real estate laundering: This type of money laundering works since the deals involve large sums of cash and legit financial agents such as mortgage companies and banks. Launderers generally buy a property using illegal cash and then quickly sell it, depositing the proceeds into a legitimate bank account.

- Casino laundering: Casinos are notorious for housing laundered money. Criminals come here with vast sums of “dirty” cash and disguise it while they gamble. They simply buy casino chips with illegal money, gamble a little, and pretend to win big.

- Bank laundering: Bank, stock trading, or mortgage company owners can quickly get away with money laundering as there is little to no accountability for people inside the financial system. These people can discreetly move the money from their company to another financial institution through currency exchanges that are very hard to detect by regulatory bodies.

What are the risks for Companies Failing to Implement a Compliant AML Process?

AML is more than a regulatory burden; it can help companies avoid serious negative consequences. Frauds are on the rise, but having an AML compliance program can help weed out potential financial crimes directed toward the company. Failing to do so will result in the organisation getting bombarded with chargebacks and similar claims.

Another cost that companies bear when they fail to implement AML screenings is monetary loss. Failing to identify and address a threat on time can rob the company of thousands or even millions of dollars. When a company becomes associated with money laundering in whatever, it loses its credibility and can even suffer from temporary or permanent closure. The amount spent on lawsuits and damage control is far more than on complying with AML procedures. Lastly, when a company has a proper AML compliance program, its customers feel more at ease doing business with them.

What are Financial Intelligence Units? (FIUs)

Financial Intelligence Units (FIUs) are national centres for collecting and assessing suspicious transaction reports and other relevant information related to money laundering, terrorist financing, and associated predicate offences. An FIU is responsible for obtaining additional data from regulatory bodies and having timely access to administrative, financial, and law enforcement information to undertake its operations effectively. Critical elements shaping a Financial Intelligence Unit’s creation include AML and anti-terrorism financing legislation, current law enforcement, and the need for a regulatory body that will receive, analyse and share valuable financial data.

We would be delighted to be your trustworthy business partner to cover your needs.

Let’s discuss your business case and how we can be beneficial to you.

Please fill out this form, and our team will contact you.