As a result of Onfido’s superior service quality in the area of Know Your Customer (KYC) verification, Wallester AS managed to drastically speed up the onboarding process.

Wallester AS, a White-label Visa card issuer, has partnered with Onfido, the world’s leading identity verification and authentication firm, to introduce Know Your Customer (KYC) verification services into its platform, ensuring a simple onboarding process for new and existing customers.

By partnering with Onfido, Wallester can now provide fintech businesses and other clients with a cutting-edge KYC verification solution that enhances consumer identification while also helping to combat money laundering. As a result, Wallester is ready to give conventional banks the most cutting-edge and efficient solution ever.

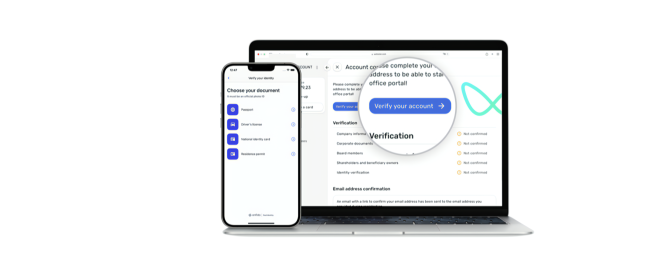

AI-powered identity verification service by Onfido has been integrated into Wallester, allowing the users to join up by taking a picture of their government-issued ID and a selfie, or a short selfie video. First, Onfido verifies that the ID is authentic and not fake; next, it uses a biometric technology to match it with the user’s face. This verifies that the individual providing the identification is authentic and present. A simple and user-friendly online experience that complies with the regulations allows the users to begin their digital journey – at any time and from any location.

If you’re a responsible fintech firm, KYC is a must-have. Sergei Astafjev, Wallester’s CEO, explains, “therefore, it was critical for us to identify a dependable partner that fits with our client onboarding aims and expectations.” “Onfido’s KYC verification and authentication services are of the highest quality. Thus, Wallester can provide its customers with the most simple and quick onboarding while effectively tackling fraud,” the company says.

Onfido’s Known Faces functionality allows Wallester AS to identify more fraud because it highlights duplicate sign-up attempts. This way, resolving repeated efforts at identity fraud is made easier, and the organization can assist consumers who may have forgotten they had already registered with their accounts.

“In today’s digital era, consumers increasingly want a simplified digital experience so that they can confirm their genuine identity while ensuring that it is secure,” stated Oliver Krebs, SVP EMEA at Onfido. For Wallester AS, this means supporting the company’s digital ambitions and growth, something we at Onfido take great pride in doing.